-

Amazon.com Files a Referendum to Ask Voters to Overturn California Internet Sales Taxes

After writing about this issue for months, I really did not see this coming.

After writing about this issue for months, I really did not see this coming.Amazon.com Inc. wants California voters to decide whether to overturn a new law that forces online retailers to collect sales taxes there.

A petition for a referendum was filed Friday with the state Attorney General’s Office so that voters can decide on the requirement, which was included in a state budget signed into law in late June.

The new law forces online retailers to collect California sales taxes by expanding the definition of having a physical presence in the state. The requirement now kicks in if an online retailer has a related company, such as a marketing or product-development arm, or affiliates in the state – individuals and companies that earn commissions by referring visitors to Amazon from their websites.

Passage of the law, which is projected to help the state collect an additional $200 million annually, adds California to a growing list of states that have turned to such measures in hopes of bringing in more tax revenue. Its legislature passed a similar law in 2009, but then-Gov. Arnold Schwarzenegger vetoed it.

Billions of dollars are at stake as a growing number of states look for ways to generate more revenue without violating a 1992 U.S. Supreme Court ruling that prohibits them from forcing businesses to collect sales taxes unless the business has a physical presence, such as a store, in that state. When consumers order from out-of-state retailers, they’re supposed to pay the tax that is due, but they rarely do and it’s difficult to enforce.

States are trying to get around the Supreme Court restriction by passing laws that broaden the definition of a physical presence. Online retailers, meanwhile, are resisting being deputized as tax collectors.

Amazon had thousands of affiliates in California, which received fees varying from 4 percent to 15 percent of each sale they brought to the company. Amazon, which is based in Seattle, cut ties with them after the law’s passage.

Paul Misener, Amazon’s vice president of public policy, said the referendum supports “jobs and investment in California.”

“At a time when businesses are leaving California, it is important to enact policies that attract and encourage business, not drive it away,” he said.

I thought Amazon.com et. al. would be headed to court rather than the political arena which in California will certainly be expensive – more expensive to gather signatures for a referendum and then a television, plus direct mail campaign to overturn the law. But, it will certainly give the California GOP an issue to run on in 2012.

Maybe they will do both?

I will have the links to the exact language of the referendum and post some updates when they are available.

-

California Affiliate Businesses Hurt By Internet Sales Tax Law

As you know, I was fired by Amazon.com as a sales affiliate because of the recently passed and enacted California internet sales tax legislation. But, others are feeling the pain even more acutely.

As you know, I was fired by Amazon.com as a sales affiliate because of the recently passed and enacted California internet sales tax legislation. But, others are feeling the pain even more acutely.For several years now, the military museum in Old Sacramento has quietly earned a nice little income by acting as a sales rep for Amazon.com.

But this small nonprofit, along with thousands of other California organizations and businesses, has been caught in an epic standoff between Amazon and state officials.

The state enacted a law last week requiring Amazon and other Internet retailers to begin collecting sales tax from California purchasers. Amazon says the law is unconstitutional and it won’t collect the tax.

While legal experts expect Amazon to sue the state, the online giant already is taking action of a different sort. Hoping to exempt itself from the law, Amazon has fired its 10,000 California affiliates, cutting off their commissions. Scores of other e-commerce companies affected by the law, including Overstock.com and a slew of smaller firms, have done the same.

Their decisions won’t prevent Californians from buying from Amazon and other online retailers.

But they will affect organizations like the California State Military Museum, which earned about $2,000 a year as an Amazon affiliate.

“That was our book-buying budget,” said Dan Sebby, the museum’s director.

A Camarillo trade group, the Performance Marketing Association, says 25,000 California businesses, individuals and nonprofits make commissions as affiliates for online retailers. They place links on their websites to the retailers, and earn commissions when visitors “click through” to make a purchase.

For many, it’s a sidelight. For others, it’s their livelihood. Rebecca Madigan, the trade group’s executive director and a critic of the new law, said the California affiliates will lose 25 percent of their Internet income as a result of the controversy.

“Hundreds and hundreds of retailers have terminated their affiliations,” she said.

California isn’t the first state to feud with Amazon. The Seattle retailer dumped affiliates in several other states, including Connecticut and Arkansas, that imposed an Internet sales tax. It has also rewarded states that remain tax free.

Citing a business-friendly climate, Amazon announced Wednesday it’s building a major distribution facility in Indiana. At the same time, it’s continuing a lengthy court fight over a New York law that imposes the tax requirement.

So, what will happen is the large sales affiliates will leave California, move to states that are not forcing Amazon.com et. al. to collect the tax and the State of California will attempt to force collection in October. Amazon and the others will simply sue.

There will be NO new tax revenue for California because of internet sales taxes and, in fact, will lose income, sales taxes, property taxes, etc. from those who will move.

Not a winner here for the California state budget and certainly not for California taxpayers.

-

California and Amazon.Com Dancing Around the Collection of Internet Sales Taxes

I doubt Amazon.com et. al. will voluntarily surrender to the newly enacted California legislation.

I doubt Amazon.com et. al. will voluntarily surrender to the newly enacted California legislation.Amazon.com Inc. is sticking by its vow not to collect California sales tax on Internet purchases — and state officials must decide what to do about it.

But the showdown over the new tax collection law that took effect Friday could be months away. Companies don’t send the taxes to the state until the end of each quarter, which means the California Board of Equalization won’t know officially about Amazon’s refusal to collect them until Oct. 1.

The tax-collecting agency said Amazon accounts for about half the Internet sales in California from large out-of-state firms that, prior to the new law, did not have to collect sales tax for the state. It said the new law would capture about $317 million a year in sales taxes that previously went uncollected.

Amazon, based in Seattle, has said repeatedly that it would not collect the California sales tax, calling it an unconstitutional infringement on interstate commerce.

Such defiance sets up a major legal battle by this fall, though Amazon could first challenge the law in court, as it has in New York. It has lost a trial court ruling there and has an appeal pending.

Amazon is “going to fight in every state where it can fight,” said Tracey G. Sellers, managing director of the Tampa, Fla., office of tax firm True Partners Consulting. “It’s going to be years before this whole issue is settled” in the courts.

Amazon declined to say whether it would sue to overturn the new California statute, though state officials expect a lawsuit.

As, I said before, ONLY the lawyers are going to get rich in litigating this legislation and California will NOT realize ANY additional tax revenue.

Plus, after many years of litigation, the federal law and court decisions are pretty clear – Amazon wins and the California taxpayers will lose with wasting tax dollars on litigation.

Stay tuned…..

-

Updated: Amazon.com Won’t Be Collecting the Internet Sales Tax Tomorrow – Amazon Has Fired Me: Amazon Cuts California Affiliate Ties Over Internet Sales Taxes

+++++ Update+++++

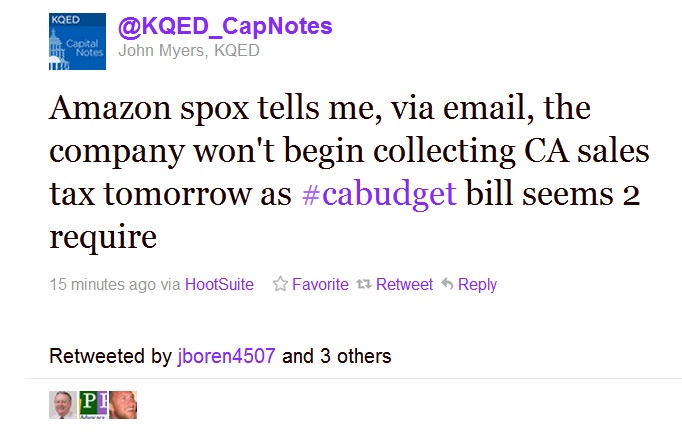

Looks like from this tweet that Amazon.com will be giving the flying fickle finger of fate to the State of California tomorrow.

You are aware of the FLAP since I have been writing about this California Legislation for months now. Here is the link to the archive of posts.

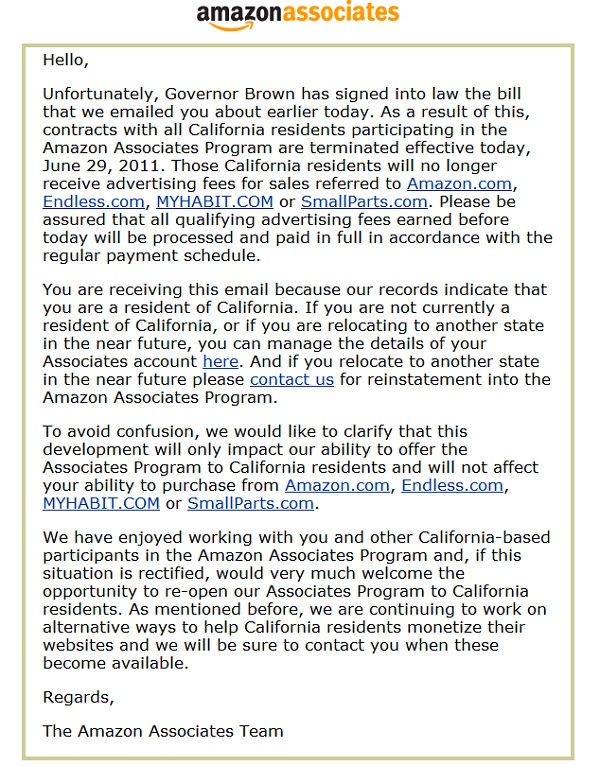

But, now it is official I am out as an Amazon.com Associate because of the actions of California Governor Jerry Brown last night.

Shopping at Amazon.com Inc. and other major Internet stores is poised to get more expensive.

Beginning Friday, a new state law will require large out-of-state retailers to collect sales taxes on purchases that their California customers make on the Internet – a prospect eased only slightly by a 1-percentage-point drop in the tax that also takes effect at the same time.

Getting the taxes, which consumers typically don’t pay to the state if online merchants don’t charge them, is “a common-sense idea,” said Gov. Jerry Brown, who signed the legislation into law Wednesday.

The new tax collection requirement – part of budget-related legislation – is expected to raise an estimated $317 million a year in new state and local government revenue.

But those taxes may come with a price. Amazon and online retailer Overstock.com Inc. told thousands of California Internet marketing affiliates that they will stop paying commissions for referrals of so-called click-through customers.

That’s because the new requirement applies only to online sellers based out of state that have some connection to California, such as workers, warehouses or offices here.

Both Amazon in Seattle and Overstock in Salt Lake City have told affiliates that they would have to move to another state if they wanted to continue earning commissions for referring customers.

“We oppose this bill because it is unconstitutional and counterproductive,” Amazon wrote its California business partners Wednesday. Amazon has not indicated what further actions it might take to challenge the California law.

Many of about 25,000 affiliates in California, especially larger ones with dozens of employees, are likely to leave the state, said Rebecca Madigan, executive director of trade group Performance Marketing Assn. The affiliates combined paid $152 million in state income taxes last year, she pointed out.”We have to consider it,” said Loren Bendele, chief executive of Savings.com, a West Los Angeles website that links viewers to hundreds of money-saving deals. “It does not look good for our business.”

Although I did not realize a great deal of money from Amazon.com in this program, since I was getting older and blogging more and practicing dentistry less, I was hoping to make a few more dollars from my blogs. But, I guess as Amazon and others gear up for the lawsuits against the State of California, we California Associates are just out of business.

Good move California Democrats and Wal-Mart. We know where you guys hang out and will sign initiative petitions and vote accordingly. Others will simply move their businesses and employees out of California.

A lose – lose for everyone with no real gains by the State of California.

Here is the final notice from Amazon.com.

-

Amazon Has Fired Me: Amazon Cuts California Affiliate Ties Over Internet Sales Taxes

You are aware of the FLAP since I have been writing about this California Legislation for months now. Here is the link to the archive of posts.

But, now it is official I am out as an Amazon.com Associate because of the actions of California Governor Jerry Brown last night.

Shopping at Amazon.com Inc. and other major Internet stores is poised to get more expensive.

Beginning Friday, a new state law will require large out-of-state retailers to collect sales taxes on purchases that their California customers make on the Internet — a prospect eased only slightly by a 1-percentage-point drop in the tax that also takes effect at the same time.

Getting the taxes, which consumers typically don’t pay to the state if online merchants don’t charge them, is “a common-sense idea,” said Gov. Jerry Brown, who signed the legislation into law Wednesday.

The new tax collection requirement — part of budget-related legislation — is expected to raise an estimated $317 million a year in new state and local government revenue.

But those taxes may come with a price. Amazon and online retailer Overstock.com Inc. told thousands of California Internet marketing affiliates that they will stop paying commissions for referrals of so-called click-through customers.

That’s because the new requirement applies only to online sellers based out of state that have some connection to California, such as workers, warehouses or offices here.

Both Amazon in Seattle and Overstock in Salt Lake City have told affiliates that they would have to move to another state if they wanted to continue earning commissions for referring customers.

“We oppose this bill because it is unconstitutional and counterproductive,” Amazon wrote its California business partners Wednesday. Amazon has not indicated what further actions it might take to challenge the California law.

Many of about 25,000 affiliates in California, especially larger ones with dozens of employees, are likely to leave the state, said Rebecca Madigan, executive director of trade group Performance Marketing Assn. The affiliates combined paid $152 million in state income taxes last year, she pointed out.”We have to consider it,” said Loren Bendele, chief executive of Savings.com, a West Los Angeles website that links viewers to hundreds of money-saving deals. “It does not look good for our business.”

Although I did not realize a great deal of money from Amazon.com in this program, since I was getting older and blogging more and practicing dentistry less, I was hoping to make a few more dollars from my blogs. But, I guess as Amazon and others gear up for the lawsuits against the State of California, we California Associates are just out of business.

Good move California Democrats and Wal-Mart. We know where you guys hang out and will sign initiative petitions and vote accordingly. Others will simply move their businesses and employees out of California.

A lose – lose for everyone with no real gains by the State of California.

Here is the final notice from Amazon.com.

-

Amazon Cuts California Affiliate Ties Over Internet Sales Taxes

Just like they warned the California Legislature and California Governor Jerry Brown. Here is the termination letter I just received via e-mail:

Just like they warned the California Legislature and California Governor Jerry Brown. Here is the termination letter I just received via e-mail: Well, at least Californians were forewarned.

Well, at least Californians were forewarned.Now, what about that assumption in the recently (last night) enacted California state budget? You know, the one that had the state realizing $200 million as a result of this tax.

Since all of the Amazon Associates, like me are now out of a job, guess that really is a ROSY Scenario and an “unbalanced” budget.

Over to you, California Controller John Chiang

-

Flap’s California Morning Collection: June 28, 2011

A morning collection of links and comments about my home, California.

A morning collection of links and comments about my home, California.Yesterday afternoon Democratic Governor Jerry Brown and Democratic Legislative leaders announced a new agreement on a majority-vote California state budget. Here are the details:

It maintains parts of the package Brown vetoed nearly two weeks ago:

— $150 million cut each to University of California, California State University

— $150 million cut to state courts

— $200 million in Amazon online tax enforcement

— $2.8 billion in deferrals to K-12 schools and community colleges

— $300 million from $12 per vehicle increase in DMV registration fee

— $50 million from fire fee for rural homeowners

— $1.7 billion from redevelopment agencies

— Higher tax receipts (now worth $1.2 billion from May and June)The new budget rejects some parts of that package:

— $1.2 billion from selling state buildings

— $900 million from raising a quarter-cent local sales tax

— $1 billion from First 5 commissions

— $500 million cut in local law enforcement grants

— $540 million deferral to University of California

— $700 million in federal funds for Medi-Cal errorsAnd it adds the following:

— $4 billion in higher projected revenues in 2011-12, with triggered cuts

— 1.06 percentage point sales tax swap that redirects money to local governments for Brown’s “realignment” plan rather than to the state. Sales tax rate will still fall 1 percent on July 1.The $4 billion “trigger” plan bears some explaining.

First, the plan requires Brown’s Department of Finance director, Ana Matosantos, to certify in January whether the $4 billion projection is accurate. She will use revenue totals for July to December and economic indicators to project the remainder of the fiscal year.

The “trigger” cuts are essentially in three tiers, based on how much of the extra $4 billion comes in.

Tier 0: If the state gets $3 billion to $4 billion of the money, the state will not impose additional cuts and roll over any balance of problem into the 2012-13 budget.

Tier 1: If the state gets $2 billion to $3 billion of the money, the state will impose about $600 million of cuts and roll over the remainder into the 2012-13 budget. The $600 million in cuts include a $100 million cut to UC, a $100 million cut to CSU, a $100 million cut to corrections and a $200 million cut to Health and Human Services.

Tier 2: If the state gets $0 to $2 billion of the money, the state will also impose up to $1.9 billion in cuts, including a $1.5 billion reduction to schools that assumes seven fewer classroom days. It also includes a $250 million elimination of school bus transportation (except for that which is federally mandated). Cuts will be proportionate to how much of the first $2 billion in revenues the state gets. State will also impose the Tier 1 cuts.

Talk about gimmicks. This budget is all smoke and mirrors with assumptions that are not within the realm of possibility.

Look at the Amazon Tax for example. Is there anyone who believes the state will capture $200 million in additional revenue when Amazon et. al. say they will cease their associate businesses in California if the law is signed. Plus, they plan to challenge the legislation in state and federal courts and what will that cost the State of California.

So, the Democrats have made a deal that will hopefully get past the Democratic Controller John Chiang in order to restore the Legislators pay. But, in all reality, this budget deal is a sham based on wildly exaggerated revenue assumptions – a rosy scenario at the extreme.

On to today’s links……

Dan Walters: Will Democrats’ rosy-scenario budget work?

When governors and legislators face seemingly big budget deficits, they often turn to gimmicks to balance income and outgo on paper.

The most creative have been what Capitol cynics call “rosy scenarios.”

The politicians conjure up some new source of revenue, swear it is legitimate and then use the projected windfall to close their gap.

Former Gov. Arnold Schwarzenegger was an early advocate of rosy scenarios, such as assuming that the state could get as much as $1 billion from new gambling compacts with Indian tribes, or it could seize a half-billion dollars from punitive judgments in lawsuits.

Later, he counted revenues from peddling the state’s workers’ compensation insurance business and state buildings. His rosiest scenario occurred last year, when his initial budget assumed that the federal government would give the state as much as $7 billion in extra cash.

None of those funds materialized, but that doesn’t prevent Capitol politicians from dusting off another rosy scenario.

Gov. Jerry Brown and Democratic legislators, whose hopes of winning Republican support for tax extensions vanished, ginned up a new budget Monday, just days before the 2011-12 fiscal year is to begin.

Brown vetoed one Democratic budget, saying it was so gimmicky that Wall Street bankers would not give the state billions of dollars in short-term operating loans. And Controller John Chiang followed that by decreeing that since a balanced budget wasn’t enacted by the constitutional deadline of June 15, he’d cut off legislators’ salaries and expense payments as a new state law requires.

Brown and Democrats went back to the budgetary drawing board, and a new rosy scenario emerged – that above-expectation tax revenue this year means the state will collect an extra $4 billion during the fiscal year.

Brown ditches special election, plans more cuts

Gov. Jerry Brown on Monday abandoned his plan to hold a special election this year on whether to renew expiring tax hikes and instead said he will balance California’s budget with a combination of spending cuts and a projected increase in normal tax revenue.

Brown announced the latest approach at a news conference during which he was accompanied by the leaders of the state Assembly and Senate, both fellow Democrats. They agreed to pursue a budget for the coming fiscal year without support from Republicans, who had refused to accept an extension of expiring temporary tax increases, which had been the centerpiece of the Democratic approach.

Brown had hoped to extend a series of tax increases that are expiring this week, but he needed two Republican votes in each house to bring the proposal before voters.

After six months of talks with a handful of GOP lawmakers, Brown said he finally gave up on the idea Sunday night after receiving a text message from one of the lawmakers.

“We had some very serious discussions. I thought we were getting close, but as I look back on it, there is an almost religious reluctance (among Republican lawmakers) to ever deal with the state budget in a way that requires new revenues,” Brown told reporters during a brief news conference.

Instead, the Democratic leaders said they would pursue a ballot initiative to bring tax increases before voters in November 2012.

In some early fallout from the political upheaval expected under proposed new districts for California lawmakers, the campaign arm for House Republicans said it would begin airing a TV ad slamming Rep. Lois Capps (D-Santa Barbara) over her position on Medicare.

“Congress is debating big changes for Medicare, and Congresswoman Lois Capps voted for the most extreme plan. Capps voted for the plan the media says would ‘decimate Medicare,'” the narrator says in the spot that the National Republican Congressional Committee said would begin airing Tuesday.

Republicans see Capps as among the most vulnerable of the Democrats under the redistricting. Her district, derided as the “ribbon of shame” for its blatant gerrymandering, forms a narrow, 200-mile coastline band that runs from Oxnard to the Monterey County line. Under the first round of proposed new maps, her district would shift considerably and become less Democratic than currently.

Enjoy your morning!

-

California Coalition to Protect Small Business Jobs Urges Governor Jerry Brown to Veto Amazon Internet Sales Tax Legislation – AB 28X

A new grass roots small business organization, the Coalition to Protect Small Business Jobs has formed to ask California Governor Jerry Brown to veto AB 28 X, the Amazon Tax Internet Sales Tax legislation. I have posted a copy of the bill here.

A new grass roots small business organization, the Coalition to Protect Small Business Jobs has formed to ask California Governor Jerry Brown to veto AB 28 X, the Amazon Tax Internet Sales Tax legislation. I have posted a copy of the bill here.

From the press release:Calling AB 28X’s new tax burdens on Internet sales a direct threat to small business and Internet entrepreneurship, the Coalition to Protect Small Business Jobs urged Governor Brown to veto the e-taxation bill approved by the California Legislature Wednesday.

“Without adequate protections for small businesses, this bill and bills like it across the country would make it even harder for us to compete with big retailers on the web, our last frontier for a more level playing field,” said Terri Hartman, Manager at Liz’s Antique Hardware in Los Angeles.

The 1992 U.S. Supreme Court Quill decision prohibits states from forcing businesses to collect sales taxes unless the business has a physical presence in that state. Bills like the one approved Wednesday attempt to get around that ruling by broadening the definition of physical presence to include those without a physical presence in the state.

“Small businesses create two of every three new jobs, account for more than half of all private sector jobs, hire 43 percent of high tech workers and drive innovation in a host of fields,” said Jessie Womble, State & Local Public Policy Manager at CONNECT – a non-profit organization that links inventors and entrepreneurs with the resources they need to succeed. “Protecting their ability to flourish on the Web should be of paramount concern to everyone.”

More than 17,000 small businesses in California have written letters to their state legislators in opposition to this legislation.

“The irony of this bill is that instead of producing more tax revenues, this unfair new tax burden would fall disproportionately on small businesses and result in fewer jobs and fewer state and local tax revenues,” said Bill LaMarr, Executive Director of the California Small Business Alliance.

The State Board of Equalization has reported that already small revenue estimates for the measure are subject to “considerable uncertainty,” don’t fully represent the likely loss of personal income to Californians and businesses and would be subject to years of delay as a result of expected litigation.

“The revenue figures for AB 28X are uncertain at best and this bill represents exactly the kind of budget gimmicks that Governor Brown is trying to correct,” said LaMarr. “We respectfully ask Governor Brown to veto this legislation and request the legislature to adopt real measures that will protect small business entrepreneurs.”

More information is available at www.ProtectSmallBusinessJobs.com.

Opponents of this e-taxation legislation include the California Small Business Alliance, NetChoice, California Business Alliance, Silicon Valley Leadership Group, TechAmerica, eBay, TechNet, Orinda Taxpayers Association, CONNECT and more than 17,000 small businesses throughout California including, Act + Fast Medical, TransTech Systems, 7daysale4u, Hamilton Tools, MRO Warehouse, Jones Vintage Parts, Electronics Nexus, Transition IT, Hall’s Window Center, Seabreeze Books and Charts , Liz’s Antique Hardware, Mannequin Madness, Valley Network Solutions and The Sticker Station.

But, before Governor Brown has a chance to veto this bill, there may be some problems with this legislation which I outlined here.

It is hard to say since California Proposition 25 language in the bill (tax increases requiring a 2/3?rds super majority) makes for some legal incongruity and the fact that Governor Jerry Brown vetoed the enabling California Budget bill .

So, it looks like now AB 28X may have to go back to the California Legislature for a re-vote.

It’s not clear if the bill will become law. It was part of the budget package approved Wednesday by the Legislature. Gov. Jerry Brown vetoed the main budget bill Thursday, and on Friday legislative staff members were determining whether the sales tax bill can still be legally sent to the governor separate from the budget, or whether lawmakers will need to vote on it again.

Brown told reporters in Los Angeles he believes the Internet tax is a “common sense idea.”

If he does sign the Internet bill, California could be in for a fight. Amazon and Overstock.com have threatened to sever ties with their California “affiliates” – thousands of businesses that earn commissions by referring customers to Amazon.

Amazon, probably the most aggressive opponent of the legislation, has already fired affiliates in several other states over similar laws, including two last week: Connecticut and Arkansas. It had no comment on this week’s developments in California.

However, should the legislature re-vote, pass the legislation and it is signed up Governor Brown (which is likely from his comments above), then Amazon and other retailers may sue anyway in either state court (the Proposition 26 requirement of increasing taxes by a 2/3rd’s super majority rule) or in federal court (the Constitutional Nexus issue.)

With the explosion in e-commerce, lawmakers in California and many other states have tried shifting the tax-collection burden from consumers to retailers – the same way brick-and-mortar transactions are treated.

Those efforts have been largely thwarted by a landmark 1992 U.S. Supreme Court decision involving a mail-order office-supply company. The court said retailers can’t be forced to collect taxes unless it has a “physical presence” in the state.

Nevertheless, several states have passed laws in the past few years forcing online retailers to collect tax. Lawmakers have attempted to get around the 1992 ruling by expanding the definitions of physical presence.

In California, with the legislation passed this week, that means subsidiaries doing business in the state. Amazon, for instance, employs 500 Californians at two subsidiaries in Silicon Valley, including one unit that helped design the Kindle electronic book reader.

California also says the retailer’s in-state affiliates constitute a physical presence. These affiliates are independent businesspeople who post links on their websites to Amazon and other e-tailers. When a customer clicks through and buys something from the e-tailer, they’re paid a commission.

Amazon and Overstock’s threats to dump their California affiliates, in retaliation for the tax legislation, has some of these affiliates rattled.

Ken Rockwell of La Jolla, who runs a photography website, said he earns much of his income from links to Amazon and other online sellers of camera equipment. If the bill becomes law, he and thousands of others would get cut off, he said.

“The only people who would get hurt are the people in the state of California,” Rockwell said.

Rockwell said he might move out of state as a result.

Well, I won’t be moving out of California because of the Amazon Tax, but can Californians really afford another costly expenditure of public funds paying lawyers to fight this for years in the courts?

What will likely happen is the bill will go back to the Legislature and pass. Then, Governor Brown will sign it into law. The law will go into effect on January 1, 2012, when Amazon and others will file their lawsuits. In the meantime, Amazon will close its two small divisions in the Silicon Valley (placing those employees out of work, at least in Califonria) and fire all of its Associates, including me.

And, the California budget will continue to be in a structural deficit with no increased internet sales tax revenue.

Previous:

-

Amazon Internet Sales Tax Legislation Passes as Part of California Budget

So, on to California Governor Jerry Brown for either his signature or veto.

For only the second time in 25 years a California spending plan was passed on time. One interesting part of that balancing act is an online sales tax, something lawmakers have been reluctant to approve in the past.

It seems like a no-brainer, the state needs money, so why not tax purchases online? We pay a tax when we buy the same products in the store. But critics say this tax could actually hurt some businesses in California. Those big online retailers, like Overstock and Amazon, have found a way around this law in other states. They just sever ties with businesses they deal with in the states with the tax. So companies that sell product to Overstock could lose Overstock as a client. This has put some small companies out of business.

The California state legislature needed to close a $9.6 billion deficit and this is expected to bring in $200 million a year in revenue. Some so called brick and mortar stores support this; they think it’s unfair that their product is taxed, but the same items online are not. The big question is do the benefits outweigh the possible side effects?

So, what happens next?

California Governor Jerry Brown can either sign the legislation, veto or allow it to become law. Brown has scheduled a 12 noon PDT new conference on the California budget and maybe we will know more then.

No word from Amazon or Overstock.com, but I bet their attorneys are preparing to file the lawsuits as soon as Brown makes his decision.

There will probably be a few court challenges.

One in federal court regarding the constitutionality of the nexus and the Commerce Clause. The other in California State Court regarding the imposition of a new tax without the 2/3’rds vote requirement of California Proposition 26.

Stay tuned…..and in the meantime, read this piece about yesterday’s legislative vote and what may portend for California.

-

Amazon Cuts Affiliate Ties In More States Over Internet Sales Taxes

Note well, California Legislators because if current legislation becomes law, then this will happen to your state.

Note well, California Legislators because if current legislation becomes law, then this will happen to your state.Amazon has shut down its affiliates program in Connecticut and Arkansas over the controversial issue of collecting state taxes.

The company announced the move in letters to affiliates Friday, noting that contracts with all Connecticut residents who participate in the Amazon Associates Program would be terminated effective immediately, while contracts with affiliates in Arkansas will be terminated on July 24.

Affiliates of the Associates Program are typically Web site owners and bloggers who link to Amazon on their sites as a way of driving traffic to the online retailer. In return, they receive a commission if a sale is made.

Though Amazon isn’t required to collect taxes in states where it has no presence, many cash-strapped local governments have tried to force the company to pay taxes in states where affiliates are located. Amazon naturally has challenged that requirement, a move that has forced the company to shut down its affiliate programs as it fights the tax regulations.

The retailer has terminated similar agreements in other states, including Illinois, Colorado, North Carolina, and Rhode Island, and has threatened to do the same in other states where affiliates are located.

In its letters to Connecticut and Arkansas affiliates, the company blamed the budgets signed by the governors of those states that force it to collect tax from online purchases even though Amazon has no physical presence in the states. Because of the new state tax laws, Amazon said it was “compelled” to shut down the affiliates programs.

Great, it looks like I will no longer be an Amazon Associate (if and when Jerry Brown signs the legislation), although I have not realized any revenue yet. But, what about the Californians that do derive their livelihood from Amazon? Well, they lose their jobs.

While federal litigation continues, up to the United States Supreme Court more than likely, the states will add little revenue while hurting its working citizens.

In a recent interview, Amazon CEO Jeff Bezos condemned the drive to collect sales tax, arguing that Amazon is no different than big retail chains that don’t collect sales tax in states where they don’t have what’s known as a “nexus,” or presence. The CEO said Amazon’s point of view is that the collection of taxes among the states should be simplified, referring to a plan called the Streamlined Sales Tax Initiative.

Previous: