-

Gallup Poll Watch: U.S. Economic Confidence Looks Bleak

According to the latest Gallup Poll.

Americans continue to have both a negative view of current U.S. economic conditions and a bleak outlook for the U.S. economy’s future, resulting in a Gallup Economic Confidence Index reading of -28 for the week of Aug. 13-19 — basically unchanged from the previous week.

Americans’ economic confidence has been low for most of the summer so far, with weekly averages between -23 and -29 since June 11. Prior to that, Americans had been somewhat more optimistic, and the weekly average of -16 in late May represented the highest confidence reading of the year. The -29 reached in January and again in late July represent the low points of the year so far. At the same time, Americans’ confidence was significantly lower in the latter part of 2011 than it is now.

Gallup’s Economic Confidence Index consists of two measures — one assessing current economic conditions and the other assessing the nation’s economic outlook.

I don’t see any burst of economic confidence out here in California. In fact, the news is filled with noise of impending business troubles and municipal bankruptcies.

So, what does this mean?

President Obama and other incumbent POLS don’t have much positive economic momentum to run for re-election.

-

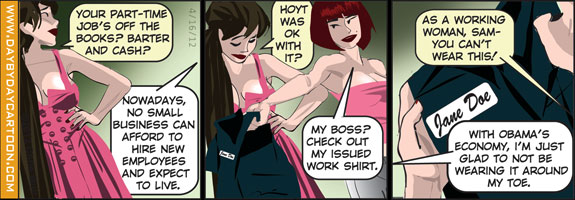

Day By Day April 16, 2012 – Obama Tag Team

Day By Day by Chris MuirChris, more and more Americans in the Obama economy are forced to work off of the books, thus, avoiding taxes.I mean, if it has worked for the illegal immigrants for decades…..

-

Poll Watch: Oklahoma City Leads America in Job Creation for Metropolitan Areas – Pittsburgh Second

According to the latest Gallup Poll.

According to the latest Gallup Poll.Oklahoma City, Okla., had the highest score on Gallup’s Job Creation Index among the 50 largest U.S. metro areas in 2011, followed by Pittsburgh, Pa., and several Southern metros. More than one in three workers in each of the top-performing metro areas said their employer was hiring or expanding the size of its workforce, but Oklahoma City led because of the relatively low percentage of workers (12%) who said their employer was letting workers go or decreasing the size of its workforce.

The metro areas surrounding Richmond, Va., Nashville, Tenn., and Orlando, Fla., complete the top five large metro areas with the highest Job Creation Index scores.

The results are based on Gallup Daily tracking interviews with U.S. workers conducted from January-December 2011. Gallup interviewed at least 698 respondents in each of the 50 largest metro areas in 2011, including 1,000 or more in 38 metro areas. Nationwide in 2011, an average of 31% of U.S. workers said their employer was hiring, while 18% said their employer was letting workers go, for a U.S. Job Creation Index score of +13.

The top-performing large metro areas have above-average hiring levels combined with below-average levels of letting go, resulting in high Job Creation Index scores. On the other side of the spectrum, some metro areas have relatively low hiring combined with high levels of letting go, resulting in low Job Creation Index scores.

Providence, R.I., Riverside, Calif., New York City, Sacramento, Calif., and Buffalo, N.Y., rank as the bottom five in net hiring among large U.S. metro areas.

Read the rest of the polling report.

Unfortunately, California and Nevada continue to struggle in the job hiring and letting go fronts.

What are the implications?

More employees will leave California for greener pastures in other less costly states, compounding on an already devastating California budget deficit.

And, in Nevada, voters may seek their revenge by voting out President Barack Obama in this Electoral College key battleground state.

-

Poll Watch: United States Economic Confidence the Best in Four Years

According to the latest Gallup Poll.

According to the latest Gallup Poll.U.S. economic confidence improved sharply to -18 in the week ending March 11 from -25 the prior week — the highest since the week ending Feb. 13, 2011, when it was also -18. The -18 readings this year and last are the highest weekly levels Gallup has recorded since it started tracking confidence daily in January 2008.

Americans’ economic confidence had declined recently from -20 in the week ending Feb. 12 to -25 for the week ending March 4. This brief deterioration in confidence may have been, at least in part, a response to increasing gas prices at the pump. However, the government’s positive unemployment report out last Friday appears to have given economic confidence another boost, as seemed to be the case following January’s unemployment report.

Gallup Daily tracking reveals that Americans’ confidence in the economy increased Friday, Saturday, and Sunday after the government report came out.

Read the entire report over at Gallup.

I am feeling better economic conditions in California although unemployment is unreasonably high and the state of California has massive budget deficits. I would say economic conditions are fluid and with rising fuel prices, there are unknowns on the horizon.

If I were President Obama, I would be leery of improving conditions to help in his re-election effort. And, if I were a GOP challenger, I would not be confident that a deteriorating economy would propel you into office.

It is important to note that Americans’ confidence in the economy was similar last year around this time. However, Americans’ hope for improvement in the overall economy during the months that followed the momentary surge in confidence early last year did not materialize. In fact, by last summer, the economy appeared to be near another downturn as politicians in the nation’s capital did battle over raising the federal debt ceiling.

It appears economic confidence is at another possible turning point, with gas prices on a pace to reach record highs in the summer. Further, it is not clear if the government can continue to report more good jobs news given modest economic growth.

For now though, it appears that higher gas prices have not been enough to keep Americans’ economic confidence from matching its highest weekly level in four years. However, if job increases slow, gas prices may quickly be perceived as an even more important threat, not only to Americans’ economic confidence, but also to the overall economy in the months ahead.

-

U.S. Job Creation Declines in February – Hiring Down and Firing Up

According to the latest Gallup Poll.

According to the latest Gallup Poll.Job market conditions in the United States slid back slightly in February, as Gallup’s Job Creation Index fell to +14 from +16 in January. The February score matches those recorded from October through December 2011. However, the reading last month reflects an improvement of two percentage points compared with a year ago (+12 in February 2011).

Hiring Down, Firing UpThe February Job Creation Index of +14 is based on 32% of workers nationwide saying their employers are hiring workers and expanding the size of their workforce, and 18% saying their employers are letting workers go and reducing the size of their workforce. The percentage hiring is down from 33% in January, while the percentage letting go is up from 17%. Both February percentages now match the readings recorded each month in the fourth quarter of 2011.

The chart:

What does all mean?

The American economy is NOT dramatically improving on the jobs front. With gasoline prices haven risen and rising and job creation prospects flat around the country in almost all regions – see map at the top), the Obama Administration will have a hard time making a case for success of their economic policies.

Declining consumer confidence is also generally unfavorable for the economy.

Gallup’s March numbers are looking a little better, but stay tuned since it is early in the month.

There will be no carping from the White House on these numbers, in advance of the government’s release of their numbers on Friday.

-

Poll Watch: U.S. Unemployment Rate Increases to 9.0 Per Cent

According to the latest Gallup Poll.

According to the latest Gallup Poll.The U.S. unemployment rate, as measured by Gallup without seasonal adjustment, is 9.0% in mid-February, up from 8.6% for January. The mid-month reading normally reflects what the U.S. government reports for the entire month, and is up from 8.3% in mid-January.

Gallup’s mid-month unemployment reading, based on the 30 days ending Feb. 15, serves as a preliminary estimate of the U.S. government report, and suggests the Bureau of Labor Statistics will likely report on the first Friday of March that its seasonally adjusted unemployment rate increased in February. Gallup found that unemployment decreased to 8.3% in its mid-January report, and suggested that the U.S. unemployment rate the BLS reported for January would decline.

Gallup also finds 10.0% of U.S. employees in mid-February are working part time but want full-time work, essentially the same as in January. The mid-February reading means the percentage of Americans who can only find part-time work remains close to its high since Gallup began measuring employment status in January 2010.

Although the past few weeks, the pundits have been spinning that the economy has been improving. America is not out of the woods just yet as far as unemployment.

And, underemployment has increased. Remember underemployment is a measure that combines the percentage of workers who are unemployed with the percentage working part time but wanting full-time work.

Now, let’s see what the United States government reports in early March.

But, the trend is upward in the unemployment rate.

-

Poll Watch: 22 Per Cent of Americans Satisfied With the Way Things Are Going

According to the latest Gallup Poll.

According to the latest Gallup Poll.The majority of Americans remain dissatisfied with the way things are going in the U.S., but the percentage who are satisfied continues to increase. Satisfaction, now at 22%, is higher than at any point since last spring.

Thirteen percent of Americans were satisfied with the state of the nation when President Barack Obama took office in January 2009. This percentage increased to as high as 36% in August 2009 before falling to the lower levels seen since then. As the economy struggled to recover during the past two years, and as the federal government had trouble reaching agreement on the major issues facing the country, satisfaction dropped, to as low as 11% last August and September.

The current results, based on a Feb. 2-5 Gallup poll, find satisfaction up significantly from December after slight increases each of the past two months. The increases are likely due to Americans’ greater optimism about the U.S. economy. The poll included three days of interviewing after the government released its positive employment report on Feb. 3.

22 per cent is nothing to write home about.

Let’s hope it continues to improve.

What are the implications?

Better news for President Obama’s re-election, but the numbers are still low historically. And, as Carly Fiorina just pointed out on Fox News and who will be delivering a speech at CPAC tomorrow, small business growth remains slow, if not stagnant, due to Obama Administration policies – namely taxation and regulation.

-

Poll Watch: Americans Ability to Afford Food Falls to Near Three Year Low

According to the latest Gallup Poll.

The percentage of Americans reporting that they had enough money to buy the food they or their families needed continued to decline in October, nearing the record low seen in November 2008. The percentage who did not lack money for food in 2011 fell to 79.8% from 80.1% in September, continuing a decline that began in April.

This is only the second time since Gallup and Healthways began tracking this measure as part of the Gallup-Healthways Well-Being Index in January 2008 that less than 80% of Americans reported that they had enough money to buy food throughout the past year. The record low was in November 2008, at the start of the economic crisis, when 79.4% reported that they had enough money to buy food for themselves or their families.

This measure — which asks if one had enough money to buy food in the past 12 months — has decreased to its lowest level of the calendar year each October since 2009. The reason for this pattern is unclear and does not appear to be related to world food prices. In 2008, fewer Americans reported that they had enough money to buy food in August and November than in October, likely affected by high gas prices in the former case and the onset of the economic crisis in the latter. Still, this October finds fewer Americans saying that they had enough money to buy food over the past year than in each October for the past three years.

Americans’ Access to Basic Needs Falls to New Record Low

Americans’ access to basic needs is now at the lowest level recorded since Gallup and Healthways began tracking it in January 2008. The Basic Access Index — which comprises 13 measures, including Americans’ ability to afford food, housing, and healthcare — declined to a record-low score of 81.2 in October. This means Americans’ access to basic needs, though still high in an absolute sense, is now worse than it was throughout the economic crisis and recession, including the prior record lows recorded in February and March 2009.

I wonder when some of these poor economic conditions in America will be referred to Obama creaations or the Occupy encampments as Obamavlles?

With the left-wing media, probably never. But, American voters understand and will take action accordingly.

-

American Unemployment Rate Steady at 9.1% Beating Tepid Expectations

Not the greatest, but 103,000 new jobs were added, albeit almost half were added because Verizon employees came off a strike.

The U.S. jobs picture beat tepid expectations, with the economy creating a significantly better than expected 103,000 new jobs in September that nonetheless was not enough to cut the unemployment rate from 9.1 percent.Economists had been looking for 60,000 total new nonfarm jobs, a month after the shock that the U.S. had created a net of zero new jobs.

That August number, though, was revised upward in the latest report, to show the economy creating 57,000 jobs for the month.

“Today’s data show the persistence of merely moderate employment gains,” Citigroup economist Steven Wieting said in a note. “Employment can be a poor guide to more than the immediate future, but the data confirm our view that early August economic reports exaggerated U.S. weakness.

Getting the jobs market rolling again is seen as one of the two central spokes — the other being housing — in preventing the US economy from entering another recession.

Friday’s numbers offered mild consolation to those hoping that the US can at least plod along if not move into expansion mode.

Striking Verizon workers back on the job fed much of the gains as 45,000 of the telecom giant’s employees came off the picket lines and the unemployment rolls.

Average hourly earnings in September rose slightly to $23.12.

“In the big picture, today’s reading soothes recessionary fears,” said Andrew Wilkinson, chief economic strategist at Miller Tabak in New York.

The enthusiasm, albeit muted, was not universally shared.

“The September performance is more of a dead cat bounce than real progress,” Peter Morici, economist at the University of Maryland, said in a snap analysis. “Jobs creation will remain inadequate to keep unemployment from falling in the months ahead, especially considering the mass layoffs recently announced in banking and pharmaceuticals that will be effected in the months ahead.”

Long-term unemployment remains a problem, as the average duration of joblessness ticked up to a new record of 40.5 weeks. The number of those out of work for more than 20 weeks rose 208,000 to 6.24 million.

The manufacturing sector shed 13,000 jobs, posting a drop for the second month in a row. But the household survey, which is a more methodical count that doesn’t utilize estimations in the way the larger survey does, showed a net job creation of 137,000.

The level of unemployed people remained unchanged, though, at 14 million.

The jobs market is stagnant as is the rest of the economy. There will probably not be any movement until the direction of federal government initiatives are made clear and the Presidential campaign season offers some clarity.

-

Poll Watch: U.S. Unemployment Rate Falls to 8.7% and Underemployment Rate Down Slightly – But…..

According to the latest Gallup Poll.U.S. unemployment, as measured by Gallup without seasonal adjustment, fell to 8.7% at the end of September, significantly improved from 9.2% at the end of August. Unemployment is also significantly lower than the 10.1% rate recorded at the end of September of last year, and among the lowest 30-day averages Gallup has measured since January 2010.

The Underemployment rate falls.

U.S. underemployment, as measured by Gallup without seasonal adjustment, improved to 18.3% at the end of September from 18.5% at the end of August, as a decline in unemployment more than offset a slight increase in part-time workers seeking full-time employment. At the same time, the percentage of workers working full time for an employer decreased slightly to 64.9% from 65.3% at the end of August.

The chart:

But, there is a big BUT:

But, there is a big BUT:Fewer Are Employed Full Time for Employers

While fewer U.S. workers were underemployed and unemployed at the end of September compared with the end of August, fewer also had full-time jobs with employers. The 64.9% who reported having full-time jobs with employers is down from 65.3% at the end of August. This percentage is up slightly from 64.3% a year ago, but that was one of the lowest percentages of 2010.

The chart:

So, what does this all mean?

Even with the better on the surface numbers, there are negative rumblings under the surface. Plus, Gallup expects the government’s numbers to not be as good wen they report later, since they calculate the unemployment rate differently.

Gallup now finds more part-time workers seeking full-time work, suggesting that some workers are finding jobs but not the full-time positions they seek. Gallup also finds fewer workers employed full-time for employers at the end of September than was true a month ago. Combined with declining job creation in recent months, the U.S. employment situation remains challenging for job seekers and for the economy in general.