-

Poll Watch: 73 Per Cent of Americans Say the Economy is Getting Worse

According to the latest Gallup Poll.Seventy-three percent of Americans in Gallup Daily tracking over the July 22-24 weekend say the U.S. economy is getting worse. This is up 11 percentage points from the three days ending July 6, and the worst level for this measure since the three days ending March 12, 2009.

Gallup tracks consumer perceptions of the U.S. economy daily and reports the results in three-day rolling, weekly, and monthly averages. More Americans have been saying the U.S. economy is getting worse throughout June and early July than said this over most of the previous five months. However, the number of Americans feeling this way has risen further over the last few weeks.

It is going to be a POX on both political parties, if the POLS don’t take active measures to increase jobs and economic growth.

The president, the Treasury secretary, and congressional leaders worried openly over the weekend about what might happen in the international financial markets if a debt-ceiling increase agreement wasn’t reached. They feared trouble in the Asian money markets when they opened on Sunday night and on Wall Street on Monday morning. Although there were some losses in the money markets after a debt ceiling deal failed to materialize, these were far less than might have been expected — particularly in light of what government leaders were saying.

Still, Gallup’s data show that Americans’ perceptions of the future of the U.S. economy should be the real concern for policymakers and the overall economy. All of the talk about default likely has weighed on consumer confidence, as has the dismal jobs market, increasing gas prices, and the economic soft patch.

It may be that once the debt ceiling battle is resolved, economic confidence will return. In the interim, however, it appears consumer psychology is continuing to deteriorate rapidly. The Conference Board is likely to pick up on this when it reports its Consumer Confidence Index later this week. It is also likely to be reflected in an anemic back-to-school sales season in the weeks ahead.

I would not want to be an incumbent member of Congress, if the economy deteriorates any further. And, the President, if trends do not change, he is a one termer.

-

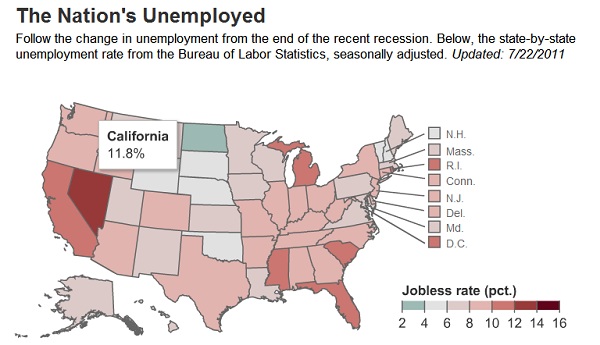

American Unemployment Increases in 28 States in June

The unemployment rate increased in 28 states in June, reflecting the nationwide increase to 9.2% from 9.1% over the month, the Labor Department said. Some 14 states saw their unemployment rate hold steady while eight logged decreases.

The U.S. economy added a paltry 18,000 jobs in June, as measured by a separate national survey, and an average of just 21,500 over the past two months – a disappointing result that has raised big questions about the sustainability of the nation’s economic recovery. The regional unemployment data show that the states that were hardest hit by the recession continue to have the toughest road in recovery.

For instance, California, Florida and Nevada — all three of which were hit hard by the housing bust — all had unemployment rates well over 10%. Nevada, at 12.4%, continues to have the nation’s highest unemployment rate, as the near-halt in homebuilding activity and steep drop in construction jobs continues to weigh heavily on the state’s economy.

Meantime, states that are rich in natural resources continue to outperform the nation. The lowest unemployment rate, 3.2%, was in oil-rich North Dakota, followed by Nebraska (4.1%) and South Dakota (4.8%) – both big farming states.

The Obama Administration must be extremely worried with these results.

Hope is not on the way and President Obama’s re-election prospects will dim, should unemployment NOT dramatically improve.

-

President 2012: Bernie Marcus Home Depot Co-Founder Says Obama is Choking Economic Recovery

According to this interview in Investor’s Business Daily.Bernie Marcus co-founded Home Depot (HD) in 1978 and brought it public in 1981 as the U.S. was suffering from the worst recession and unemployment in 40 years. The company thrived, creating hundreds of thousands of jobs and redefining home improvement retailing.

But Marcus says Home Depot “would never have succeeded” if it launched today due to onerous regulation. He recently helped launch the Job Creators Alliance, a Dallas-based nonprofit of CEOs and entrepreneurs dedicated to preserving the free enterprise system. IBD recently spoke to him about jobs and the economy.

IBD: What’s the single biggest impediment to job growth today?

Marcus: The U.S. government. Having built a small business into a big one, I can tell you that today the impediments that the government imposes are impossible to deal with. Home Depot would never have succeeded if we’d tried to start it today. Every day you see rules and regulations from a group of Washington bureaucrats who know nothing about running a business. And I mean every day. It’s become stifling.

If you’re a small businessman, the only way to deal with it is to work harder, put in more hours, and let people go. When you consider that something like 70% of the American people work for small businesses, you are talking about a big economic impact.

IBD: President Obama has promised to streamline and eliminate regulations. What’s your take?

Marcus: His speeches are wonderful. His output is absolutely, incredibly bad. As he speaks about cutting out regulations, they are now producing thousands of pages of new ones. With just ObamaCare by itself, you have a 2,000 page bill that’s probably going end up being 150,000 pages of regulations.

IBD: Washington has been consumed with debt talks. Is this the right focus now?

Marcus: They are all tied together. If we don’t lower spending and if we don’t deal with paying down the debt, we are going to have to raise taxes. Even brain-dead economists understand that when you raise taxes, you cost jobs.

IBD: If you could sit down with Obama and talk to him about job creation, what would you say?

Marcus: I’m not sure Obama would understand anything that I’d say, because he’s never really worked a day outside the political or legal area. He doesn’t know how to make a payroll, he doesn’t understand the problems businesses face. I would try to explain that the plight of the busi nessman is very reactive to Washington. As Washington piles on regulations and mandates, the impact is tremendous. I don’t think he’s a bad guy. I just think he has no knowledge of this.

Read it all.

The problem is that President Obama is an ideologue and will not listen. He will just spin out the same old Hope and Change Tripe and hope to get his demographic of voters to the polls for his re-election.

-

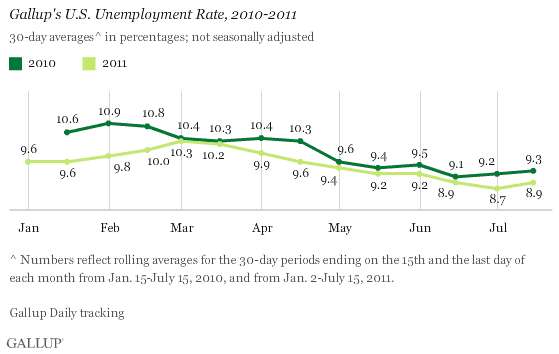

Poll Watch: American Unemployment at 8.9% Mid-July With Underemployment at 18.3%

According to the latest Gallup Poll.Unemployment, as measured by Gallup without seasonal adjustment, is at 8.9% in the middle of July — up from 8.7% at the end of June. Unemployment was at 9.3% at this same time a year ago.

The percentage of part-time workers who want full-time work is 9.4% in mid-July — down from 9.6% at the end of June. However, more Americans are working part time but seeking full-time work in mid-July 2011 than was the case in mid-July 2010 (9.0%).

Underemployment Shows No Improvement

Underemployment, a measure that combines the percentage of unemployed with the percentage working part time but wanting full-time work, is at 18.3% in mid-July — precisely the same as at the end of June and in mid-July 2010.

The chart:

So, what does this all mean?

American unemployment will continue to dog the Obama administration throughout the summer. The job situation is about the same as last year and there appear to be no help on the way.

Gallup’s modeling of its most recent unemployment results suggests an early July deterioration in the U.S. jobs situation. This may be partly a lagged effect of the economic soft patch during the first two quarters of 2011. It may also be a sign that many employers are pulling back on their hiring intentions, as slower-than-expected economic growth has reduced their sales and revenue expectations for the second half of the year.

Company hiring may also be suffering from the political rhetoric surrounding the debate over raising the federal debt limit. There seems to be a lack of clarity about exactly what would happen if the federal government is temporarily unable to pay its obligations — although everyone knows such an outcome would not be good. In addition, there are uncertainties on Wall Street, financial problems in Europe, and a sharp drop in economic confidence on Main Street. It is hard to hire when business prospects become so much more uncertain than usual.

Federal Reserve Chairman Ben Bernanke, in his testimony before the Congress last week, repeated his view that the weakness in today’s economy is temporary and that economic activity will pick up in the second half of 2011. At this point, the lack of job growth as reflected by Gallup’s unemployment, underemployment, and job creation data does not support that assessment. Instead, Gallup’s survey results tend to imply that the current economic soft patch may be somewhat less transitory than the Fed chief hopes.

The chart as to how Gallup’s unemployment rate differs from the U.S. Bureau of Labor Statistics.

-

Poll Watch: For Many Americans the Economic Recession Persists

According to the latest Gallup Poll.

According to the latest Gallup Poll.More Americans continue to struggle to access basic necessities than before the 2008 economic crisis. The U.S. earned a Basic Access Index score of 82.0 in June — about on par with the low point of 81.5 recorded in February and March of 2009 — and down compared with 83.6 measured in June 2008.

The current score is more than two points lower than the highest measured point of 84.1 in October 2008, revealing that nearly 5 million fewer Americans today have access to the basic necessities of life compared to that time.

These findings are based on approximately 29,000 interviews conducted each month from January 2008 through June 2011 with American adults as a part of the Gallup-Healthways Well-Being Index. The Basic Access Index is a 13-item measure of Americans’ access to basic necessities, ranging from food and shelter to clean water and healthcare.

Fewer Americans have health insurance or a personal physician

Americans’ access to health insurance declined the most among the items included in the Basic Access Index. In June 2011, 82.1% reported having health insurance, continuing a steady decline from 85.4% in June 2008. Fewer Americans also report having a personal doctor and visiting the dentist at least once in the last 12 months. “Enough money to buy food at all times in the last 12 months” is also trending lower compared to 2008 and 2009.

The chart:

So, what does this all mean?

I would not want to be an incumbent politician running in 2012. Voters who cannot meet basic needs will eventually lash out at the ballot box.

The idea that the 2008 economic recession is over is a fallacy.

The continued lack of recovery in the Basic Access Index metrics overall in 2011 shows that Americans are still lagging behind prior years in terms of their access to the basic necessities that foster a healthy, productive life. While Gallup has documented the decline in access to health insurance in recent years, important elements of healthcare including Americans’ ability to maintain a personal doctor and visit the dentist have also been casualties of the economic recession. This means millions fewer American adults have those basic needs met now than did before the financial crisis, despite modest improvements found in some areas. These results lend further evidence to the sluggishness of the current economic recovery, and underscore in real terms the health impact of the recession on the lives of American adults.

-

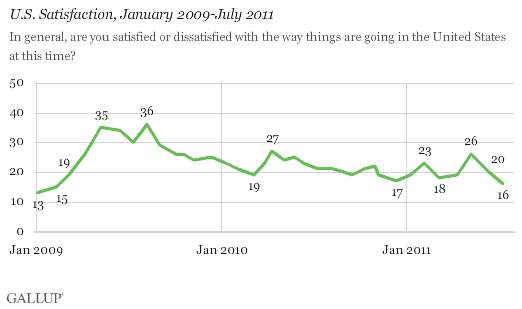

Poll Watch: U.S. Satisfaction Falls to Two Year Low = 16%

According to the latest Gallup Poll.

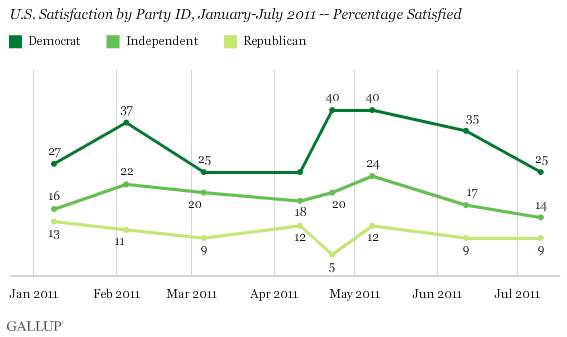

According to the latest Gallup Poll.Americans’ satisfaction with the way things are going in the country fell to 16% in July, the lowest in more than two years. Satisfaction approached this level in December 2010, when it descended to 17%, but it has not registered as low as 16% since February 2009 — President Barack Obama’s first full month in office — when it was 15%.

Not a good sign for the incumbent President or members of Congress.

Satisfaction fell four percentage points just in the last month, from 20% in June. Among party groups, Democrats’ satisfaction has dropped the most, from 35% to 25%. Independents’ satisfaction in June and July was fairly steady at 17% and 14%, respectively, and Republicans’ was unchanged at 9%.

Looks like even Democrats are giving up on President Obama and his administration.

Fewer Americans are satisfied with the way things are going in the country today than were satisfied in June or in any month since February 2009. The recent month-to-month decline is seen particularly among Democrats, but is also evident among whites, broadly.

Fewer Americans are satisfied with the way things are going in the country today than were satisfied in June or in any month since February 2009. The recent month-to-month decline is seen particularly among Democrats, but is also evident among whites, broadly.Americans’ approval of Obama and of Congress, along with their economic confidence ratings, are all similar to where they stood in June, as well as prior to the bin Laden-related rally in April. Whether the dampened satisfaction this month is a temporary finding or the precursor for a possible decline in Gallup’s political and economic indicators remains to be seen.

-

Poll Watch: Americans Prefer Spending Cuts But Are Open to Tax Increases

According to the latest Gallup Poll.

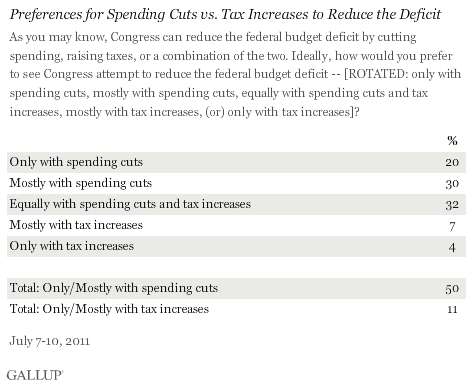

According to the latest Gallup Poll.Americans’ preferences for deficit reduction clearly favor spending cuts to tax increases, but most Americans favor a mix of the two approaches. Twenty percent favor an approach that relies only on spending cuts and 4% favor an approach that uses tax increases alone.

These results are based on a July 7-10 Gallup poll, conducted as government leaders from both parties continued negotiating an agreement to raise the federal debt limit. Both Republicans and Democrats appear willing to raise the debt limit, provided the government outlines plans to significantly reduce federal deficits in the future. The parties generally agree on making deep spending cuts, but do not agree on whether tax increases should be included to help reach their target goals for deficit reduction. Many Republicans in Congress oppose any such tax increases; thus, the legislation may not pass if tax hikes are included.

Americans do not necessarily share this view, with 20% saying deficit reduction should come only through spending cuts. That percentage is a little higher, 26%, among those who identify as Republicans. Republicans do, however, tilt heavily in favor of reducing the deficit primarily if not exclusively with spending cuts (67%) as opposed to tax increases (3%). Fifty-one percent of independents share that preference. Democrats are most inclined to want equal amounts of spending cuts and tax increases (42%), though more favor a tilt toward spending cuts (33%) than tax increases (20%).

So, what does this all mean?

There is political cover for Republicans to accept some tax increases or tax reform in return for receiving massive concessions from Congressional Democrats and President Obama on government spending.

But, whether Republicans will accept ANY tax increases and then vote to increase the debt ceiling is doubtful.

The best approach may be for the GOP House to vote for a three or six month debt ceiling extension without tax increases (all cuts) and dare Democrats in the Senate to filibuster it or President Obama to exercise his veto.

-

President 2012: Obama Says It Is Time to Eat Our Peas

I mean really how stupid is this?“I will not sign a 30-day or a 60-day or a 90-day extension. That is just not an acceptable approach. And if we think it’s hard now, imagine how these guys are going to be thinking six months from now in the middle of election season when they are all up. It’s not going to get easier, it’s going to get harder. So, we might as well do it now. Pull off the band-aid. Eat our peas. Now is the time to do it. If not now, when? We keep on talking about this stuff, and we have these high-minded pronouncements about how we’ve got to get control of the deficit, how we owe it to our children and our grandchildren. Well, let’s step up. Let’s do it,” President Obama said at his press conference today.

Mr. President, where in the frak have you been the past few years?

You have greatly expanded the national debt over the life of your administration, a trillion dollars alone on your failed economic stimulus program. Unemployment has increased and you have made the American economy worse.

Now, you want the Republicans to eat their peas?

Come on, you are not serious about limiting spending and the debt, you simply want political cover for your failed economic policies. You are not fooling anyone.

-

Poll Watch: Job Creation Index Edges Higher But Employers Still NOT Eager to Hire

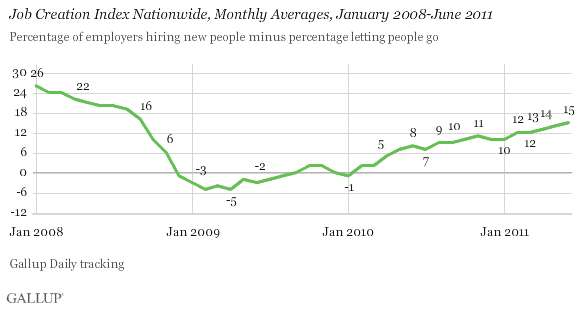

According to the latest Gallup Poll.Gallup’s Job Creation Index was at +15 in June. While this does not differ much from the +14 of May or the +13 of April, it is the highest since September 2008’s +16.

The Job Creation Index has increased steadily if marginally in 2011. This continues a pattern that began after the Index matched its low point of -5 in April 2009, and is consistent with the improvement in the overall U.S. job situation over the past couple of years.

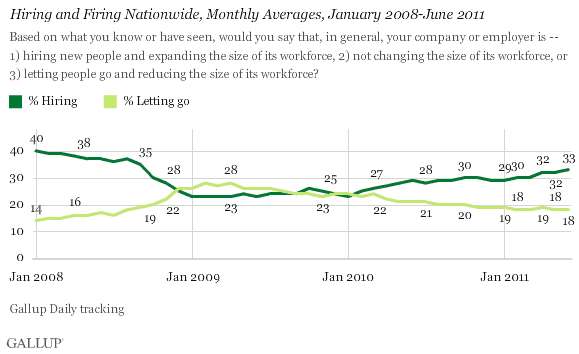

Hiring has increased moderately in 2011.

The Job Creation Index score of +15 in June is based on 33% of workers nationwide saying their employers are hiring and 18% saying their employers are letting workers go. Between 18% and 19% of workers have said their employers are reducing staff size throughout the first half of 2011. However, there has been a slight increase in the percentage saying their companies are hiring employees and expanding their workforces, from 29% in January to 33% in June.

Here is the graph.

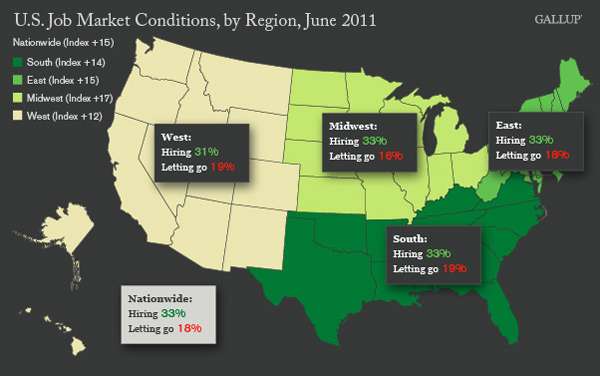

And, what about regional job creation? Hiring patterns are similar.

And, what about regional job creation? Hiring patterns are similar.

So, what does this all mean?

Job creation is slow and has remained so. With vast numbers of unemployed Americans, it is doubtful that robust job growth will be realized before the Presidential race for 2012 begins after this summer.

President Obama will have to run on this record of anemic job growth and high unemployment.

Gallup’s Job Creation Index, at +15 for June 2011, is much improved over June 2010’s +8 and June 2009’s -3 readings. One reason for this improvement, according to employee reports, is that the nation’s employers are holding on to their workers; the percentage currently letting people go is just about where it was in June 2008. Additionally, the percentage reporting their employer is hiring has increased slightly during the first half of 2011.

However, companies are still not in a hurry to hire. The percentage saying their employers were hiring in June is down seven points from January 2008, when the recession was just getting underway. New jobs are being created at an anemic pace compared with what is needed to lower the U.S. unemployment and underemployment rates. These job creation trends are consistent with Gallup’s recent unemployment report that shows the current job situation has seen little year-over-year improvement.

These job creation findings are also consistent with the recent trend in jobless claims, whose four-week average is currently 426,750. This is better than the year-ago numbers, but — like the job creation trend — is not enough of an improvement to support a decline in the unemployment rate. In this regard, the modest improvement in Gallup’s Job Creation Index over recent months is also consistent with the consensus among economists that there will be essentially no change when the government reports the June unemployment rate on Friday.

Right now, Gallup’s job data suggest that job market conditions are slightly more positive than the government’s numbers show. Although economists declared the recession over two years ago, job growth has a long way to go, with the current Job Creation Index nowhere near the +26 seen just as the recession was beginning in January 2008. -

Poll Watch: United States Economic Confidence Remains Low

According to the latest Gallup Poll.

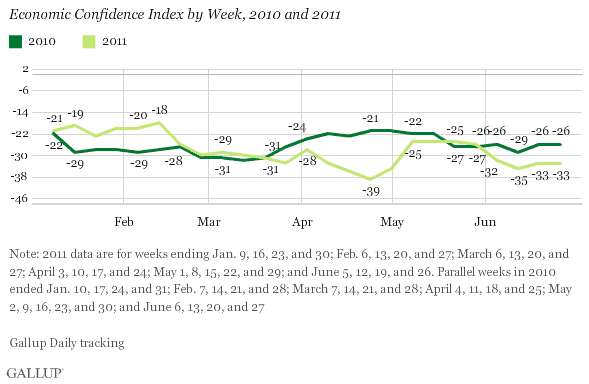

According to the latest Gallup Poll.After surging in May, Americans’ economic confidence receded in early June and remains near its 2011 low, averaging -33 in the week ending June 26. This is down seven percentage points from the week ending May 29 and down a similar amount compared with the same week a year ago.

U.S. economic confidence peaked this year at -18 in February and then generally declined, reaching -39 during week ending April 24, as gas prices surged and economic activity slowed. Confidence increased in May, averaging -26, likely in response to the news of Osama bin Laden’s death in a U.S. military raid.

Gallup’s Economic Confidence Index combines two measures: one assessing Americans’ views about whether the U.S. economy is “getting better” or “getting worse,” and the second involving Americans’ ratings of current economic conditions as “excellent,” “good,” “only fair,” or “poor.” Both ratings have deteriorated thus far in June.

Only 31% say that the U.S. economy is getting better.

The graph:

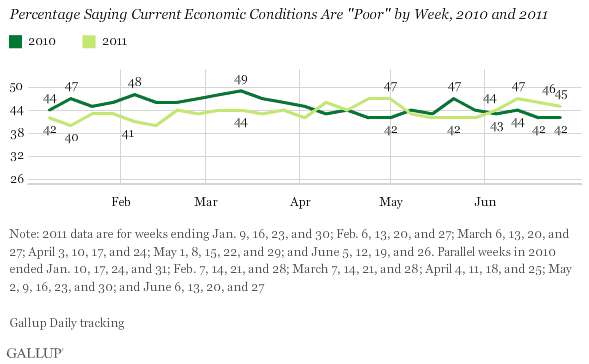

45 % of Americans rate the American economy is poor:

45 % of Americans rate the American economy is poor: So, what does this all mean?

So, what does this all mean?Perception of the economy is important to voters. If President Obama and his cronies in the Congress wish to be re-elected they will have to make the case that their stewardship of the economy has been successful. Poll numbers are not demonstrating this perception.

The worsening of Gallup’s economic confidence measure during June may be due in part to the dissipation of the “halo effect” surrounding the death of bin Laden. Confidence has now moved back near the April 2011 low. This suggests that the consumer benefits associated with steadily declining gas prices at the pump — down 14 cents per gallon in the past two weeks — are being offset by other factors. One such factor might just be that gas prices remain 82 cents per gallon higher than they were a year ago. Another could be the continuing dismal jobs situation.

Federal Reserve Board Chairman Ben Bernanke last week seemed to add to the growing economic pessimism, noting that the Fed has reduced its 2011 growth forecast for the U.S. economy. Wall Street continues to suffer as a result of the Fed’s apparent confirmation of the economic “soft patch” and the financial problems in Europe. The battle over raising the debt ceiling has not disrupted the money markets to this point, but certainly represents another negative for overall economic confidence.

It may be that declining gas prices will eventually lead to improved consumer confidence and increased consumer spending, which could make the current economic soft patch modest and transitory. At this point, however, Gallup’s monitoring of economic confidence does not support that idea.