-

Poll Watch: U.S. Unemployment Rate Increases to 9.1 Per Cent

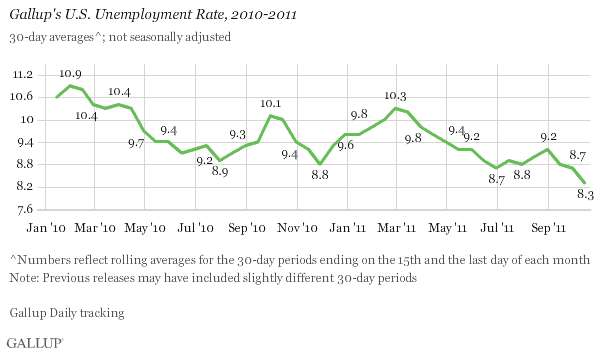

According to the latest Gallup Poll.U.S. unemployment, as measured by Gallup without seasonal adjustment, increased to 9.1% in February from 8.6% in January and 8.5% in December.

The 0.5-percentage-point increase in February compared with January is the largest such month-to-month change Gallup has recorded in its not-seasonally adjusted measure since December 2010, when the rate rose 0.8 points to 9.6% from 8.8% in November. A year ago, Gallup recorded a February increase of 0.4 percentage points, to 10.3% from 9.9% in January 2011.

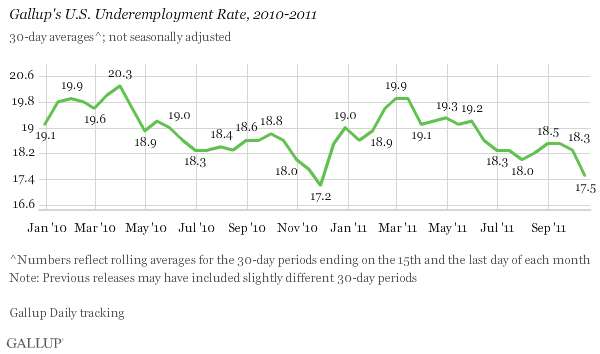

And, the Underemployment Rate has increased:

Gallup’s U.S. underemployment measure, which combines the percentage of workers who are unemployed and the percentage working part time but wanting full-time work, increased to 19.1% in February from 18.7% in January.

Here is the chart:

Remember the pundit-accepted unemployment rate threshold required for re-election of the current President of 8%.

Remember the pundit-accepted unemployment rate threshold required for re-election of the current President of 8%.The one exception was when Ronald Reagan was President and the economy was demonstrably improving.

Today, the US. Unemployment rate continues above 8 per cent and it not improving = warning signs to the White House.

All of this in advance of tomorrow’s U.S. government’s release of its unemployment rate numbers. Let’s see if they show the same trend, as some have surmised that the Obama Administration Labor Department is massaging the numbers.

The February unemployment rate the U.S. government reports on Friday morning will be based largely on mid-month conditions. In mid-February, Gallup reported that its U.S. unemployment rate had increased to 9.0% from 8.3% in mid-January. The mid-month reading normally provides a relatively good estimate of the government’s unadjusted unemployment rate for the month.

Assuming the government’s unadjusted rate increases — from its 8.8% in January — to at least match Gallup’s mid-month measurement for February, then the government should also report an increase in the seasonally adjusted unemployment rate for February. If the government’s unadjusted unemployment rate increases to the degree that Gallup’s has from mid-month to mid-month, then the government’s seasonally adjusted unemployment rate could show an even larger increase.

However, the extent of the seasonal adjustment also makes a difference. Last February, the U.S. Bureau of Labor Statistics applied a seasonal adjustment factor of 0.5 points to its unadjusted unemployment rate for the month. If that same seasonal adjustment is applied to Gallup’s mid-month unemployment rate of 9.0%, it would produce a seasonally adjusted unemployment rate of 8.5%. Alternatively, if it was applied to Gallup’s full-month unemployment rate of 9.1%, it would produce a seasonally adjusted rate of 8.6%. Gallup therefore forecasts an increase in the unemployment rate.

Regardless of what the government reports, Gallup’s unemployment and underemployment measures show a substantial deterioration since mid-January. In this context, the increase in unemployment as measured by Gallup may, at least partly, reflect growth in the workforce, as more Americans who had given up looking for work become slightly more optimistic and start looking for work again. So while there may be positive signs, the reality Gallup finds is that more Americans are looking for work now than were doing so just six weeks ago.

-

Poll Watch: U.S. Unemployment Rate Increases to 9.0 Per Cent

According to the latest Gallup Poll.

According to the latest Gallup Poll.The U.S. unemployment rate, as measured by Gallup without seasonal adjustment, is 9.0% in mid-February, up from 8.6% for January. The mid-month reading normally reflects what the U.S. government reports for the entire month, and is up from 8.3% in mid-January.

Gallup’s mid-month unemployment reading, based on the 30 days ending Feb. 15, serves as a preliminary estimate of the U.S. government report, and suggests the Bureau of Labor Statistics will likely report on the first Friday of March that its seasonally adjusted unemployment rate increased in February. Gallup found that unemployment decreased to 8.3% in its mid-January report, and suggested that the U.S. unemployment rate the BLS reported for January would decline.

Gallup also finds 10.0% of U.S. employees in mid-February are working part time but want full-time work, essentially the same as in January. The mid-February reading means the percentage of Americans who can only find part-time work remains close to its high since Gallup began measuring employment status in January 2010.

Although the past few weeks, the pundits have been spinning that the economy has been improving. America is not out of the woods just yet as far as unemployment.

And, underemployment has increased. Remember underemployment is a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work.

Now, let’s see what the United States government reports in early March.

But, the trend is upward in the unemployment rate.

-

CBO Report: Unemployment to Rise to 8.9 Per Cent in 2012 and 9.2 Per Cent in 2013

And, the federal budget deficit will continue to be over $1 Trillion.

The Congressional Budget Office said Tuesday that the economy would remain sluggish, with high unemployment, and that the federal budget deficit would exceed $1 trillion in 2012 for the fourth consecutive year.

The deficit will be $1.1 trillion in the current fiscal year, about $200 billion less than in 2011, and will fall sharply in the next three years as a result of tax increases and spending cuts required by existing law, the agency said in its annual report on the budget and economic outlook.

However, it said, that same combination of higher taxes and caps on spending will crimp economic growth. As a result, it said, the unemployment rate, which was 8.5 percent in December, will climb to 8.9 percent in the last quarter of this year, which includes Election Day, and will rise to 9.2 percent in the final quarter of 2013.

“We have not had a period of such persistently high unemployment since the Depression,” said Douglas W. Elmendorf, director of the Congressional Budget Office.

So, when you see President Obama giving rosy scenario speeches, ask yourself, what is he really doing about America’s economic problems?

-

U.S. Unemployment Rate Falls to 8.6 % From 9% – But….

According to the latest government figures.Job creation remained weak in the U.S. during November, with just 120,000 new positions created, though the unemployment rate slid to 8.6 percent, a government report showed Friday.

The rate fell from the previous month’s 9.0 percent, a move which in part reflected a drop in those looking for jobs. The participation rate dropped to 64 percent, from 64.2 percent in October, representing 315,000 fewer job-seekers.

The actual employment level increased by 278,000. The total amount of those without a job fell to 13.3 million.

The drop in participation rate is significant in that had the labor force remained steady, the jobless rate would have dropped to 8.8 percent, according to Citigroup calculations. If the labor force had followed trend growth, unemployment would be at 8.9 percent.

“Overall, the continued modest employment gains reflect an economy that plods along at an uninspiring pace,” Kathy Bostjancic, director of macroeconomic analysis at The Conference Board, said in a statement. “These modest job gains are still not enough to propel economic growth to a sustainable 2 percent-plus growth path.”

And, some pundits this morning are even questioning the 120,000 jobs created.

The economy remains mired in a stagnant employment mode with over 13 million Americans unemployed.

-

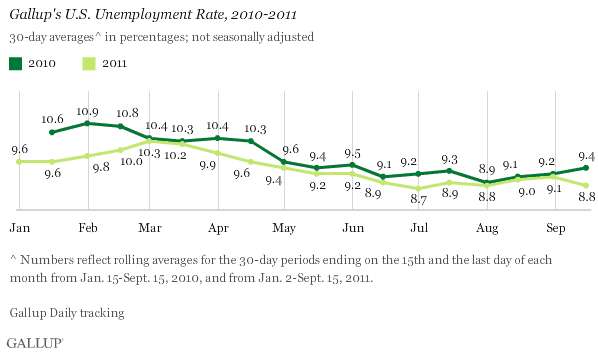

Poll Watch: U.S. Unemployment Rate Increases in Mid-November

According to the latest Gallup Poll.

According to the latest Gallup Poll.Unemployment, as measured by Gallup without seasonal adjustment, is 8.5% in mid-November — up from 8.3% in mid-October, but down significantly from 9.2% in mid-November 2010. Gallup’s mid-month unemployment measure suggests the government is likely to report no change in its seasonally adjusted unemployment rate for November 2011.

An additional 9.7% of U.S. employees work part time but want full-time work, up from 9.2% in mid-October. The current reading is significantly higher than the 8.5% of mid-November 2010.

And, underemployment has increased.

The chart:

Underemployment is a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work.

Underemployment is a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work.So, what does this all mean?

It appears that the unemployment rate is modestly improving because Americans are more accepting of part-time work. But, as Gallup says: a part-time job is better than NO job but there is no real sign that American unemployment is improving.

How will this impact the upcoming 2012 elections?

In most recent elections, an unemployment rate above 8% is a danger sign for a Presidential re-election.

-

Gallup Poll Watch: U.S. Unemployment Improves to 8.4%

According to the latest Gallup Poll.Unemployment, as measured by Gallup without seasonal adjustment, is at 8.4% at the end of October, down from 8.7% in September and 9.2% in August. Unemployment was at 8.3% in mid-October — its lowest level since Gallup began continuous monitoring in January 2010. Gallup’s unemployment measure is also now much lower compared with a year ago — it stood at 9.4% at the end of October 2010.

Underemployment is also down.

Underemployment, a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work, is 17.8% at the end of October — down from 18.3% at the end of September.

The chart:

The government’s report is due out tomorrow and will be based on data from mid-october.

The government’s seasonally adjusted October unemployment report, to be released Friday, will be based on data collected during mid-October, around the time Gallup released its mid-month findings. At that time, Gallup suggested that the government would report a drop in the U.S. unemployment rate for October. The continued improvement Gallup has found in the job situation since mid-month reinforces this idea. Gallup modeling suggests the government’s unemployment rate could fall below 9.0% for October.

Gallup’s October data are consistent with Wednesday’s Challenger, Gray, & Christmas report showing that planned layoffs in October were at their lowest level since June. The decline Gallup finds in unemployment also aligns with the 2.5% increase in U.S. GDP for the third quarter and the Federal Reserve’s statement on Wednesday suggesting the economy is strengthening modestly. Additionally, Gallup Daily tracking shows economic confidence, consumer spending, and job creation improving in October.

But, the changes may be based on seasonal factors which the government uses in calculating its figures.

However, a modest improvement in unemployment may give Americans some confidence going into the Christmas shopping season.

It is the best time to be obtaining a job in almost two years and as Gallup says: a temporary job is better than no job at all.

-

Poll Watch: U.S. Unemployment Rate Decreases Sharply in Early October to 8.3% – But…..

According to the latest Gallup Poll.Unemployment, as measured by Gallup without seasonal adjustment, is 8.3% in mid-October — down sharply from 8.7% at the end of September and 9.2% at the end of August. A year ago, Gallup’s U.S. unemployment rate stood at 10.0%. While seasonal hiring patterns may explain some of this improvement, the drop suggests the government could report an October unemployment rate of less than 9.0%.

And, underemployment is down sharply.

Underemployment, a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work, is thus at 17.5% in mid-October, down sharply from 18.3% at the end of September — and its lowest measurement of the year.

The Chart.

But, Gallup polling is not the government and they issue their poll with caveats.

Gallup’s mid-month U.S. unemployment report covers the same period the government uses to collect data for its October unemployment report, which will be released on the first Friday in November. As a result, Gallup’s data lead the government’s report by several weeks. Modeling based on statistical comparisons of Gallup’s unemployment and job creation data to the government’s seasonally adjusted data over time suggests that the Bureau of Labor Statistics could report an October unemployment rate of less than 9.0%.

The sharp drop in Gallup’s unemployment and underemployment rates may partly result from seasonal factors. Halloween has become the third-largest sales season for many retailers, who are likely increasing their staffing accordingly. In addition, some stores may have been minimally staffed and are beginning early to add employees for the holidays. The surge on Wall Street during early October may also have provided some relief for business owners as they evaluate the prospects of the U.S. economy and their potential sales. Whatever the reasons, Gallup’s Job Creation Index tends to confirm this improvement in the job market because it has been near its highs for the year in early October.

Of course, the precipitous and counterintuitive nature of this sharp improvement in the U.S. job market, as measured by Gallup over the past couple of weeks, means it could be something of an aberration that will dissipate during the weeks ahead. It might even have been missed if not for Gallup’s Daily tracking. But for now, this job market improvement appears real — and, in turn, that implies the Main Street economy may be somewhat stronger than Wall Street generally perceives.

So, while this is good news about the American economy it may be too soon to cheer and may be short-lived at that.

-

American Unemployment Rate Steady at 9.1% Beating Tepid Expectations

Not the greatest, but 103,000 new jobs were added, albeit almost half were added because Verizon employees came off a strike.

The U.S. jobs picture beat tepid expectations, with the economy creating a significantly better than expected 103,000 new jobs in September that nonetheless was not enough to cut the unemployment rate from 9.1 percent.Economists had been looking for 60,000 total new nonfarm jobs, a month after the shock that the U.S. had created a net of zero new jobs.

That August number, though, was revised upward in the latest report, to show the economy creating 57,000 jobs for the month.

“Today’s data show the persistence of merely moderate employment gains,” Citigroup economist Steven Wieting said in a note. “Employment can be a poor guide to more than the immediate future, but the data confirm our view that early August economic reports exaggerated U.S. weakness.

Getting the jobs market rolling again is seen as one of the two central spokes — the other being housing — in preventing the US economy from entering another recession.

Friday’s numbers offered mild consolation to those hoping that the US can at least plod along if not move into expansion mode.

Striking Verizon workers back on the job fed much of the gains as 45,000 of the telecom giant’s employees came off the picket lines and the unemployment rolls.

Average hourly earnings in September rose slightly to $23.12.

“In the big picture, today’s reading soothes recessionary fears,” said Andrew Wilkinson, chief economic strategist at Miller Tabak in New York.

The enthusiasm, albeit muted, was not universally shared.

“The September performance is more of a dead cat bounce than real progress,” Peter Morici, economist at the University of Maryland, said in a snap analysis. “Jobs creation will remain inadequate to keep unemployment from falling in the months ahead, especially considering the mass layoffs recently announced in banking and pharmaceuticals that will be effected in the months ahead.”

Long-term unemployment remains a problem, as the average duration of joblessness ticked up to a new record of 40.5 weeks. The number of those out of work for more than 20 weeks rose 208,000 to 6.24 million.

The manufacturing sector shed 13,000 jobs, posting a drop for the second month in a row. But the household survey, which is a more methodical count that doesn’t utilize estimations in the way the larger survey does, showed a net job creation of 137,000.

The level of unemployed people remained unchanged, though, at 14 million.

The jobs market is stagnant as is the rest of the economy. There will probably not be any movement until the direction of federal government initiatives are made clear and the Presidential campaign season offers some clarity.

-

Poll Watch: U.S. Unemployment Rate Falls to 8.7% and Underemployment Rate Down Slightly – But…..

According to the latest Gallup Poll.U.S. unemployment, as measured by Gallup without seasonal adjustment, fell to 8.7% at the end of September, significantly improved from 9.2% at the end of August. Unemployment is also significantly lower than the 10.1% rate recorded at the end of September of last year, and among the lowest 30-day averages Gallup has measured since January 2010.

The Underemployment rate falls.

U.S. underemployment, as measured by Gallup without seasonal adjustment, improved to 18.3% at the end of September from 18.5% at the end of August, as a decline in unemployment more than offset a slight increase in part-time workers seeking full-time employment. At the same time, the percentage of workers working full time for an employer decreased slightly to 64.9% from 65.3% at the end of August.

The chart:

But, there is a big BUT:

But, there is a big BUT:Fewer Are Employed Full Time for Employers

While fewer U.S. workers were underemployed and unemployed at the end of September compared with the end of August, fewer also had full-time jobs with employers. The 64.9% who reported having full-time jobs with employers is down from 65.3% at the end of August. This percentage is up slightly from 64.3% a year ago, but that was one of the lowest percentages of 2010.

The chart:

So, what does this all mean?

Even with the better on the surface numbers, there are negative rumblings under the surface. Plus, Gallup expects the government’s numbers to not be as good wen they report later, since they calculate the unemployment rate differently.

Gallup now finds more part-time workers seeking full-time work, suggesting that some workers are finding jobs but not the full-time positions they seek. Gallup also finds fewer workers employed full-time for employers at the end of September than was true a month ago. Combined with declining job creation in recent months, the U.S. employment situation remains challenging for job seekers and for the economy in general.

-

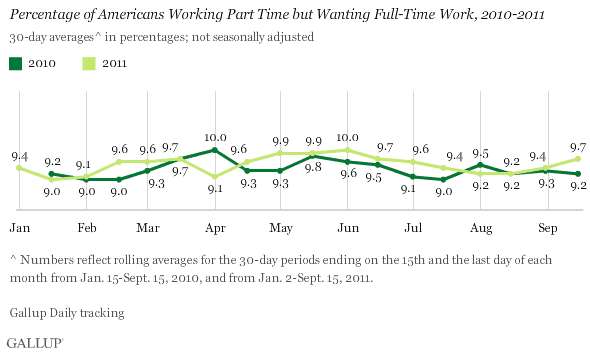

Poll Watch: Unemployment Rate Improves in Mid-September to 8.8% But Underemployment Remains High

According to the latest Gallup Poll.

According to the latest Gallup Poll.Unemployment, as measured by Gallup without seasonal adjustment, is 8.8% in mid-September — down from 9.1% at the end of August and the same as it was at the end of July. However, the apparent improvement in unemployment from August to mid-September may merely reflect normal seasonal hiring patterns and not be an indication that the employment situation is improving. On the other hand, current unemployment is considerably better than the 9.4% of a year ago.

But……

Underemployment remains stuck at 18.5% in Mid-September.

Underemployment, a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work, is 18.5% in mid-September — the same as the 18.5% at the end of August and the 18.6% of mid-September a year ago.

Number Forced to Take Part-time Work Increases

Offsetting the drop in the percentage of unemployed is an increase to 9.7% in the percentage of part-time workers who want full-time work in mid-September — up from 9.4% at the end of August and its highest level since mid-June. It is also up from 9.2% in mid-September last year. It is this increase, coupled with the downturn in unemployment, that yields the stability this month in the measure of overall underemployment.

The chart:

Gallup’s issues a caveat that the improving unemployment rate may not indicate that the employment situation is improving appreciably because of the difference in their polling methodology as compared to the government’s. Gallup maintains that the underemployment rate is a better indicator.

Nearly one in five Americans remain underemployed this year, as was the case a year ago, and the figures are worse for certain subgroups, including 28.9% underemployment for those 18 to 29, 23.1% for those who have not attended college, and 27.8% among blacks.

More Americans are now being forced to take part-time jobs when they really want full-time work. Focusing merely on unemployment instead of underemployment tends to ignore the hardship facing the millions of Americans forced to work part time. The long-term implications of this jobs situation — particularly among specific groups of Americans — for U.S. society as a whole may be more important than any of the major topics currently being debated nationally.

In other words, the employment situation is not improving appreciably.