-

IN-Sen Video: Richard Mourdock Up With New Ad Linking Sen Lugar as President Obama’s Favorite Republican

Indiana Republican challenger, Richard Mourdoc is up with a new hard hitting ad against Republican Senator Richard Lugar.

Indiana Republican challenger, Richard Mourdoc is up with a new hard hitting ad against Republican Senator Richard Lugar.Indiana Treasurer Richard Mourdock puts his most potent hits against incumbent Sen. Richard Lugar into one strong 30-second ad, which will begin airing today on broadcast and cable TV statewide. A disappointed-sounding older male narrator: “When Dick Lugar moved to Washington, he left behind more than his house. He left behind his conservative Hoosier values – voting for more earmarks, Obama’s liberal Supreme Court choices, amnesty for illegals, even supporting a $1 a gallon gas tax. Now they call him Obama’s favorite Republican. Lugar’s been in Washington for 36 years. That’s too long. Time for a change.” For the next 13 days, this is the hottest race in America.

Here is the ad:

This is a tough race for Senator Lugar.

He may win a narrow victory, but I would not be surprised if Indiana nominates Mourdock. Lugar has been there a long time and some would say too long.

-

Poll Watch: Most American Workers Expect to Continue Working After Retirement Age

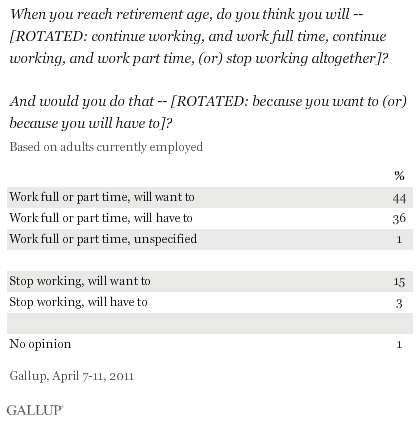

According to the latest Gallup Poll.A combined 8 in 10 American workers think they will continue working full or part time after they reach retirement age. Proportionately more of these workers, 44% to 36%, say they will do so because they “want to” rather than because they “will have to.”

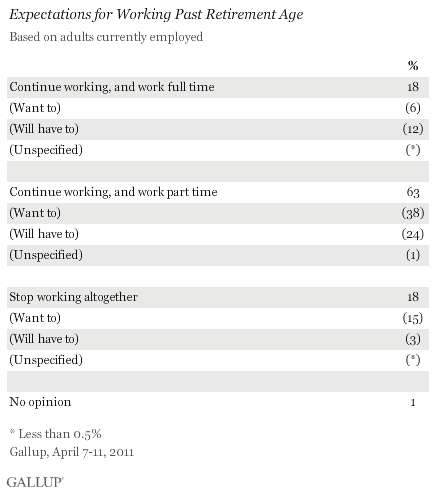

Overall, most workers expect to work part time after retirement age (63%), rather than to work full time (18%) or stop working altogether (18%). Those who expect to work full time are twice as likely to say they will do so out of need rather than as a choice. In contrast, those who expect to stop working overwhelmingly say it is because they want to. Workers who expect to work on a part-time basis are more likely to say they will want to work than will need to do so.

The expectations for working past retirement age graph:

And, the demographics graph for those working past retirement age:

And, the demographics graph for those working past retirement age:

But, expectations are different than reality, as few retirees rely on part-time work.

The 80% of current workers expecting to work past retirement age highlights the differences in retirement experience and expectations between current and future retirees. A separate question in the poll found a total of 18% of current retirees saying part-time work is a major (2%) or minor source (16%) of retirement income for them, compared with 74% of nonretirees (including those currently working and those not working) who expect part-time work to be a major (22%) or minor (52%) source of income in retirement.

Additionally, current retirees say they retired at age 60, on average, compared with nonretirees’ average expectation of retiring at age 66. The average expected retirement age among nonretirees has increased in recent years.

So, what does this all mean?

The eyes for potential work rather it be full-time or part-time, are better when you are contemplating retirement versus ACTUALLY being retired. Future retirees are perhaps being too optimistic out of a sense of self-worth, because the number of job opportunities may not be available to them.

The common expectation among today’s workers that they will continue working once they reach retirement age underscores the changing nature of the retirement landscape in the United States, partly because of changes in the economics of retirement and partly because of individuals’ desired level of activity in retirement. Changes in the payment of Social Security benefits in recent decades as well as many employers’ moving away from guaranteed pensions for retirees in favor of employee-directed retirement savings plans — in addition to the high cost of healthcare — have altered the economic calculus of retirement. Also, the significant percentage of workers who say they will continue working beyond retirement age because they “want to” suggests American workers may be less interested in a lifestyle free from work in their older years, regardless of their economic situation.

As more and more baby boomers retire, an emerging question is whether there will be enough jobs for older workers who want to work, particularly if the overall employment situation remains weak.