-

Los Angeles Mayor Antonio Villaraigosa Proposes Driving the Rest of California Business to Texas

Los Angeles Mayor Antonio Villaraigosa, left, and Los Angeles County Supervisor Zev Yaroslavsky hold souvenir concrete chips as they celebrate the demolition of two lanes of the Mulholland Drive bridge over Interstate 405 ahead of schedule in Los Angeles Sunday, July 17, 2011. The event that many feared would be the “Carmageddon” of epic traffic jams cruised calmly toward a finish Sunday as bridge work on the Los Angeles roadway was completed 16 hours ahead of schedule and officials reopened a 10-mile stretch of one of the nation’s busiest freeways

Oh, I mean Mayor Villar has proposed to modify California’s Proposition 13 for business property taxes.In what could be an initial foray into statewide politics, Los Angeles Mayor Antonio Villaraigosa called Tuesday for a renewal of progressive politics in California in the nation, including an overhaul of the state’s iconic limit on property taxes, Proposition 13.

“Progressives have to start thinking – and acting – big again,” Villaraigosa declared in prepared remarks for the Sacramento Press Club, to counteract anti-tax and anti-government drives by the Tea Party and other conservative blocs.

“If the Tea Party in Washington and their counterparts here in Sacramento are intent on pitching jobs overboard in the mindless pursuit of ideology over country, we have to be willing to stand and defend our people,” Villaraigosa said, adding, “And yes, that means making a case for new revenue to sustain long-term investment.”

Villaraigosa was particularly critical of the spending cuts that Gov. Jerry Brown and the Legislature’s Democrats made to balance the state budget after their efforts to extend some state taxes were rejected by Republicans. Those cuts, he said, will damage California’s ability to educate its children and remain economically competitive.

“Governor Brown, I say we need to have the courage to test the voltage in some of these so-called ‘third-rail’ issues, beginning with Proposition 13,” Villaraigosa told the press club. “We need to strengthen Proposition 13 and get it back to the original idea of protecting homeowners, Proposition 13 was never intended to be a corporate tax giveaway but that is what is has become.”

Some Democrats have backed changes in Proposition 13 that would remove, or at least modify, its protections for business property, but Brown has not signed onto that drive. He was governor when Proposition 13 passed in 1978 and although he opposed it prior to the election, after its passage he declared himself to be a “born-again tax cutter” and became a champion of state tax cuts and spending limits.

Does Villaraigosa who is termed out for another term as the Los Angeles Mayor, really think he has a shot at the California Governorship? And, by going to the LEFT of Jerry Brown, Lt. Governor and former San Francisco Mayor Gavin Newsom and/or Attorney General Kamala Harris?

I guess so.

But, Texas Governor Rick Perry must be licking his chops for all of the California businesses planning to move out of state, once this massive property tax increase hits the ballot.

-

The Myth of California Proposition 13 – Is it Toast?

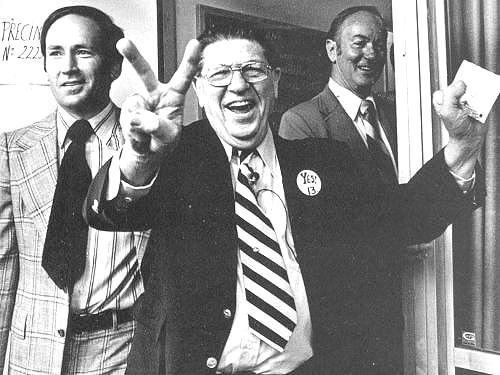

Howard Jarvis, chief sponsor of California Proposition 13, signals victory as he casts his own vote at the Fairfax-Melrose

precinct, June 1978. Courtesy of the Los Angeles TimesCalifornia Proposition 13 will be toast only if you desire a colossal collapse of the California real estate market and state government.The analysis of California demographics and history is so flawed that I hesitate to mention that the Professor pronouncing them is from my alma mater, USC.

The facts is that California Democrats have dominated the California Legislature for decades and would have spent California blind and bankrupt without Proposition 13, which limited taxes on real property. This is what was happening in California during the 1970’s prior to its passage.

The California Legislature, County and City governments just could not say no to government spending. It was far easier to raise property taxes a few more per cent every year or to instruct County Assessors to inflate the assessed value of homes and/or apartment buildings, than to disappoint a voting constituency. Property taxes rose California County by County until some folks were priced out of their homes i.e. had to sell them since they no longer had the cash to pay the growing property tax debt (liens are placed on California homes when property taxes are delinquent).

So, what would happen if Proposition 13 was disgarded or modified (not an easy task since it is engrained in the California Constitution.)?

The tenuous and foreclosure ridden California real estate market would collapse. As property taxes increased, in some cases precipitously, sales would commence or residents would walk away from their homes. With a burdening tax environment, even more businesses would relocate out of California since they would be unable to attract employees who could afford to live in California.

And, for what?

California’s tax scheme is already one of the highest in the country.

California’s State and Local Tax Burden Above National Average

California’s 2009 state and local tax burden of 11.8% of income is above the national average of 9.8%. California’s tax burden has decreased overall from 11.8% (5th nationally) in 1977 to 10.6% (6th nationally) in 2009. Californians pay $4,910 per capita in state and local taxes.

California’s 2011 Business Tax Climate Ranks 49th

California ranks 49th in the Tax Foundation’s State Business Tax Climate Index. The Index compares the states in five areas of taxation that impact business: corporate taxes; individual income taxes; sales taxes; unemployment insurance taxes; and taxes on property, including residential and commercial property. The ranks of neighboring states are as follows: Washington (11th), Oregon (14th), Arizona (34th), Nevada (4th) and Hawaii (22nd).

California’s Top Individual Income Tax Rate Is Third-Highest in the Nation

With seven brackets and a top rate of 10.3 percent for those earning over $1,000,000. California’s individual income tax has the third-highest rate and one of the most highly progressive structures in the nation. In 2009, California’s state-level individual income tax collections were $1,206 per person, which ranked 6th highest nationally. Since most small businesses are S Corporations, partnerships, or sole proprietorships, they pay their business taxes at the rates for individuals. That makes California’s taxes on small businesses some of the most burdensome in the nation.

California’s Corporate Income Tax Rate is the Highest in the West

Corporations looking to relocate, or even establish, a business in the West may shy away from California, as the state’s 8.84% flat rate is the highest corporate tax rate in the West. Nationally, only 8 states have a higher top corporate tax rate than California. In 2009, state-level corporate tax collections (excluding local taxes) in California were $259 per capita, which ranked 5th highest nationally.

California’s Sales Tax Rate Is Highest in the Nation

California levies an 8.25% general sales or use tax on consumers, which is the highest in the nation and above than the national median of 5.85%. Local governments are also permitted to levy another 1.5%. In 2007 combined state and local general and selective sales tax collections were $1,502 per person, which ranks 15th highest nationally. California’s statewide gasoline tax stands at 46.6 cents per gallon and is the 2nd highest in the nation, while its cigarette tax stands at $0.87 per pack of twenty (31rst highest nationally). Additionally, California’s general sales tax and various municipal sales taxes are levied on the sale of gasoline. The sales tax was adopted in 1933, the gasoline tax in 1923 and the cigarette tax in 1959.

Property Tax Collections Slightly Below Average

Despite Proposition 13, California ranks in the middle of the pack when the states are ranked on combined state/local property tax collections. Proposition 13 favors people who have owned the same property many years by only permitting re-evaluations at resale. As in most states, local governments in California collect far more in property taxes than the state does. California’s localities collected $968.01 per capita in property taxes in fiscal year 2006, the latest year for which the Census Bureau has published state-by-state data. At the state level, California collected $62.59 per capita during FY 2006. That brought its combined state/local property taxes to $1,030.60 per capita, ranked 28th highest nationally.

The problem with funding Big Government in California is not with tax receipts or Proposition 13. It is with the Democrats in the California Legislature who have not met a program they won’t fund, an entitlement they won’t increase or a tax they won’t raise.

Proposition 13 is going nowhere.

-

California Democrats Attempt to Balance State Budget By Violating the California Constitution But Arnold Schwarzenegger Says NO

Howard Jarvis, chief sponsor of the controversial Proposition 13, signals victory as he casts his own vote at the Fairfax-Melrose precinct.†June 1978. Courtesy of the Los Angeles Times

Even RINO California Governor Arnold Schwarzenegger will NOT take on Prop 13 and the California Constitution.Democratic leaders sent Gov. Arnold Schwarzenegger an $18 billion deficit-cutting package on Tuesday, a plan he quickly vetoed as anti-tax groups filed a lawsuit to stop it.

The activity came amid the Legislature’s third special session since the November election to deal with California’s worsening budget deficit, projected at $42 billion over the next 18 months.

With Schwarzenegger’s veto, time is running out for lawmakers to find a midyear fix. The state controller has warned that California will be so short of cash it will have to start issuing IOUs in February to vendors and taxpayers expecting refunds.

Democrats said their plan would have avoided what Schwarzenegger has described as a “financial Armageddon,” but it appeared to be dead even before it arrived on the governor’s desk.

California Legislative Democrats tried an end run around the California Constitution that was amended in 1978 by Proposition 13 that requires any increase in taxes be affirmed by a 2/3rd’s vote of the Legislature.

If the Governor were to have a change of heart and approve such an outrageous scheme, the California Supreme Court would quickly issue an injunction and/or a referendum petition would be quickly filed by California voters.

Looks like the California Legislature better get busy and cut spending.

Technorati Tags: Arnold Schwarzenegger, Proposition 13

-

Proposition 13 – 30 Years Later

Howard Jarvis, chief sponsor of the controversial Proposition 13, signals victory as he casts his own vote at the Fairfax-Melrose precinct.” June 1978. Courtesy of the Los Angeles Times

It has been 30 years ago today that California voters approved tax reduction initiative, Proposition 13.

Thirty years ago today, California voters overwhelmingly approved Proposition 13 as a way to keep seniors from losing their homes to skyrocketing property taxes. But the 1978 vote also ignited a revolution that dramatically changed the way people across America look at government and taxes.

The grassroots initiative has saved California property owners billions of dollars since it was passed, but the shackles Prop. 13 put on the ability of state and local governments to increase taxes could turn out to be its most important legacy. Even today, with the state facing a $17 billion budget shortfall, tax increases face certain opposition from many legislators and voters.

“Clearly, the Prop. 13 movement had the general attitude … that government and its ability to tax people isn’t to be trusted,” said Mark Baldassare, head of the nonpartisan Public Policy Institute of California. “That’s very much the theme that Ronald Reagan picked up when he ran for president in 1980, and it’s had a dramatic impact on national politics, particularly on the Republican side.”

Flap remembers the election well and was a California voter who voted to approve Proposition 13. Average Californians were struggling to pay their property taxes as each county trumped each other to reassess property and change the property tax rates to atone for spending mismanagement.

This fiscal mismanagement continues today with Governor Arnold Schwarzenegger’s $17 billion deficit laden budget. God only knows what tax rates would be today if Proposition 13 had not passed and started a nationwide tax revolt.

California’s LEFT continues to rail against the measure even after thirty years. Look at the pieces at the San Francisco Chronicle and the Los Angeles Times who both editorially opposed the June 1978 vote.

But, today’s polls show Californians still very much in favor of Proposition 13.

Across the state, 57 percent of voters said they would vote for Prop. 13 if it was on the ballot today while just 23 percent would vote against the measure. Support for the initiative was even stronger among homeowners, with 64 percent saying they support it.

About 79 percent of homeowners who bought their current homes prior to the passage of Prop. 13 said they support it.

“It’s always been popular,” said Mark DiCamillo, director of Field Poll. “And for many years, political insiders have considered Prop. 13 as a third rail of California politics. You just cannot touch it or if you do, you’ll be electrocuted. And this poll is another confirmation of that.”

The California Field Poll on Proposition 13 is here.

Key graphs:

- Sixty-six percent oppose a plan to gradually raise property taxes of longtime property owners so that they would pay rates similar to those who recently bought homes.

- Seventy-eight percent oppose amending Prop. 13 so that local governments can increase property taxes by more than 2 percent per year.

- About 70 percent of voters strongly object to the idea of amending a provision in the Prop. 13 that requires a two-thirds vote of the Legislature to increase taxes.

Howard Jarvis with Proposition 13 started an era of limited government and tax limitation. It has also fueled a real estate boom in California over three decades.

However, California politicians have NOT learned the lessons of 1978. And, this will be to their political peril.

After thirty years, the “dream” of Howard Jarvis and Paul Gann lives on.