-

Video: Obama at Fault if There is a No Debt Ceiling Deal

There will be a deal as the House GOP WILL pass the Boehner Plan this afternoon.Dick Morris explains why this is a good deal for the GOP.Watch it all. -

Poll Watch: 70% Say Debt Ceiling Will Be Raised – 42% Say Long Term Government Spending Will NOT Be Reduced

According to the latest Rasmussen Poll.

With less than five days left until the federal government could begin defaulting on its debts, voters continue to express unhappiness with both sides of the debt ceiling debate. While most voters continue to believe the debt ceiling will be raised before the government defaults, most don’t think the president and Congressional Republicans will agree on significant long-term spending cuts before the 2012 elections.

The latest Rasmussen Reports national telephone survey of Likely Voters shows that 70% believe it’s at least somewhat likely that the debt ceiling will be raised before the government begins defaulting on its debts. Only 18% don’t think the debt ceiling will be raised by Tuesday, while another 12% are undecided. These findings include 33% who say a debt ceiling increase is Very Likely and just three percent (3%) who think it’s Not at all Likely to happen

However, less than half of voters (42%) say it’s likely President Obama and congressional Republicans will reach an agreement to significantly cut long-term government spending trends before the 2012 elections, including just eight percent (8%) who say it’s Very Likely. Fifty-one percent (51%) don’t believe it’s likely the two sides will reach this agreement, including 15% who say it’s Not At All Likely.

Only 35% of voters nationwide approve the way the president and congressional Democrats are handling the debt ceiling debate, while most (61%) disapprove.

Republicans aren’t off the hook either: 38% approve of the way the GOP are handling the debate while 57% disapprove. Voter sentiments about both sides are similar to those found last week.

You can fool some of the people some of the time.

All of the drama and for what?

The Boehner or Reid Plan?

Move on to the 2012 elections because nothing is going to happen until there is a new Senate and/or President.

-

Updated 11 AM EDT: The Boehner Debt-Llimit Plan GOP Whip List

Whipping The Boehner Proposal To Raise The Nation’s Debt Ceiling

The nonpartisan Congressional Budget Office reported Wednesday that House Speaker John Boehner’s revised proposal to raise the debt ceiling deficit reduction plan would reduce budget deficits by about $915 billion over 10 years through FY2021. With the bill slated to hit the House floor Thursday, Boehner is trying to secure the necessary number of votes needed to pass the measure.

A vote originally scheduled for Wednesday was delayed late Tuesday amid disunity within the GOP conference and a previous report from the CBO that Boehner’s plan would accomplish cuts $150 billion below the $1 trillion target House Republicans want.

National Journal has compiled a list of Republican Members who have committed to voting no, and those who have declared they are undecided. We’ve also included the stances of notable yes votes as well as the positions of notable Democrats, based on the recent House vote on the GOP’s “Cut, Cap And Balance” measure. If no Democrats support the Boehner plan, the maximum number of votes the House speaker can lose and still pass the measure is 23. Right now, 19 Members have committed to voting no.

Here is the revised NO GOP List:

NO (19)

Rep. Roscoe Bartlett, R-Md.

Rep. Trent Franks, R-Ariz.

Rep. Louie Gohmert, R-Texas

Rep. Phil Gingrey , R-Ga.

Rep. Jim Jordan, R-Ohio

Rep. Todd Akin, R-Mo.

Rep. Tim Huelskamp, R-Kan.

Rep. Jason Chaffetz, R-Utah

Rep. Michele Bachmann, R-Minn. (multiple news reports)

Rep. Ron Paul, R-Texas

Rep. Joe Walsh, R-Ill.

Rep. Tom Graves, R-Ga. (National Review)

Rep. Jeff Landry, R-La. (National Review)

Rep. Dennis Ross, R-Fla.

Rep. Paul Broun, R-Ga.

Rep. Jeff Duncan, R-S.C. (The Hill)

Rep. Steve King, R-Iowa (The Hill)

Rep. Steve Southerland, R-Fla. (The Hill)

Rep. Chuck Fleischmann, R-Tenn. (Washington Post)LEANING NO (3)

Rep. Tim Scott, R-S.C.

Rep. Trey Gowdy, R-S.C. (The Hill)

Rep. David Schweikert, R-Ariz. -

Day By Day July 28, 2011 – Put It in Drive

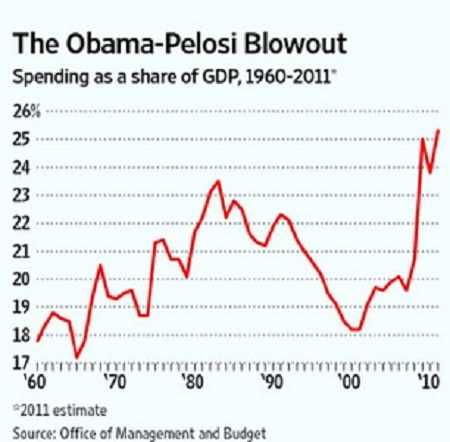

The GOP has won the debt-limit debate and American voters now understand how President Obama has spent the United States into a ditch. Look at this graphic:

The GOP has won the debt-limit debate and American voters now understand how President Obama has spent the United States into a ditch. Look at this graphic: So, the House should pass the Boehner Plan and if the Democrats decide to vote against it in the Senate, then they broke it and they will own it.

So, the House should pass the Boehner Plan and if the Democrats decide to vote against it in the Senate, then they broke it and they will own it.Stay tuned as the vote commences this morning. Looks like a close vote.

Previous: -

The Boehner Debt-Llimit Plan GOP Whip List

The Hill has an updated list for either this morning’s vote or one which could be postponed if the votes are not there.

House Republicans are scrambling to come up with the votes to pass Speaker John Boehner’s (R-Ohio) new plan to raise the nation’s debt ceiling.

While they have some work ahead of them, House GOP leaders are starting to pick up more yes votes. On Wednesday, several Republican members who had been undecided earlier in the week said they are leaning toward yes, including Reps. Marsha Blackburn (Tenn.), Bob Goodlatte (Va.), Rob Woodall (Ga.) and Cynthia Lummis (Wyo.).

Yet, it appears that the vote will be a nail-biter as a slew of Republican members are firmly opposed to the bill.

If all Democrats vote no, Republican leaders will have to minimize defections to about two dozen members.

Here is the list who are opposed:

House Republicans against/leaning no on Boehner plan (22)

- Todd Akin (Mo.) — Senate hopeful is a no

- Justin Amash (Mich.) — Not shy about breaking from GOP leaders

- Michele Bachmann (Minn.) — Against raising debt ceiling; voted against CCB*

- Paul Broun (Ga.) — Against raising debt ceiling; voted against CCB*

- Jason Chaffetz (Utah) — Possible Senate candidate is a no

- Jeff Duncan (S.C.) Told thestate.com, a South Caroline media outlet, that he is a no

- Jeff Flake (Ariz.) — Senate hopeful “can’t support the current bill”

- Phil Gingrey (Ga.) — A definite no

- Louie Gohmert (Texas) — Planning to vote no

- Paul Gosar (Ariz.) — Leaning no

- Trey Gowdy (S.C.) — Leaning no

- Tom Graves (Ga.) — Firm no

- Andy Harris (Md.) — Strong proponent of BBA**; Indicated to Baltimore Sun he is a no

- Tim Huelskamp (Kan.) — Firm no

- Jim Jordan (Ohio) — RSC chairman is strongly opposed

- Steve King (Iowa) — Firm no

- Connie Mack (Fla.) — Voted against CCB*; firm no

- Mick Mulvaney (S.C.) — A no vote

- Ron Paul (Texas) — Against raising debt ceiling; voted against CCB*

- Dennis Ross (Fla.) — Leaning no, according to National Journal Daily

- Steve Southerland (Fla.) — Lawmaker told AP he is a no

- Joe Walsh (Ill.) — Said on MSNBC he is a no

-

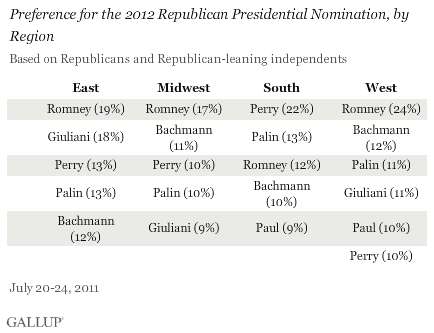

President 2012 GOP Poll Watch: Rick Perry is Leading in the South While Mitt Romney Leads in the West

According to the latest Gallup Poll.

According to the latest Gallup Poll.Texas Gov. Rick Perry is the favorite among southern Republicans when they are asked to say who they are most likely to support for the party’s 2012 presidential nomination, with a 22% to 13% advantage over Sarah Palin in that region. Mitt Romney has a similar edge, 24% to 12%, over Michele Bachmann in the West. Romney and Rudy Giuliani essentially tie for first in the East, with Romney holding a slight advantage among midwestern Republicans.

These results are based on a July 20-24 Gallup poll that shows Romney (17%) and Perry (15%) in a statistical tie as the preferred nominee among Republicans nationwide. However, Romney has a more significant lead among the more limited set of announced GOP candidates, which excludes Perry, Palin, and Giuliani.

This is a good poll for Rick Perry who has NOT even anounced an official candidacy. When he does in late August he will zoom past Michele Bachmann into second place.

With regards to Sarah Palin, she remains a “wild card” in this race. I have written for weeks now that should she run, then Rudy Giuliani would run. Rudy figures his strength in the East and somewhat in California might propel him to a place at the table at a “brokered” GOP Convention.

But, remember Rick Perry and Rudy are friends. Perry endorsed Rudy in 2008 and it would not be surprising that should Palin not decide to run, that Rudy would endorse Perry which would swing support to him in the East and West.

So, we wait for a few weeks and see what Sarah Palin announces at a Tea Party rally in Iowa on September 3rd.

Given Romney’s positioning among southern Republicans, a candidate like Perry could pose the most significant threat to him. One key would be whether Perry, as he became better known (currently 56% of Republicans are familiar with him), would expand his appeal in other regions, or if his core support would remain limited to the South. If the latter, Romney may still be able to hold onto his status as the front-runner even if his support in the South drops. If the former, Perry could emerge as the new GOP front-runner should he become an official candidate.

-

Flap’s Links and Comments for July 27th on 20:27

These are my links for July 27th from 20:27 to 20:38:

- Gregory Flap Cole – Google+ – I say better stock up on water, bread, milk and Kruggerands.Default is a-comin'

- Senate Democrats Send Speaker Boehner a Letter Favoring an American Debt Default? | Flap’s Blog – FullosseousFlap’s Dental Blog – Senate Democrats Send Speaker Boehner a Letter Favoring an American Debt Default? #tcot #catcot

-

@Flap Twitter Updates for 2011-07-28

- White House 'rickrolls' Twitter critic http://bit.ly/n6LknG #

- Will Janice Hahn Run For The "Black" Seat After Redistricting? http://bit.ly/oCKOq9 #

- Dentists Have a High Oral Lesion Misdiagnosis Rate? http://bit.ly/mZ2ZAt #

- Downgrade's a-comin' for sure #tcot http://t.co/qXoV6O4 #

- @hamsterwatch Yeah a House meeting and Kalia is blowing up – fight fight without booze and I love it…. #bb13 in reply to hamsterwatch #

- Gallup Daily Presidential Approval Vs. Disapproval Poll 46% Vs. 46% http://bit.ly/craYbK #

- California Legislature and State Board of Equalization Harass California Small Business With Mary Kay Tax http://bit.ly/nJ0gle #tcot #catcot #

- Oh Boy another White House briefing….. Wonder if they will let Carney skate today? #tcot #

- Obama jobs Czar Immelt of GE moving jobs out of Wisconsin to China – Nice….. #tcot #

- Flap’s Links and Comments for July 27th on 01:02 http://bit.ly/rm7Nst #tcot #catcot #

- Tweeps please support @Flap by going to flapsblog.com and flapsblog.net and clicking on my advertisers ADS. Thanks in Advance #tcot #

- Day By Day July 27, 2011 – The View | Flap's Blog – FullosseousFlap's Dental Blog http://bit.ly/nYjL5c #

- President 2012 Poll Watch: Obama Has the Key Battleground State Blues | Flap's Blog – FullosseousFlap's Dental Blog http://bit.ly/o8iXYQ #

- Flap's Dentistry Blog: The Morning Drill: July 27, 2011 http://bit.ly/p51qi1 #

- Follow @Flap on Google Plus gplus.to/flap #tcot #teaparty #catcot #cagop #

- Day By Day July 27, 2011 – The View http://bit.ly/re8PLA #tcot #catcot #

- President 2012 Poll Watch: Obama Has the Key Battleground State Blues http://bit.ly/pTFb5c #tcot #catcot #

- The Morning Drill: July 27, 2011 http://bit.ly/odG9B4 #

- The Debt-Limit Debate: Call it a Day and a Win GOP http://bit.ly/nytvFr #tcot #catcot #

- President 2012 GOP Poll Watch: Romney 17% Vs. Perry 15% Vs. Palin 12% Vs. Giuliani 11% Vs. Bachmann 11% http://bit.ly/op7Uoy #tcot #catcot #

- @Flap Twitter Updates for 2011-07-27 http://bit.ly/oRLbFe #tcot #catcot #

- Flap’s Links and Comments for July 26th on 15:02 http://bit.ly/qNORsM #tcot #catcot #

- California State Board of Equalization Votes to Begin Rule Making to Implement the Amazon Internet Sales Tax | F… http://bit.ly/qYqyBs #

- Dilbert July 26, 2011 – Drawing Attention | Flap's Blog – FullosseousFlap's Dental Blog http://bit.ly/qTuhEC #

- Poll Watch: Americans Favor Obama’s Mixed Solution for Debt-Limit Deal 56% Vs. 19% | Flap's Blog – FullosseousFl… http://bit.ly/o3qexb #

Powered by Twitter Tools

-

Senate Democrats Send Speaker Boehner a Letter Favoring an American Debt Default?

Senate Majority Leader Harry Reid is pictured as he speaks to the press following more U.S. debt reduction talks on Capitol Hill, July 26, 2011

Well, something like that because their letter promises to reject Boehner’s Debt-Limit Plan.Fifty-three Democratic senators have signed a letter to House Speaker John A. Boehner saying they intend to vote against his plan for an increase in the debt ceiling, virtually assuring its defeat in the Senate even as the speaker lines up Republican votes to pass it in the House on Thursday.

Votes are not final until they are cast. But if the Democrats hold to their promise in the letter, Mr. Boehner’s plan for a six-month increase in borrowing authority will not make it to President Obama’s desk.

“We heard that in your caucus you said the Senate will support your bill,” the senators say in the letter. “We are writing to tell you that we will not support it, and give you the reasons why.”

In the letter, the senators argue that a short-term extension of the debt ceiling would “put America at risk” and “could be nearly as disastrous as a default.”

Some compromise there, eh?

I say the House GOP and whatever Democrats who dare, pass the bill anyway and dare Dingy Harry to hold it up for defeat in the Senate.

To the Democrats then, you voted twice against House passed plans, so if it breaks the American economy, you own it baby – House/Senate Democrats and President Obama.

Here is the double dare letter to Boehner:

Dear Speaker Boehner,

With five days until our nation faces an unprecedented financial crisis, we need to work together to ensure that our nation does not default on our obligations for the first time in our history. We heard that in your caucus you said the Senate will support your bill. We are writing to tell you that we will not support it, and give you the reasons why.

A short-term extension like the one in your bill would put America at risk, along with every family and business in it. Your approach would force us once again to face the threat of default in five or six short months. Every day, another expert warns us that your short-term approach could be nearly as disastrous as a default and would lead to a downgrade in our credit rating. If our credit is downgraded, it would cost us billions of dollars more in interest payments on our existing debt and drive up our deficit. Even more worrisome, a downgrade would spike interest rates, making everything from mortgages, car loans and credit cards more expensive for families and businesses nationwide.

In addition to risking a downgrade and catastrophic default, we are concerned that in five or six months, the House will once again hold the economy captive and refuse to avoid another default unless we accept unbalanced, deep cuts to programs like Medicare and Social Security, without asking anything of the wealthiest Americans.

We now have only five days left to act. The entire world is watching Congress. We need to do the right thing to solve this problem. We must work together to avoid a default the responsible way – not in a way that will do America more harm than good.

And, here I thought Dingy Harry “The Iraq War is Lost” Reid was a deal maker?

Default, here we come….

-

John Boehner’s Debt-Limit Plan is a Good Start?

It is a good start towards replacing Obama as President next year.

It is, as many conservatives have said in floor speeches and statements of support for the Boehner bill, an important first step. The immediate cuts are small relative to our $14 trillion debt, but the trajectory of spending will now go down.

Before we get ahead of ourselves, it is important to remember this has to come to a vote in the House. (I suspect it won’t be all that close, unfortunately relieving some die-hards of the necessity of discarding their political purity.) It also has to get through the Senate, where other hardline Republicans, not to mention a whole lot of Democrats, will have to decide: Boehner or default?

And should this get through both houses, the president will have zero choice in the matter. He will sign it, and we will avoid default. And then the spinning begins. As for those GOP pols and pundits who favored the burn-down-the-building approach, there is perhaps time to reconsider whether they want to be on board with a vote that may change the course of our fiscal future and the shape of the Republican party.

Read Rep. Paul Ryan’s treatise on the revised legislation here.

And, looking at the polls today in the key battleground states, in another year, the GOP House Leadership will not have to worry about negotiating with Harry Reid or the White House.