-

California Affiliate Businesses Hurt By Internet Sales Tax Law

As you know, I was fired by Amazon.com as a sales affiliate because of the recently passed and enacted California internet sales tax legislation. But, others are feeling the pain even more acutely.

As you know, I was fired by Amazon.com as a sales affiliate because of the recently passed and enacted California internet sales tax legislation. But, others are feeling the pain even more acutely.For several years now, the military museum in Old Sacramento has quietly earned a nice little income by acting as a sales rep for Amazon.com.

But this small nonprofit, along with thousands of other California organizations and businesses, has been caught in an epic standoff between Amazon and state officials.

The state enacted a law last week requiring Amazon and other Internet retailers to begin collecting sales tax from California purchasers. Amazon says the law is unconstitutional and it won’t collect the tax.

While legal experts expect Amazon to sue the state, the online giant already is taking action of a different sort. Hoping to exempt itself from the law, Amazon has fired its 10,000 California affiliates, cutting off their commissions. Scores of other e-commerce companies affected by the law, including Overstock.com and a slew of smaller firms, have done the same.

Their decisions won’t prevent Californians from buying from Amazon and other online retailers.

But they will affect organizations like the California State Military Museum, which earned about $2,000 a year as an Amazon affiliate.

“That was our book-buying budget,” said Dan Sebby, the museum’s director.

A Camarillo trade group, the Performance Marketing Association, says 25,000 California businesses, individuals and nonprofits make commissions as affiliates for online retailers. They place links on their websites to the retailers, and earn commissions when visitors “click through” to make a purchase.

For many, it’s a sidelight. For others, it’s their livelihood. Rebecca Madigan, the trade group’s executive director and a critic of the new law, said the California affiliates will lose 25 percent of their Internet income as a result of the controversy.

“Hundreds and hundreds of retailers have terminated their affiliations,” she said.

California isn’t the first state to feud with Amazon. The Seattle retailer dumped affiliates in several other states, including Connecticut and Arkansas, that imposed an Internet sales tax. It has also rewarded states that remain tax free.

Citing a business-friendly climate, Amazon announced Wednesday it’s building a major distribution facility in Indiana. At the same time, it’s continuing a lengthy court fight over a New York law that imposes the tax requirement.

So, what will happen is the large sales affiliates will leave California, move to states that are not forcing Amazon.com et. al. to collect the tax and the State of California will attempt to force collection in October. Amazon and the others will simply sue.

There will be NO new tax revenue for California because of internet sales taxes and, in fact, will lose income, sales taxes, property taxes, etc. from those who will move.

Not a winner here for the California state budget and certainly not for California taxpayers.

-

California and Amazon.Com Dancing Around the Collection of Internet Sales Taxes

I doubt Amazon.com et. al. will voluntarily surrender to the newly enacted California legislation.

I doubt Amazon.com et. al. will voluntarily surrender to the newly enacted California legislation.Amazon.com Inc. is sticking by its vow not to collect California sales tax on Internet purchases — and state officials must decide what to do about it.

But the showdown over the new tax collection law that took effect Friday could be months away. Companies don’t send the taxes to the state until the end of each quarter, which means the California Board of Equalization won’t know officially about Amazon’s refusal to collect them until Oct. 1.

The tax-collecting agency said Amazon accounts for about half the Internet sales in California from large out-of-state firms that, prior to the new law, did not have to collect sales tax for the state. It said the new law would capture about $317 million a year in sales taxes that previously went uncollected.

Amazon, based in Seattle, has said repeatedly that it would not collect the California sales tax, calling it an unconstitutional infringement on interstate commerce.

Such defiance sets up a major legal battle by this fall, though Amazon could first challenge the law in court, as it has in New York. It has lost a trial court ruling there and has an appeal pending.

Amazon is “going to fight in every state where it can fight,” said Tracey G. Sellers, managing director of the Tampa, Fla., office of tax firm True Partners Consulting. “It’s going to be years before this whole issue is settled” in the courts.

Amazon declined to say whether it would sue to overturn the new California statute, though state officials expect a lawsuit.

As, I said before, ONLY the lawyers are going to get rich in litigating this legislation and California will NOT realize ANY additional tax revenue.

Plus, after many years of litigation, the federal law and court decisions are pretty clear – Amazon wins and the California taxpayers will lose with wasting tax dollars on litigation.

Stay tuned…..

-

Updated: Amazon.com Won’t Be Collecting the Internet Sales Tax Tomorrow – Amazon Has Fired Me: Amazon Cuts California Affiliate Ties Over Internet Sales Taxes

+++++ Update+++++

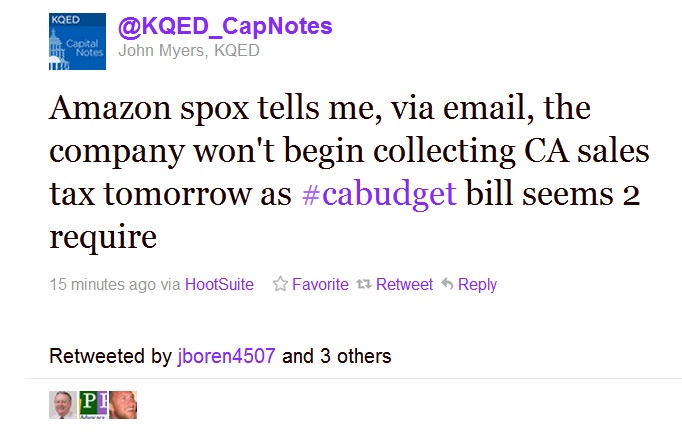

Looks like from this tweet that Amazon.com will be giving the flying fickle finger of fate to the State of California tomorrow.

You are aware of the FLAP since I have been writing about this California Legislation for months now. Here is the link to the archive of posts.

But, now it is official I am out as an Amazon.com Associate because of the actions of California Governor Jerry Brown last night.

Shopping at Amazon.com Inc. and other major Internet stores is poised to get more expensive.

Beginning Friday, a new state law will require large out-of-state retailers to collect sales taxes on purchases that their California customers make on the Internet – a prospect eased only slightly by a 1-percentage-point drop in the tax that also takes effect at the same time.

Getting the taxes, which consumers typically don’t pay to the state if online merchants don’t charge them, is “a common-sense idea,” said Gov. Jerry Brown, who signed the legislation into law Wednesday.

The new tax collection requirement – part of budget-related legislation – is expected to raise an estimated $317 million a year in new state and local government revenue.

But those taxes may come with a price. Amazon and online retailer Overstock.com Inc. told thousands of California Internet marketing affiliates that they will stop paying commissions for referrals of so-called click-through customers.

That’s because the new requirement applies only to online sellers based out of state that have some connection to California, such as workers, warehouses or offices here.

Both Amazon in Seattle and Overstock in Salt Lake City have told affiliates that they would have to move to another state if they wanted to continue earning commissions for referring customers.

“We oppose this bill because it is unconstitutional and counterproductive,” Amazon wrote its California business partners Wednesday. Amazon has not indicated what further actions it might take to challenge the California law.

Many of about 25,000 affiliates in California, especially larger ones with dozens of employees, are likely to leave the state, said Rebecca Madigan, executive director of trade group Performance Marketing Assn. The affiliates combined paid $152 million in state income taxes last year, she pointed out.”We have to consider it,” said Loren Bendele, chief executive of Savings.com, a West Los Angeles website that links viewers to hundreds of money-saving deals. “It does not look good for our business.”

Although I did not realize a great deal of money from Amazon.com in this program, since I was getting older and blogging more and practicing dentistry less, I was hoping to make a few more dollars from my blogs. But, I guess as Amazon and others gear up for the lawsuits against the State of California, we California Associates are just out of business.

Good move California Democrats and Wal-Mart. We know where you guys hang out and will sign initiative petitions and vote accordingly. Others will simply move their businesses and employees out of California.

A lose – lose for everyone with no real gains by the State of California.

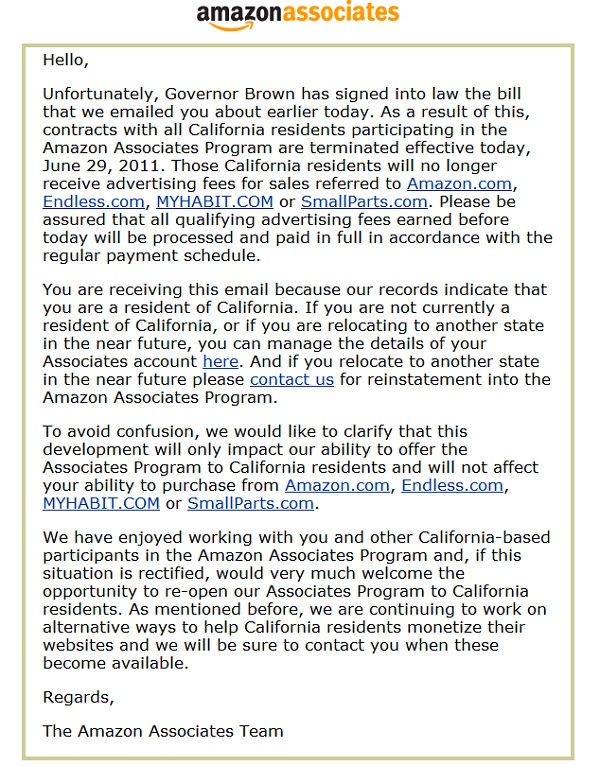

Here is the final notice from Amazon.com.

-

Amazon Has Fired Me: Amazon Cuts California Affiliate Ties Over Internet Sales Taxes

You are aware of the FLAP since I have been writing about this California Legislation for months now. Here is the link to the archive of posts.

But, now it is official I am out as an Amazon.com Associate because of the actions of California Governor Jerry Brown last night.

Shopping at Amazon.com Inc. and other major Internet stores is poised to get more expensive.

Beginning Friday, a new state law will require large out-of-state retailers to collect sales taxes on purchases that their California customers make on the Internet — a prospect eased only slightly by a 1-percentage-point drop in the tax that also takes effect at the same time.

Getting the taxes, which consumers typically don’t pay to the state if online merchants don’t charge them, is “a common-sense idea,” said Gov. Jerry Brown, who signed the legislation into law Wednesday.

The new tax collection requirement — part of budget-related legislation — is expected to raise an estimated $317 million a year in new state and local government revenue.

But those taxes may come with a price. Amazon and online retailer Overstock.com Inc. told thousands of California Internet marketing affiliates that they will stop paying commissions for referrals of so-called click-through customers.

That’s because the new requirement applies only to online sellers based out of state that have some connection to California, such as workers, warehouses or offices here.

Both Amazon in Seattle and Overstock in Salt Lake City have told affiliates that they would have to move to another state if they wanted to continue earning commissions for referring customers.

“We oppose this bill because it is unconstitutional and counterproductive,” Amazon wrote its California business partners Wednesday. Amazon has not indicated what further actions it might take to challenge the California law.

Many of about 25,000 affiliates in California, especially larger ones with dozens of employees, are likely to leave the state, said Rebecca Madigan, executive director of trade group Performance Marketing Assn. The affiliates combined paid $152 million in state income taxes last year, she pointed out.”We have to consider it,” said Loren Bendele, chief executive of Savings.com, a West Los Angeles website that links viewers to hundreds of money-saving deals. “It does not look good for our business.”

Although I did not realize a great deal of money from Amazon.com in this program, since I was getting older and blogging more and practicing dentistry less, I was hoping to make a few more dollars from my blogs. But, I guess as Amazon and others gear up for the lawsuits against the State of California, we California Associates are just out of business.

Good move California Democrats and Wal-Mart. We know where you guys hang out and will sign initiative petitions and vote accordingly. Others will simply move their businesses and employees out of California.

A lose – lose for everyone with no real gains by the State of California.

Here is the final notice from Amazon.com.

-

Amazon Cuts California Affiliate Ties Over Internet Sales Taxes

Just like they warned the California Legislature and California Governor Jerry Brown. Here is the termination letter I just received via e-mail:

Just like they warned the California Legislature and California Governor Jerry Brown. Here is the termination letter I just received via e-mail: Well, at least Californians were forewarned.

Well, at least Californians were forewarned.Now, what about that assumption in the recently (last night) enacted California state budget? You know, the one that had the state realizing $200 million as a result of this tax.

Since all of the Amazon Associates, like me are now out of a job, guess that really is a ROSY Scenario and an “unbalanced” budget.

Over to you, California Controller John Chiang

-

California Coalition to Protect Small Business Jobs Urges Governor Jerry Brown to Veto Amazon Internet Sales Tax Legislation – AB 28X

A new grass roots small business organization, the Coalition to Protect Small Business Jobs has formed to ask California Governor Jerry Brown to veto AB 28 X, the Amazon Tax Internet Sales Tax legislation. I have posted a copy of the bill here.

A new grass roots small business organization, the Coalition to Protect Small Business Jobs has formed to ask California Governor Jerry Brown to veto AB 28 X, the Amazon Tax Internet Sales Tax legislation. I have posted a copy of the bill here.

From the press release:Calling AB 28X’s new tax burdens on Internet sales a direct threat to small business and Internet entrepreneurship, the Coalition to Protect Small Business Jobs urged Governor Brown to veto the e-taxation bill approved by the California Legislature Wednesday.

“Without adequate protections for small businesses, this bill and bills like it across the country would make it even harder for us to compete with big retailers on the web, our last frontier for a more level playing field,” said Terri Hartman, Manager at Liz’s Antique Hardware in Los Angeles.

The 1992 U.S. Supreme Court Quill decision prohibits states from forcing businesses to collect sales taxes unless the business has a physical presence in that state. Bills like the one approved Wednesday attempt to get around that ruling by broadening the definition of physical presence to include those without a physical presence in the state.

“Small businesses create two of every three new jobs, account for more than half of all private sector jobs, hire 43 percent of high tech workers and drive innovation in a host of fields,” said Jessie Womble, State & Local Public Policy Manager at CONNECT – a non-profit organization that links inventors and entrepreneurs with the resources they need to succeed. “Protecting their ability to flourish on the Web should be of paramount concern to everyone.”

More than 17,000 small businesses in California have written letters to their state legislators in opposition to this legislation.

“The irony of this bill is that instead of producing more tax revenues, this unfair new tax burden would fall disproportionately on small businesses and result in fewer jobs and fewer state and local tax revenues,” said Bill LaMarr, Executive Director of the California Small Business Alliance.

The State Board of Equalization has reported that already small revenue estimates for the measure are subject to “considerable uncertainty,” don’t fully represent the likely loss of personal income to Californians and businesses and would be subject to years of delay as a result of expected litigation.

“The revenue figures for AB 28X are uncertain at best and this bill represents exactly the kind of budget gimmicks that Governor Brown is trying to correct,” said LaMarr. “We respectfully ask Governor Brown to veto this legislation and request the legislature to adopt real measures that will protect small business entrepreneurs.”

More information is available at www.ProtectSmallBusinessJobs.com.

Opponents of this e-taxation legislation include the California Small Business Alliance, NetChoice, California Business Alliance, Silicon Valley Leadership Group, TechAmerica, eBay, TechNet, Orinda Taxpayers Association, CONNECT and more than 17,000 small businesses throughout California including, Act + Fast Medical, TransTech Systems, 7daysale4u, Hamilton Tools, MRO Warehouse, Jones Vintage Parts, Electronics Nexus, Transition IT, Hall’s Window Center, Seabreeze Books and Charts , Liz’s Antique Hardware, Mannequin Madness, Valley Network Solutions and The Sticker Station.

But, before Governor Brown has a chance to veto this bill, there may be some problems with this legislation which I outlined here.

It is hard to say since California Proposition 25 language in the bill (tax increases requiring a 2/3?rds super majority) makes for some legal incongruity and the fact that Governor Jerry Brown vetoed the enabling California Budget bill .

So, it looks like now AB 28X may have to go back to the California Legislature for a re-vote.

It’s not clear if the bill will become law. It was part of the budget package approved Wednesday by the Legislature. Gov. Jerry Brown vetoed the main budget bill Thursday, and on Friday legislative staff members were determining whether the sales tax bill can still be legally sent to the governor separate from the budget, or whether lawmakers will need to vote on it again.

Brown told reporters in Los Angeles he believes the Internet tax is a “common sense idea.”

If he does sign the Internet bill, California could be in for a fight. Amazon and Overstock.com have threatened to sever ties with their California “affiliates” – thousands of businesses that earn commissions by referring customers to Amazon.

Amazon, probably the most aggressive opponent of the legislation, has already fired affiliates in several other states over similar laws, including two last week: Connecticut and Arkansas. It had no comment on this week’s developments in California.

However, should the legislature re-vote, pass the legislation and it is signed up Governor Brown (which is likely from his comments above), then Amazon and other retailers may sue anyway in either state court (the Proposition 26 requirement of increasing taxes by a 2/3rd’s super majority rule) or in federal court (the Constitutional Nexus issue.)

With the explosion in e-commerce, lawmakers in California and many other states have tried shifting the tax-collection burden from consumers to retailers – the same way brick-and-mortar transactions are treated.

Those efforts have been largely thwarted by a landmark 1992 U.S. Supreme Court decision involving a mail-order office-supply company. The court said retailers can’t be forced to collect taxes unless it has a “physical presence” in the state.

Nevertheless, several states have passed laws in the past few years forcing online retailers to collect tax. Lawmakers have attempted to get around the 1992 ruling by expanding the definitions of physical presence.

In California, with the legislation passed this week, that means subsidiaries doing business in the state. Amazon, for instance, employs 500 Californians at two subsidiaries in Silicon Valley, including one unit that helped design the Kindle electronic book reader.

California also says the retailer’s in-state affiliates constitute a physical presence. These affiliates are independent businesspeople who post links on their websites to Amazon and other e-tailers. When a customer clicks through and buys something from the e-tailer, they’re paid a commission.

Amazon and Overstock’s threats to dump their California affiliates, in retaliation for the tax legislation, has some of these affiliates rattled.

Ken Rockwell of La Jolla, who runs a photography website, said he earns much of his income from links to Amazon and other online sellers of camera equipment. If the bill becomes law, he and thousands of others would get cut off, he said.

“The only people who would get hurt are the people in the state of California,” Rockwell said.

Rockwell said he might move out of state as a result.

Well, I won’t be moving out of California because of the Amazon Tax, but can Californians really afford another costly expenditure of public funds paying lawyers to fight this for years in the courts?

What will likely happen is the bill will go back to the Legislature and pass. Then, Governor Brown will sign it into law. The law will go into effect on January 1, 2012, when Amazon and others will file their lawsuits. In the meantime, Amazon will close its two small divisions in the Silicon Valley (placing those employees out of work, at least in Califonria) and fire all of its Associates, including me.

And, the California budget will continue to be in a structural deficit with no increased internet sales tax revenue.

Previous:

-

Is the California Amazon Internet Sales Tax Legislation Dead?

It is hard to say since California Proposition 25 language in the bill (tax increases requiring a 2/3’rds super majority) makes for some legal incongruity and the fact that Governor Jerry Brown vetoed the enabling California Budget bill .

ABX1 28 (Blumenfield)

State Board of Equalization: administration: retailer engaged in business in this state.The Sales and Use Tax Law imposes a tax on retailers measured by the gross receipts from the sale of tangible personal property sold at retail in this state, or on the storage, use, or other consumption in this state of tangible personal property purchased from a retailer for storage, use, or other consumption in this state, measured by sales price. That law defines a ?retailer engaged in business in this state? to include retailers that engage in specified activities in this state and requires every retailer engaged in business in this state and making sales of tangible personal property for storage, use, or other consumption in this state to register with the State Board of Equalization and to collect the tax from the purchaser and remit it to the board.

This bill would further define a retailer engaged in business in this state as a retailer that has substantial nexus with this state and a retailer upon whom federal law permits the state to impose a use tax collection duty. The bill would also include specified retailers as retailers engaged in business in this state and would eliminate an exclusion.

This bill would include in the definition of a retailer engaged in business in this state any retailer entering into agreements under which a person or persons in this state, for a commission or other consideration, directly or indirectly refer potential purchasers, whether by an Internet-based link or an Internet Web site, or otherwise, to the retailer, provided the total cumulative sales price from all sales by the retailer to purchasers in this state that are referred pursuant to these agreements is in excess of $10,000 within the preceding 12 months, and provided further that the retailer has cumulative sales of tangible personal property to purchasers in this state of over $500,000, within the preceding 12 months, except as specified. This bill would also provide that a retailer entering into specified agreements to purchase advertising is not a retailer engaged in business in this state and would define a retailer to include an entity affiliated with a retailer under federal income tax law, as specified. This bill would further provide that these provisions would not apply if the retailer can demonstrate that the referrals wold not satisfy specified United States constitutional requirements, as provided.

This bill would also include as a retailer engaged in business in this state as a retailer that is a member of a commonly controlled group, as defined under the Corporation Tax Law, and a member of a combined reporting group, as defined, that includes another member of the retailer?s commonly controlled group that, pursuant to an agreement with or in cooperation with the retailer, performs services in this state in connection with tangible personal property to be sold by the retailer.

This bill would provide that the provisions of this bill are severable.

This bill would appropriate $1,000 from the General Fund to the State Board of Equalization for administrative operations.

The California Constitution authorizes the Governor to declare a fiscal emergency and to call the Legislature into special session for that purpose. Governor Schwarzenegger issued a proclamation declaring a fiscal emergency, and calling a special session for this purpose, on December 6, 2010. Governor Brown issued a proclamation on January 20, 2011, declaring and reaffirming that a fiscal emergency exists and stating that his proclamation supersedes the earlier proclamation for purposes of that constitutional provision.

This bill would state that it addresses the fiscal emergency declared and reaffirmed by the Governor by proclamation issued on January 20, 2011, pursuant to the California Constitution.

This bill would declare that it is to take immediate effect as a bill providing for appropriations related to the Budget Bill.

The lawyers will have to get together on this one but at first blush and with the solence coming from Amazon and Overstock.com, my bet is that the legislation is dead.

Thank goodness! I can keep my meager Amazon Associate status – at least for today.

Stay tuned….

-

Amazon Internet Sales Tax Legislation Passes as Part of California Budget

So, on to California Governor Jerry Brown for either his signature or veto.

For only the second time in 25 years a California spending plan was passed on time. One interesting part of that balancing act is an online sales tax, something lawmakers have been reluctant to approve in the past.

It seems like a no-brainer, the state needs money, so why not tax purchases online? We pay a tax when we buy the same products in the store. But critics say this tax could actually hurt some businesses in California. Those big online retailers, like Overstock and Amazon, have found a way around this law in other states. They just sever ties with businesses they deal with in the states with the tax. So companies that sell product to Overstock could lose Overstock as a client. This has put some small companies out of business.

The California state legislature needed to close a $9.6 billion deficit and this is expected to bring in $200 million a year in revenue. Some so called brick and mortar stores support this; they think it’s unfair that their product is taxed, but the same items online are not. The big question is do the benefits outweigh the possible side effects?

So, what happens next?

California Governor Jerry Brown can either sign the legislation, veto or allow it to become law. Brown has scheduled a 12 noon PDT new conference on the California budget and maybe we will know more then.

No word from Amazon or Overstock.com, but I bet their attorneys are preparing to file the lawsuits as soon as Brown makes his decision.

There will probably be a few court challenges.

One in federal court regarding the constitutionality of the nexus and the Commerce Clause. The other in California State Court regarding the imposition of a new tax without the 2/3’rds vote requirement of California Proposition 26.

Stay tuned…..and in the meantime, read this piece about yesterday’s legislative vote and what may portend for California.

-

Amazon Cuts Affiliate Ties In More States Over Internet Sales Taxes

Note well, California Legislators because if current legislation becomes law, then this will happen to your state.

Note well, California Legislators because if current legislation becomes law, then this will happen to your state.Amazon has shut down its affiliates program in Connecticut and Arkansas over the controversial issue of collecting state taxes.

The company announced the move in letters to affiliates Friday, noting that contracts with all Connecticut residents who participate in the Amazon Associates Program would be terminated effective immediately, while contracts with affiliates in Arkansas will be terminated on July 24.

Affiliates of the Associates Program are typically Web site owners and bloggers who link to Amazon on their sites as a way of driving traffic to the online retailer. In return, they receive a commission if a sale is made.

Though Amazon isn’t required to collect taxes in states where it has no presence, many cash-strapped local governments have tried to force the company to pay taxes in states where affiliates are located. Amazon naturally has challenged that requirement, a move that has forced the company to shut down its affiliate programs as it fights the tax regulations.

The retailer has terminated similar agreements in other states, including Illinois, Colorado, North Carolina, and Rhode Island, and has threatened to do the same in other states where affiliates are located.

In its letters to Connecticut and Arkansas affiliates, the company blamed the budgets signed by the governors of those states that force it to collect tax from online purchases even though Amazon has no physical presence in the states. Because of the new state tax laws, Amazon said it was “compelled” to shut down the affiliates programs.

Great, it looks like I will no longer be an Amazon Associate (if and when Jerry Brown signs the legislation), although I have not realized any revenue yet. But, what about the Californians that do derive their livelihood from Amazon? Well, they lose their jobs.

While federal litigation continues, up to the United States Supreme Court more than likely, the states will add little revenue while hurting its working citizens.

In a recent interview, Amazon CEO Jeff Bezos condemned the drive to collect sales tax, arguing that Amazon is no different than big retail chains that don’t collect sales tax in states where they don’t have what’s known as a “nexus,” or presence. The CEO said Amazon’s point of view is that the collection of taxes among the states should be simplified, referring to a plan called the Streamlined Sales Tax Initiative.

Previous:

-

Updated: California Assembly Passes Amazon Internet Sales Tax Legislation – Lawyers Get Rich; PMA Sues Illinois Over Internet Sales Tax Nexus

***** Update*****Well, it didn’t take long. the California Assembly passes this arguably unconstitutional internet sales tax legislation and in Illinois which had previously passed it, the Performance Marketing Association files a federal lawsuit.The Performance Marketing Association (PMA) filed a lawsuit against the Illinois Department of Revenue on Wednesday challenging the constitutionality of the newly enacted law that requires out-of-state merchants who advertise on affiliate websites in Illinois to collect sales tax.

PMA said there are at least 9,000 Illinois-based affiliates including bloggers, non-profits, home-based businesses and small businesses with dozens of employees that generated $744 million in advertising revenue last year.

Since the law was enacted in March, retailers including Amazon.com and Overstock.com have already severed their relationships, and PMA said if HB 3659 takes effect on July 1 as scheduled, Illinois affiliates will be in jeopardy, as will the $22 million in state income tax it estimates are generated annually from the affiliates.

PMA said there are over 200,000 online affiliates operating nationwide. It explained the affiliate model as follows:

“Performance marketing is an advertising model whereby an independent affiliate receives a referral fee or payment from an online retailer when visitors to the affiliate’s website use links and banners to navigate to and subsequently purchase products on the retailer’s site. Affiliate marketers do not sell products or collect money from consumers. Affiliates do not deliver products or services, and there is no ownership or business relationship between affiliates and merchants beyond a limited advertising agreement.”

The PMA said it filed its complaint with the United States District Court for the Northern District of Illinois on behalf of its members in an effort to reverse the effects of the Illinois affiliate nexus legislation and to deter other states from enacting similar measures.

According to the PMA, HB 3659 exceeds the limits of the state’s power to regulate interstate commerce under the Commerce Clause, as established in the 1992 Supreme Court ruling in Quill Corp. v. North Dakota, which declares that a state cannot impose a sales or use tax collection obligation on a company if the company does not have a physical presence in that state.

Additionally, the PMA believes the law discriminates against electronic commerce in violation of the Internet Tax Freedom Act, which states that Internet sales cannot be discriminated against through tax obligations that apply only to online transactions.

Fancy that.

The PMA’s news release is here. The Democrat majority and one Republican in the California Assembly passed the legislation yesterday.

The Democrat majority and one Republican in the California Assembly passed the legislation yesterday.The last of three bills aimed at getting the Seattle giant and other out-of-state online retailers to pay sales tax passed the Assembly on Wednesday afternoon.

“It’s something we’ve been working on for years,” said Assemblywoman Nancy Skinner, D-Berkeley, who authored the bill. “But this is the first time that so many businesses up and down the state are supporting it.”

A companion bill, authored by Assemblyman Charles Calderon, D-Whittier (Los Angeles County), passed the full floor on a 47-16 vote on Tuesday.

“This bill levels the playing field for businesses in California,” said Assemblyman Bill Berryhill, R-Ceres (Stanislaus County). “Not a day goes by when I don’t hear from businesses about their ability to compete.”

Which is what supporters of the so-called e-fairness legislation have been shouting from the rooftops for years, despite vetoes from former Gov. Arnold Schwarzenegger and dire threats from Amazon.com (2010 profit: $34 billion) and Utah’s Overstock.com to pull their affiliate business out of the state.

So, what comes next?

Senate action on the two Assembly bills, AB 153 (50-21- 9) and AB 155 (52-20 -8) and Assembly Action on SB 234 (22-17). Then the complimentary legislation if passed would go to Democrat Governor Jerry Brown. But, these bills passed with simple majority votes and some maintain that these “new” taxes fall under the jurisdiction of California Proposition 26, which requires a super legislative majority in order to pass.

I smell a lawsuit and a state court case, unless Governor Jerry Brown vetoes these bills, like Governor Arnold Schwarzenegger did in the past two legislative sessions.

In the meantime, if the bills become law, the actions should come swift from Amazon and the other internet sales tax targets, as they will pull their business out of California to reduce their liability.

And, as to the nexus issue, they will file probably a federal lawsuit.

This issue is far from resolved and I see the only revenue California will receive will be for its legal staff and judiciary.

Kind of a waste for California taxpayers.