-

Flap’s California Morning Collection: July 1, 2011

A morning collection of links and comments about my home, California.

A morning collection of links and comments about my home, California.Happy New Fiscal Year, California!

It is a happy day for most California taxpayers as the California Sales Tax has decreased one percentage point and motor vehicle registration fees have decreased, as interim tax increases expire.

It is not a happy day for hybrid automobile drivers since they will no longer have free rein driving in HOV – car poll lanes on California freeways.

But, oh well, I don’t drive a hybrid but do buy products subject to the sales tax.

California starts the new fiscal new year with a state budget which is unusual. But, alas, the budget is really a sham, full of gimmicks and slight of hand. But, hey, it passed California Democratic Controller John Chiang’s review and California Legislators will receive their paychecks. Just for your information, floor sessions are scheduled today so that our fair members of the California Assembly and State Senate can get their per diem for today and, of course, holiday pay for Monday.

It is all about the money.

With those happy thoughts it is onto the links:

Jerry Brown signs budget after making more cuts

California has a balanced budget for the fiscal year that begins today, after Gov. Jerry Brown on Thursday signed the spending plan to close what had been a $26.6 billion deficit when he took office in January.

The governor used his line-item veto to cut an additional $23.8 million from the state’s $86 billion general fund. He also cut another $234 million of spending from bond funds, largely the high-speed rail fund, in a move that could jeopardize BART’s plan to replace aging rail cars. Money also will be blocked from reaching Muni and Caltrain projects.

The governor also signed a bill, which is part of the budget package, that will take $130 million from cities across the state and could force some of those cities to disband.

At a low-key bill-signing ceremony that was closed to all but a photographer, a TV cameraman and a radio reporter, Brown praised lawmakers for doing “an extraordinary job with a budget nobody really liked anyway.” He went on to say, “It really does put our fiscal house in much better shape, but we’re not finished.”

Among the line-item vetoes the governor made in the general fund are a $22.8 million cut to courts. That money would have funded a part of the governor’s realignment plan to shift some inmates to county jails. The implementation has been delayed, and so court officials were expecting the cut.

The governor saved nearly $2 million by eliminating the California Postsecondary Education Commission, which he called “ineffective,” and cut $200,000 from the budget for the Commission on the Status of Women. Because of complicated accounting, some of the money doesn’t fall under the veto total.

Assembly Republicans celebrate ‘death’ of higher tax rates

Your wallets will start feeling heavier tomorrow.

That was the message from a handful of Republican Assembly members this morning as they applauded their resistance during budget talks to approving temporary tax extensions. The budget plan passed by the Legislature this week assures that those taxes will expire at midnight, which the legislators say will save the average Californian about $260 each year.

“This is a great day for California,” said Assemblyman Tim Donnelly, R-Twin Peaks. “The death of these taxes is the rebirth of our economy.”

As the legislators gathered in front of a pair of SUVs at Downtown Ford in Sacramento, Assembly Republican leader Connie Conway said that someone buying a $20,000 car this weekend would pay $300 less in taxes and fees than if they bought the car today.

“We’ve held the line. We’ve not negotiated. We’re very happy that July 1st is coming,” said Assemblyman Steve Knight, R-Palmdale.

Gov. Jerry Brown’s original budget plan required at least two Republican votes each from the Assembly and the Senate. It would have held steady the rates for income and sales taxes and vehicle license fees. Instead, all of those rates will drop under the spending plan that Brown is expected to sign into law today.

Texas Gov. Rick Perry wows conservatives in the OC: “Heavy on candor, light on pander”

Republican Texas Gov. Rick Perry was a whirlwind in the Golden State Thursday, racking up the miles, talking up his record — and meeting with potential supporters and donors.

And he’s not even running for President — yet.

Perry held a breakfast with San Diego insiders yesterday, and today hit Los Angeles, two events in Orange County and then flew to Sacramento.

We checked in with Jon Fleischman, publisher of the popular GOP website FlashReport, who co-hosted a grassroots meeting of 60 Republicans in Newport Beach for Perry with OC GOP chair Scott Baugh. He said the Lonestar State gov’s initial reviews from party activists and conservative stalwarts were strong.

“He was really, really impressive. He comes off as a very genuine — heavy on candor and light on pander,” said Fleischman. “Part of what we’re looking for is someone who has authenticity….who resonates, and has an ability to connect.”

“He’s got a very strong record of accomplishment that will appeal to GOP voters,” Fleischman said. “This is someone who isn’t going to have any problem going into meetings with major donors and blowing people away.”

So is he running? Bet on it, says The Flash.

UC Berkeley out-of-state student enrollment soars

The number of out-of-state students is soaring at UC Berkeley, with new figures showing more than a quarter of newcomers on campus – freshmen and transfer students – won’t be from California this year. That’s up from 23 percent last year, and 15 percent two years ago.

More important for the campus, the nonresidents pay nearly three times the tuition of in-state students, and will bring in $80 million this year, up from $54 million last year, spokeswoman Janet Gilmore said.

The trend is similar throughout the University of California, although Berkeley far outpaces other campuses in its zeal to bring in the lucrative outsiders.

Across UC’s nine undergraduate campuses, 14 percent of the freshmen and transfer students who plan to enroll this fall are from out of state, up from 11 percent last year, and 9 percent the year before, according to figures released Thursday.

Enjoy your morning!

-

Flap’s California Morning Collection: June 29, 2011

A morning collection of links and comments about my home, California.

Well, the Democrats in the California Legislature passed a state budget last night using rosy scenarios and some more dramatic cuts, if revenues do not arrive next January. Everyone agrees this is not a “balanced” budget but with the pre-agreement of Democrat Governor Jerry Brown will be signed into law. Democrat Controller, John Chiang will more than likely say it is balanced enough to allow California Legislators to finally receive their paychecks. After all, that is what is the most important for Sacramento Pols.

But, Californians will have their taxes lowered on July 1.

On to the links:

Democrats pass austerity budget for California

The Legislature passed an austerity budget Tuesday night that would cut from universities, courts and the poor, shutter 70 parks and threaten schools but would not — by officials’ own admission — restore California’s long-term financial health.

The UC and Cal State systems would face about a 23% funding cut, among the steepest in the proposal. Cash grants for the needy would fall, a program to help thousands of teen mothers get an education would be suspended and hundreds of millions of dollars would be siphoned from mental health programs.

The state park closures would be the first ever. Courts would face what the state’s chief justice has described as crippling reductions.

In an optimistic forecast, lawmakers built in an extra $4 billion of revenue. If all that cash does not materialize, K-12 schools — which had so far survived negotiations relatively unscathed — would face a cutback equal to shortening the academic year by seven days.

California Budget Deal Leaves GOP out in Cold

California’s budget is closely watched because the state is the most populous, has the largest economy and issues the most debt of any state in the U.S.

In budget talks of past years, Republicans typically extracted policy changes such as corporate tax breaks in exchange for their budget votes. But this year, their refusal to extend taxes left them with little negotiating power.

“We started a dialogue to put a cap in state spending, and we also asked for a reform in public pensions,” Sen. Bob Huff, the Republican vice chairman of the senate budget committee, said in floor comments. But he said Republicans were ultimately “iced out” of the budget process.

Republicans’ absence from budget-making is expected to be especially noticeable during boom times and under Democratic administrations, when Democrats could potentially raise spending more than in the past and wouldn’t require Republican help to do so, said Bruce Cain, a political-science professor at the University of California, Berkeley.

However, a budget supported only by Democrats cannot boost or extend taxes unless Democrats make up two-thirds of the legislature. So during tough times—such as this year, as California emerges from recession—Republicans can still stymie Democrats by blocking their attempts to raise revenue through taxes.

“One hand is still tied behind the majority party’s back,” Sen. Mark Leno, the Democratic chairman of the senate budget committee, said in comments on the senate floor.

Good news for David Dreier from redistricting panel? Perhaps

Things may be looking up for Rep. David Dreier.

The San Dimas Republican was penciled into a new congressional district dominated by Democrats under the first draft maps by the state’s redistricting commission, but he had reason for hope under a new concept unveiled Friday.

“It could potentially save one of the Republican seats in Los Angeles,” said Paul Mitchell, a redistricting consultant and Democratic political consultant who identified the potential beneficiaries as Dreier or Rep. Gary Miller, R-Diamond Bar.

Rob Wilcox, spokesman for the redistricting commission, cautioned Tuesday against drawing conclusions from the very conceptual maps, which he characterized as “visualizations” rather than actual proposals.

Boundary lines were drawn, in part, to increase the number of likely Los Angeles-area Latino congressional seats in consideration of the federal Voting Rights Act, meant to protect the voting power of minority groups.

The conceptual maps were shown to the redistricting commission for comment, then line drawers went back to the drawing board.

The boundary proposals targeted only a handful of congressional districts — none safe for Dreier — but their location suggested that a district could be drawn near his home that could make him a viable candidate, according to Mitchell.

Dan Walters: California’s new budget relies on shaky assumptions

The much-revised state budget that Gov. Jerry Brown and Democratic legislative leaders have cobbled together solves their political problem, at least for the moment.

It means a budget will be in place for the new fiscal year that begins Friday and the state can now ask bankers to buy billions of dollars in short-term revenue anticipation notes needed for cash flow purposes.

It means that legislators, whose salaries and expense checks had been suspended by Controller John Chiang for non-action on the budget, will be paid again.

It means that Democrats didn’t have to meet demands from Republicans, whose votes would have been needed for the tax extensions Brown and the Democrats originally sought.

However, it doesn’t mean that the chronic fiscal crisis is over, and the budget’s shaky assumptions mean it could fall apart in months.

Gov. Jerry Brown vetoes farmworkers’ bill

Gov. Jerry Brown, whose signature more than three decades ago gave agricultural workers the right to unionize by secret ballot, vetoed a bill Tuesday that would have made it easier for farm laborers to organize.

The proposal has been the top legislative goal for years for the United Farm Workers, whose founder, Cesar Chavez, had strong ties to Brown. It would have allowed the union to bargain for employees without holding an election — by simply collecting signatures from a majority of workers on cards saying they wanted representation.

Gov. Arnold Schwarzenegger vetoed similar measures four times during his seven years in office. Supporters of the latest bill had been hopeful that Brown, a Democrat who often spoke of his relationship with Chavez during his gubernatorial campaign last year, would approve it.

In his veto message Tuesday, Brown cited his work with the union 36 years ago.

“I am not yet convinced that the far-reaching provisions of this bill … are justified,” Brown wrote.

Enjoy your morning!

-

Flap’s California Morning Collection: June 28, 2011

A morning collection of links and comments about my home, California.

A morning collection of links and comments about my home, California.Yesterday afternoon Democratic Governor Jerry Brown and Democratic Legislative leaders announced a new agreement on a majority-vote California state budget. Here are the details:

It maintains parts of the package Brown vetoed nearly two weeks ago:

— $150 million cut each to University of California, California State University

— $150 million cut to state courts

— $200 million in Amazon online tax enforcement

— $2.8 billion in deferrals to K-12 schools and community colleges

— $300 million from $12 per vehicle increase in DMV registration fee

— $50 million from fire fee for rural homeowners

— $1.7 billion from redevelopment agencies

— Higher tax receipts (now worth $1.2 billion from May and June)The new budget rejects some parts of that package:

— $1.2 billion from selling state buildings

— $900 million from raising a quarter-cent local sales tax

— $1 billion from First 5 commissions

— $500 million cut in local law enforcement grants

— $540 million deferral to University of California

— $700 million in federal funds for Medi-Cal errorsAnd it adds the following:

— $4 billion in higher projected revenues in 2011-12, with triggered cuts

— 1.06 percentage point sales tax swap that redirects money to local governments for Brown’s “realignment” plan rather than to the state. Sales tax rate will still fall 1 percent on July 1.The $4 billion “trigger” plan bears some explaining.

First, the plan requires Brown’s Department of Finance director, Ana Matosantos, to certify in January whether the $4 billion projection is accurate. She will use revenue totals for July to December and economic indicators to project the remainder of the fiscal year.

The “trigger” cuts are essentially in three tiers, based on how much of the extra $4 billion comes in.

Tier 0: If the state gets $3 billion to $4 billion of the money, the state will not impose additional cuts and roll over any balance of problem into the 2012-13 budget.

Tier 1: If the state gets $2 billion to $3 billion of the money, the state will impose about $600 million of cuts and roll over the remainder into the 2012-13 budget. The $600 million in cuts include a $100 million cut to UC, a $100 million cut to CSU, a $100 million cut to corrections and a $200 million cut to Health and Human Services.

Tier 2: If the state gets $0 to $2 billion of the money, the state will also impose up to $1.9 billion in cuts, including a $1.5 billion reduction to schools that assumes seven fewer classroom days. It also includes a $250 million elimination of school bus transportation (except for that which is federally mandated). Cuts will be proportionate to how much of the first $2 billion in revenues the state gets. State will also impose the Tier 1 cuts.

Talk about gimmicks. This budget is all smoke and mirrors with assumptions that are not within the realm of possibility.

Look at the Amazon Tax for example. Is there anyone who believes the state will capture $200 million in additional revenue when Amazon et. al. say they will cease their associate businesses in California if the law is signed. Plus, they plan to challenge the legislation in state and federal courts and what will that cost the State of California.

So, the Democrats have made a deal that will hopefully get past the Democratic Controller John Chiang in order to restore the Legislators pay. But, in all reality, this budget deal is a sham based on wildly exaggerated revenue assumptions – a rosy scenario at the extreme.

On to today’s links……

Dan Walters: Will Democrats’ rosy-scenario budget work?

When governors and legislators face seemingly big budget deficits, they often turn to gimmicks to balance income and outgo on paper.

The most creative have been what Capitol cynics call “rosy scenarios.”

The politicians conjure up some new source of revenue, swear it is legitimate and then use the projected windfall to close their gap.

Former Gov. Arnold Schwarzenegger was an early advocate of rosy scenarios, such as assuming that the state could get as much as $1 billion from new gambling compacts with Indian tribes, or it could seize a half-billion dollars from punitive judgments in lawsuits.

Later, he counted revenues from peddling the state’s workers’ compensation insurance business and state buildings. His rosiest scenario occurred last year, when his initial budget assumed that the federal government would give the state as much as $7 billion in extra cash.

None of those funds materialized, but that doesn’t prevent Capitol politicians from dusting off another rosy scenario.

Gov. Jerry Brown and Democratic legislators, whose hopes of winning Republican support for tax extensions vanished, ginned up a new budget Monday, just days before the 2011-12 fiscal year is to begin.

Brown vetoed one Democratic budget, saying it was so gimmicky that Wall Street bankers would not give the state billions of dollars in short-term operating loans. And Controller John Chiang followed that by decreeing that since a balanced budget wasn’t enacted by the constitutional deadline of June 15, he’d cut off legislators’ salaries and expense payments as a new state law requires.

Brown and Democrats went back to the budgetary drawing board, and a new rosy scenario emerged – that above-expectation tax revenue this year means the state will collect an extra $4 billion during the fiscal year.

Brown ditches special election, plans more cuts

Gov. Jerry Brown on Monday abandoned his plan to hold a special election this year on whether to renew expiring tax hikes and instead said he will balance California’s budget with a combination of spending cuts and a projected increase in normal tax revenue.

Brown announced the latest approach at a news conference during which he was accompanied by the leaders of the state Assembly and Senate, both fellow Democrats. They agreed to pursue a budget for the coming fiscal year without support from Republicans, who had refused to accept an extension of expiring temporary tax increases, which had been the centerpiece of the Democratic approach.

Brown had hoped to extend a series of tax increases that are expiring this week, but he needed two Republican votes in each house to bring the proposal before voters.

After six months of talks with a handful of GOP lawmakers, Brown said he finally gave up on the idea Sunday night after receiving a text message from one of the lawmakers.

“We had some very serious discussions. I thought we were getting close, but as I look back on it, there is an almost religious reluctance (among Republican lawmakers) to ever deal with the state budget in a way that requires new revenues,” Brown told reporters during a brief news conference.

Instead, the Democratic leaders said they would pursue a ballot initiative to bring tax increases before voters in November 2012.

In some early fallout from the political upheaval expected under proposed new districts for California lawmakers, the campaign arm for House Republicans said it would begin airing a TV ad slamming Rep. Lois Capps (D-Santa Barbara) over her position on Medicare.

“Congress is debating big changes for Medicare, and Congresswoman Lois Capps voted for the most extreme plan. Capps voted for the plan the media says would ‘decimate Medicare,'” the narrator says in the spot that the National Republican Congressional Committee said would begin airing Tuesday.

Republicans see Capps as among the most vulnerable of the Democrats under the redistricting. Her district, derided as the “ribbon of shame” for its blatant gerrymandering, forms a narrow, 200-mile coastline band that runs from Oxnard to the Monterey County line. Under the first round of proposed new maps, her district would shift considerably and become less Democratic than currently.

Enjoy your morning!

-

California Controller John Chiang Says California Budget NOT Balanced and Refuses to Pay Legislators

Controller John Chiang discusses his decision to halt paychecks for all 120 state lawmakers after they failed to come up with a balanced budget by the June 15th deadline, during an interview with the Associated Press in Sacramento, Calif., Tuesday, June 21, 2011. Chiang said that he found the plan passed by Democrats on a simple majority vote last week was not balanced and therefore lawmakers did not meet the requirement for getting paid under Proposition 25, passed by the voters in November

Well, it will really hit the fan now about the California budget. It will be donkey against donkey.California lawmakers must forfeit their pay as of mid-June because the budget they passed last week — which Gov. Jerry Brown vetoed less than 24 hours later -– was not balanced, the state controller said Tuesday.

Since last week, Controller John Chiang, a Democrat, has been pondering whether to pay lawmakers. They passed budget legislation on June 15, meeting their constitutional deadline for only the second time in a quarter-century, but their plan relied heavily on accounting schemes to paper over the state’s deficit. In his veto message, Brown said he could not sign such a plan.

Chiang, who issues the state’s paychecks, said Tuesday that it wasn’t sufficient to keep their pay coming.

Voters approved a law last fall that empowered legislators to pass a budget with a simple majority vote but also threatened to strip them of pay for every day the blueprint is late. The measure makes no mention of approving a balanced budget, but other laws on the books dictate that state budgets be balanced.

Chiang’s decision is widely expected to spur a lawsuit, and lawmakers had begun questioning his authority over their pay even before he made his decision.

Yeah, here come the lawsuits and the California supreme Court will ultimately decide the issue. But, if I were the Democrats who hold an overwhelming majority in the Assembly and the State Senate, I would get busy and pass another budget – one that is balanced.

But, then again, the majority Dems would have to vote for unpopular cuts in spending and they don’t really want to do that.

Pity…..

-

Is the California Amazon Internet Sales Tax Legislation Dead?

It is hard to say since California Proposition 25 language in the bill (tax increases requiring a 2/3’rds super majority) makes for some legal incongruity and the fact that Governor Jerry Brown vetoed the enabling California Budget bill .

ABX1 28 (Blumenfield)

State Board of Equalization: administration: retailer engaged in business in this state.The Sales and Use Tax Law imposes a tax on retailers measured by the gross receipts from the sale of tangible personal property sold at retail in this state, or on the storage, use, or other consumption in this state of tangible personal property purchased from a retailer for storage, use, or other consumption in this state, measured by sales price. That law defines a ?retailer engaged in business in this state? to include retailers that engage in specified activities in this state and requires every retailer engaged in business in this state and making sales of tangible personal property for storage, use, or other consumption in this state to register with the State Board of Equalization and to collect the tax from the purchaser and remit it to the board.

This bill would further define a retailer engaged in business in this state as a retailer that has substantial nexus with this state and a retailer upon whom federal law permits the state to impose a use tax collection duty. The bill would also include specified retailers as retailers engaged in business in this state and would eliminate an exclusion.

This bill would include in the definition of a retailer engaged in business in this state any retailer entering into agreements under which a person or persons in this state, for a commission or other consideration, directly or indirectly refer potential purchasers, whether by an Internet-based link or an Internet Web site, or otherwise, to the retailer, provided the total cumulative sales price from all sales by the retailer to purchasers in this state that are referred pursuant to these agreements is in excess of $10,000 within the preceding 12 months, and provided further that the retailer has cumulative sales of tangible personal property to purchasers in this state of over $500,000, within the preceding 12 months, except as specified. This bill would also provide that a retailer entering into specified agreements to purchase advertising is not a retailer engaged in business in this state and would define a retailer to include an entity affiliated with a retailer under federal income tax law, as specified. This bill would further provide that these provisions would not apply if the retailer can demonstrate that the referrals wold not satisfy specified United States constitutional requirements, as provided.

This bill would also include as a retailer engaged in business in this state as a retailer that is a member of a commonly controlled group, as defined under the Corporation Tax Law, and a member of a combined reporting group, as defined, that includes another member of the retailer?s commonly controlled group that, pursuant to an agreement with or in cooperation with the retailer, performs services in this state in connection with tangible personal property to be sold by the retailer.

This bill would provide that the provisions of this bill are severable.

This bill would appropriate $1,000 from the General Fund to the State Board of Equalization for administrative operations.

The California Constitution authorizes the Governor to declare a fiscal emergency and to call the Legislature into special session for that purpose. Governor Schwarzenegger issued a proclamation declaring a fiscal emergency, and calling a special session for this purpose, on December 6, 2010. Governor Brown issued a proclamation on January 20, 2011, declaring and reaffirming that a fiscal emergency exists and stating that his proclamation supersedes the earlier proclamation for purposes of that constitutional provision.

This bill would state that it addresses the fiscal emergency declared and reaffirmed by the Governor by proclamation issued on January 20, 2011, pursuant to the California Constitution.

This bill would declare that it is to take immediate effect as a bill providing for appropriations related to the Budget Bill.

The lawyers will have to get together on this one but at first blush and with the solence coming from Amazon and Overstock.com, my bet is that the legislation is dead.

Thank goodness! I can keep my meager Amazon Associate status – at least for today.

Stay tuned….

-

California, California Budget, California Economy, California Unemployment, Flap's California Morning Collection, Jerry Brown

Flap’s California Morning Collection: June 17, 2011

A morning collection of links and comments about my home, California.

A morning collection of links and comments about my home, California.The big news in California today is the Jerry Brown veto of the California State budget yesterday. A budget passed over the objections and votes of the California GOP. In other words, Brown vetoed (the first such veto in California history) his own Democratic Party’s majority passed budget.

So, what is everyone concerned about in the Capitol today?

Why, it is whether California Legislators will get paid.

Wow!

In the meantime, the California economy continues in a downward spiral and unemployment actually increased this past month.

No word on the ridiculous Amazon Tax, but I assume that it was vetoed with the California Budget veto yesterday. But, I could be wrong. How convenient for the Governor though.

On to the links…..

California loses 29,200 jobs in May, a blow to recoveryCalifornia’s economic recovery stumbled in May as employers shed 29,200 jobs from payrolls, a surprisingly large loss in a state that had been on the mend. The state’s unemployment rate still dropped to 11.7%, from 11.8% the month before, according to numbers released this morning by the federal Bureau of Labor Statistics.

The numbers follow a slate of bad economic news throughout the country. The nation added just 54,000 jobs in May, and its unemployment rate grew to 9.1%. The previous three months, it had added an average of 220,000 jobs a month. Home prices have dropped in California and the nation to surprising lows as sales slow.

California has the second-highest unemployment rate in the nation, after Nevada, although Nevada’s unemployment rate dropped significantly in May, to 12.1% from 14.9% the year before.

California had added an adjusted 14,900 jobs in April, after cutting a net 11,600 in March. It experienced five straight months of job growth from October through February.

“We do know that the picture is not terribly rosy,” said Johannes Moenius, an economist at University of Redlands.

Gov. Jerry Brown’s veto of the new state budget Democrats passed this week represents a gamble that California’ deadlocked Legislature can find its way to a bipartisan solution that has evaded it all year.

Brown, in his veto message, blamed Republicans for refusing to go along with his proposal for a special election at which voters would be asked to ratify the extension of about $10 billion in taxes due to expire at the end of this month.

Brown also slammed his fellow Democrats, indirectly, by describing the budget they passed as filled with “legally questionable maneuvers, costly borrowing and unrealistic savings.” He noted that it would leave the state’s books unbalanced for years to come and add billions of dollars of new debt to the California’s already overburdened balance sheet.

But Brown’s rejection of the budget does not guarantee he is going to get anything better from the Legislature in the days and weeks ahead.

Republicans remain opposed to new taxes, and even to extending the temporary taxes that are about to expire. Democrats remain opposed to making the kind of spending cuts that would be required to balance the budget without those taxes. There appears to be very little middle ground.

Los Angeles Dodgers and Los Angeles Marathon: Judge extends McCourt talks, deal might be close

Superior Court Judge Scott Gordon on Thursday rescinded his finding that Frank and Jamie McCourt were at an impasse in their settlement talks, and he set a hearing for later today to determine if a deal had been reached. “I think we are close,” said Jamie’s lawyer Dennis Wasser, according to AP. “Hopefully, we can get it done tonight.

Dan Walters: If California legislators get paid, vetoed budget is giant charade

That presumes, of course, that the Democratic budget somehow put pressure on Republicans. In fact, it may have had the opposite effect of increasing their leverage on Brown to make concessions to get his centerpiece, an extension of expiring sales, income and car taxes, on the ballot.

A complicating factor is that Steinberg, Pérez and public employee unions really don’t want the fall election that Brown seeks on taxes, fearing – with good reason – that voters would reject them.

Still another is the new state law that strips legislators of salaries and expense checks, about $400 per day each, if a budget is not passed by June 15.

Controller John Chiang has appointed himself the law’s enforcer. Legislative leaders contend that Wednesday’s budget action complies, but Brown’s declaration that the budget was unbalanced gives Chiang grounds to stop the paychecks if he wishes.

Chiang was waffling Thursday, saying he wants “to complete our analysis” before deciding whether to pay lawmakers at the end of the month.

If Chiang pays legislators, the rejected budget will look like a giant charade by Democrats to evade the law.

Non-Californians at UC campuses get summer subsidy

A taxpayer subsidy that out-of-state students enrolled in the University of California system have been receiving for years is under scrutiny as the schools search for extra revenue.

During the regular school year, nonresidents pay up to three times as much as students from California, bringing the universities a few hundred million dollars. But partly due to measures taken to boost summer enrollment, they are spared from paying higher fees for summer classes.

“It seems out of sync,” said Steve Boilard, director of higher education policy for the Legislative Analyst’s Office.

Enjoy your morning!

-

Video: Governor Jerry Brown Vetoes California Budget – Now What?

I am returning Senate Bill 69 and Assembly Bill 98 without my signature

Brown announced the veto in a press release Thursday. “Unfortunately, the budget I have received is not a balanced solution,” his statement said. “It continues big deficits for years to come and adds billions of dollars of new debt. It also contains legally questionable maneuvers, costly borrowing and unrealistic savings. Finally, it is not financeable and therefore will not allow us to meet our obligations as they occur.”

Read the governor’s official veto message here.

The plan contains higher taxes, billions of dollars in delayed payments to schools, and various accounting maneuvers to balance the books. Brown had previously warned that he would not sign a budget containing such accounting gimmicks.

Democratic leaders in the Assembly and Senate said the plan they passed Wednesday was crafted without input from the administration.

It is unclear whether state lawmakers will receive their paychecks in the wake of the veto. Under a law passed by voters last year, legislators lose pay if they fail to send the governor a budget by June 15. Lawmakers said Wednesday they believe the budget they passed meets that test, but Controller John Chiang, California’s chief financial officer, will decide whether to issue their paychecks.

Brown’s veto is the latest twist in a budget process that has been just as divisive and partisan as it was under his predecessor, Arnold Schwarzenegger.

The ball is back in the California’s Legislature’s court, which I am positive they do not appreciate, especially if the California Controller decides to withhold their paychecks.

The Democrats who control the Legislature will either have to make more cuts or make some sort of deal with the Republicans to raise revenue – but in return for something. The likelihood of a deal with the GOP is extremely unlikely.

Plus, the unions who own the Democrats don’t want a tax election before 2012, because they wish to use their campaign cash to win a 2/3’rds super majority in the Legislature at the November 2012 general election.

So, it is the Schwarzenegger years all over again = budget gridlock and accounting tricks. But, Brown vetoed THAT budget today – so, what is next?

All eyes and ears in the California Legislature today will be on California Controller John Chiang to see if they get paid.

Bet they move fast, if their paychecks are withheld.

-

Flap’s California Morning Collection: June 16, 2011

A morning collection of links and comments about my home, California.

A morning collection of links and comments about my home, California.Well, California has a “balanced” budget, albeit a Democrat majority vote one and questionably balanced. It will be within the purview of California State Controller John Chiang to decide whether the passed budget legislation is indeed balanced or he is empowered by California law to ding (meaning withhold) the paychecks of California Legislators.

California Governor Jerry Brown continues (supposedly) to negotiate with the Republicans in order to schedule a tax election or pass tax extensions to make budget revenues easier for him and the majority Democrats. No deal so far.

Brown who can either sign, allow it to become law or veto the budget has scheduled a High Noon 12 PM PDT news conference and we will all learn more then – if it doesn’t leak out before = likely. Brown has 12 days to take or not take action.

So, on to the links.

California Democrats pass budget with taxes, cuts and tricksDemocratic lawmakers passed a rare on-time state budget Wednesday over Republican objections, but the plan — balanced with a blend of taxes, cuts and clever accounting — faces an uncertain fate at the hands of Gov. Jerry Brown.

After warning for months that devastating cutbacks to schools and public safety would occur without the renewed taxes that Brown has sought but has been unable to sell to Republicans, Democrats averted the most severe reductions.

But they did so by returning to old strategies that have papered over California’s deficits for years: delaying the payment of billions in bills, skipping debt repayments and penciling in money that may not materialize.

Using their new authority to pass a budget on a majority vote — and under threat of lost pay if a spending plan was not approved by Wednesday — the Democrats pushed through provisions to hike car registration fees and local sales tax rates and force online retailers, such as Amazon.com, to collect sales tax.

The plan would also cut more deeply into higher education, the courts and local law enforcement.

“It is not perfect. It is Plan B,” said Senate President Pro Tem Darrell Steinberg (D-Sacramento), who nonetheless called the package “worthy of the governor’s signature.”

Democrats said they hoped Brown would continue to negotiate with Republicans for the taxes he wants, to make some of their cutbacks unnecessary. But their blueprint puts Brown in a political pickle. It asks him to break two pledges central to his campaign for governor: no new taxes without voter approval and no more smoke-and-mirrors budgeting.

Brown has not said whether he will sign the document; he has 12 days to decide.

Fight Breaks Out on California Assembly Floor During Budget Debate

A fight broke out Wednesday on the Assembly floor as Assemblyman Warren Furutani confronted Assemblyman Don Wagner over comments deemed offensive.

The two members jawed angrily in each other’s faces before Furutani, D-Gardena, appeared to give Wagner a shove, prompting several colleagues to separate them in the final minutes of the day’s budget session.

The dispute brought the house to a standstill for a couple of minutes during debate over a controversial redevelopment plan.

The two-bill proposal compels redevelopment agencies to backfill state coffers and give money to local governments under threat of elimination. Wagner, R-Irvine, testified that it was comparable to a shakedown scheme and referred to the popular HBO show, “The Sopranos.”

That prompted Assemblyman Anthony Portantino, D-La Cañada Flintridge, to demand an apology for the Sopranos reference “as a proud Italian American.”

Wagner retorted that he’d “apologize to any Italian Americans who are not in the Mafia and engaged in insurance scams,” setting off a murmur among lawmakers.

Minutes later, Furutani and Wagner were in each other’s faces and had to be broken up by three other lawmakers. The back of the Assembly chamber was soon flooded with legislative aides who came to see the commotion.

The budget bills Democrats approved Wednesday include a combination of tax and fee increases, spending cuts and revenue assumptions. Democrats and Gov. Jerry Brown previously took steps to reduce the state’s deficit by $11.4 billion, primarily through spending cuts.

Here are some of the key provisions of the latest bills:

Taxes and fees:

— $12 annual fee on car registrations to pay for Department of Motor Vehicle services. The department’s costs previously were covered by a voter-approved increase in the vehicle license fee increase that expires July 1.

— $150 annual fee on homes in rural areas that depend on the California Department of Forestry and Fire Protection for wildfire protection.

— A quarter-cent local sales tax. A 1 percent increase in the state sales tax is scheduled to expire June 30, so consumers would see a net reduction of three-quarters of a cent in the sales tax they pay on goods.

— Requiring online retailers such as Amazon.com to collect California sales taxes, a change projected to net $200 million annually.

Additional spending cuts:

— University of California, $150 million.

— California State University, $150 million.

— California courts, $150 million.

— County offices of education, $50 million.

Field Poll: California voters favor revamping “three-strikes” law

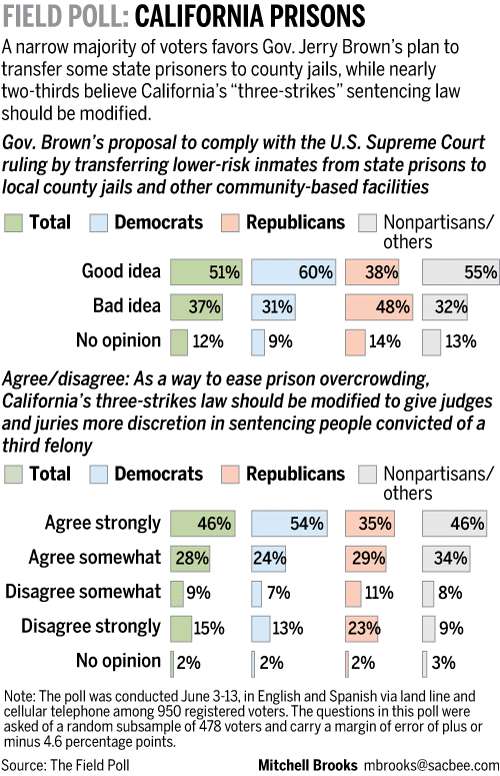

Most California voters see a court order to reduce the state’s prison population by 30,000 inmates as a serious problem, and nearly three out of four say it is time to revamp the state’s “three-strikes” law, a Field Poll out today finds.

The poll comes on the heels of last month’s ruling by the U.S. Supreme Court ordering California to address its prison overcrowding problem, and 79 percent of those surveyed said the matter is serious.

But there were not similar margins of support for Gov. Jerry Brown’s plans to transfer lower-risk inmates from prisons to county jails.

The poll found 51 percent of voters support the plan, with 37 percent saying it is a bad idea. Yet less than a majority of voters would support an extension of temporary tax increases to pay for it, the poll found.

The most significant finding came when voters were asked whether the state’s three-strikes law, which passed in 1994, should be modified to allow judges and juries more discretion when sentencing a criminal for a third felony.

The poll found 74 percent of voters would support allowing that discretion to ease prison overcrowding, with 24 percent opposed.

Enjoy your morning!

-

Amazon Internet Sales Tax Legislation Passes as Part of California Budget

So, on to California Governor Jerry Brown for either his signature or veto.

For only the second time in 25 years a California spending plan was passed on time. One interesting part of that balancing act is an online sales tax, something lawmakers have been reluctant to approve in the past.

It seems like a no-brainer, the state needs money, so why not tax purchases online? We pay a tax when we buy the same products in the store. But critics say this tax could actually hurt some businesses in California. Those big online retailers, like Overstock and Amazon, have found a way around this law in other states. They just sever ties with businesses they deal with in the states with the tax. So companies that sell product to Overstock could lose Overstock as a client. This has put some small companies out of business.

The California state legislature needed to close a $9.6 billion deficit and this is expected to bring in $200 million a year in revenue. Some so called brick and mortar stores support this; they think it’s unfair that their product is taxed, but the same items online are not. The big question is do the benefits outweigh the possible side effects?

So, what happens next?

California Governor Jerry Brown can either sign the legislation, veto or allow it to become law. Brown has scheduled a 12 noon PDT new conference on the California budget and maybe we will know more then.

No word from Amazon or Overstock.com, but I bet their attorneys are preparing to file the lawsuits as soon as Brown makes his decision.

There will probably be a few court challenges.

One in federal court regarding the constitutionality of the nexus and the Commerce Clause. The other in California State Court regarding the imposition of a new tax without the 2/3’rds vote requirement of California Proposition 26.

Stay tuned…..and in the meantime, read this piece about yesterday’s legislative vote and what may portend for California.

-

Flap’s California Morning Collection: June 15, 2011

All eyes are on California Capitol today, as the the Legislature faces a 11:59 PM deadline to pass a balanced budget or have their own paychecks affected. Any odds at some sort of “balanced” budget will pass when legislator’s own bank accounts are on the line?

All eyes are on California Capitol today, as the the Legislature faces a 11:59 PM deadline to pass a balanced budget or have their own paychecks affected. Any odds at some sort of “balanced” budget will pass when legislator’s own bank accounts are on the line?The answer is: YES.

Both the California Assembly and Senate have morning sessions this morning and the poop is that they will pass a majority vote “balanced budget.” Remember California Democrats hold overwhelming majorities in both houses, but lack the 2/3’rds super majority in order to raise taxes.

The California Legislature is facing an almost $ 10 Billion budget shortfall and is required by law to balance the books. Some of the proposals leaked out of the Capitol for the Democrat majority only plan include:

- Increasing the state sales tax by 1/4%

- Increasing car/vehicle registration fees by $12 each

- Imposing the “Amazon Tax” or internet sales tax collection requirements for online retailers who do not have a physical presence in California

- Charging rural homeowners a fee for firefighting services

- Cutting the budget of the California Court system by $150 Million

There are others, but the Democrats are floundering since most of the above will face certain court challenges or have no realistic ability to either cut spending or raise revenues. In other words, it is a SHAM and GIMMIC budget. Whether Democrat Governor Jerry Brown will go along with this Democrat majority only budget is uncertain.

Brown will continue to negotiate with the Republicans and hope for a better deal. The Republicans have no incentive to deal with the Governor unless some real reforms become reality – if even that.

So, on to the links:

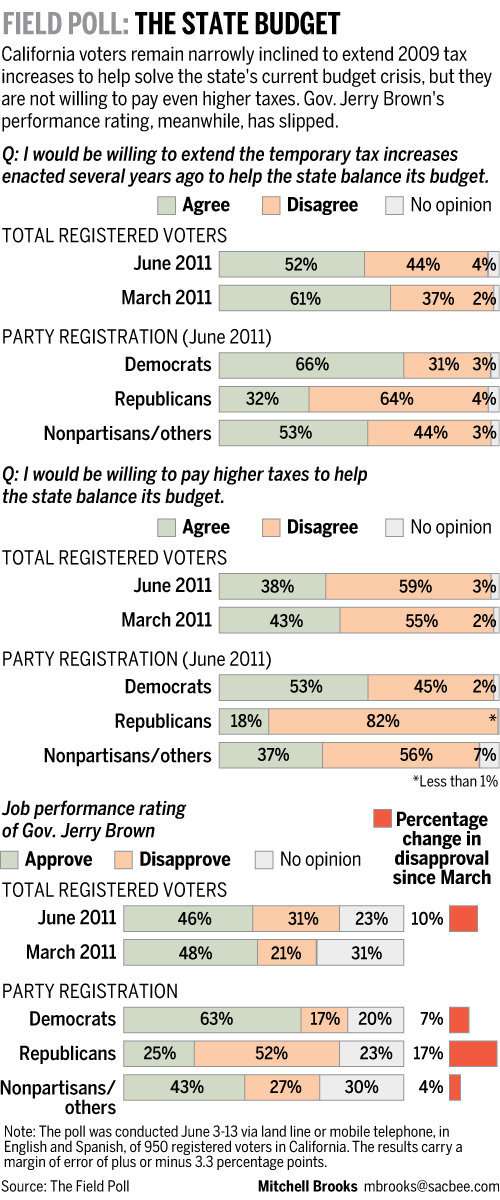

Field Poll: Support Slipping for Jerry Brown, Tax Extensions

Gov. Jerry Brown still has public support for his tax plan, but the margin has slipped, and so has his public approval rating, according to a Field Poll released today.

The poll comes as legislative Democrats – frustrated by months of failed budget talks between Brown and Republican lawmakers – prepare today to take up a budget of their own.

Though Brown’s public approval rating has slipped just two percentage points since March, to 46 percent, many Californians who previously were undecided about Brown made up their minds against him. Thirty-one percent of voters disapprove of Brown’s job performance, up from 21 percent in March.

Fifty-two percent of registered voters surveyed said they would be willing to extend temporary tax increases to close the state’s remaining $9.6 billion budget deficit, a drop of nine percentage points from March.

Highlights of the Democratic budget planHighlights of the Democratic budget package that lawmakers plan to vote on Wednesday, according to Assembly budget staff:

TAXES AND FEES

$900 million –- Raise local sales tax rate by 0.25 percentage point

$300 million –- Raise annual car registration fee by $12

$200 million –- Require online retailers, such as Amazon.com, to collect sales taxes

$160 million –- Impose fee on residents in fire zones

CUTS

$500 million –- Cut spending on a local law enforcement program (could be offset by a vehicle tax hike, if GOP agrees)

$300 million –- Reduce spending on University of California and California State University systems by $150 million each

$150 million –- Reduce court spending

DEFERRALS

$2.85 billion –- Delay paying schools and community bills until the next fiscal year

$540 million –- Delay paying some UC bills until next fiscal year

OTHER

$1.2 billion -– Revive a new version of proposal to sell state buildings,and then lease space back

$1 billion –- Assume state wins lawsuit to take money from early-childhood programs

$800 million -– Additional unanticipated tax revenue

$750 million -– Cancel repayment of old school debts

$700 million -– Assume federal government will pay some Medi-Cal bills

Conservative heat to end redevelopment

Who would have guessed that California conservative icon Tom McClintock, the former longtime legislator from Ventura County and current congressman representing a district in Northern California, would step up at a critical time to give Democratic Gov. Jerry Brown a boost in promoting one of his controversial budget proposals?

The answer is, anyone who paid attention to McClintock’s position as a legislator on the issue of redevelopment. As a property rights advocate, he was a leading foe of redevelopment. Now he’s stepped up and released a You Tube video in which he calls on supporters to urge their state lawmakers “to abolish these rogue agencies.”

The video comes just as city governments and other redevelopment advocates are sounding the alarm about a potential vote in the Legislature on two developing bills to accomplish most of what Brown is seeking. One bill would abolish redevelopment agencies; the other would allow specific agencies to stay in business, but only if they agreed to turn over most of their current flow of property tax revenues to their local school districts.

Enjoy your morning!