President 2012 GOP Poll Watch: Rick Perry Collapses as Herman Cain Gains in Positive Intensity

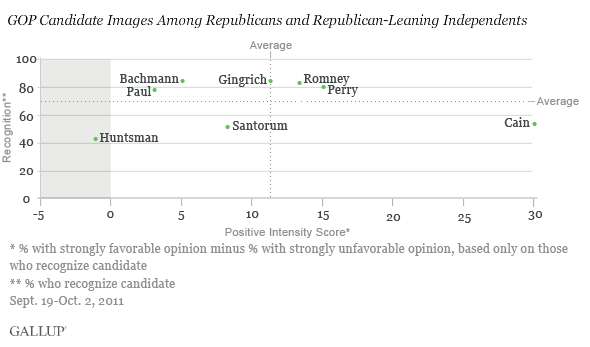

Rick Perry’s image is suffering, with his Positive Intensity Score among Republicans familiar with him down to 15, and below 20 for the first time. Meanwhile, Herman Cain’s score is now 30, the highest for any candidate this year.

The results are based on Gallup Daily tracking from Sept. 19-Oct. 2. Gallup calculates candidate Positive Intensity Scores as the percentage of strongly favorable opinions minus the percentage of strongly unfavorable opinions of each candidate among Republicans and Republican leaners familiar with the candidate.

The movement in Perry’s and Cain’s scores follows recent campaign developments, including poor reviews of Perry’s performance in the September debates and Cain’s surprising win in the Sept. 24 Florida straw poll.

In addition to Perry, Michele Bachmann and Ron Paul established new low Positive Intensity Scores this week, at 5 and 3, respectively. Bachmann was among the highest-rated candidates in June, peaking at 24, but has seen a steady decline since she posted a score of 20 in Aug. 1-14 tracking. Paul has not been rated as positively, with a high of 16 in May, and has registered in the single digits in all but one update since late May.

The graph says it all.

Mitt Romney has regained front-runner status.

2 Comments

Pingback:

Mwmtnview

Herman Cain’s 999 is 666 for middle class. Every person that filed a 1040 for 2010 needs to multiply their Gross income on line 22 by 9% and turn the form over and look at line 60 (total tax and see how you fare. Then there will be no adjustments for 15a, 16a, & 20a because 999 is a flat tax you’ll really pay 9% of that instead of b amounts.

No deductions, standard or itemized. Then think about paying 9.00 on every $100.00 in sales tax. It plus my state county & city tax of 9% would mean $18.00 per $100 Then realize that Corporations will pay 9% flat tax their gross profits. YOU will pay higher prices for every item bought and every service used so corporations can make up for their taxes.

He says there will be no payroll taxes! What part of 999 will pay for the FICA & Medicare payroll taxes collected now? I checked my 1040 and with the Total income w/a amounts I would pay 7.21 times what I paid. With the b amounts , I would have to pay 3.60 times as much in income tax, plus 9$ per$100 sales tax.

He says everyone will pay a flat tax on their income. Does that mean people who have not had to file will file and pay 9% of their Social security and SSI benefits? Will food stamps be income or will the $80.00 per child that is received on the food stamp cards be taxable income?? I think Mr. Cain has never filled out an In come tax form! If he had he would know that the average person will consider 999 as 666!!