-

Day By Day July 28, 2011 – Put It in Drive

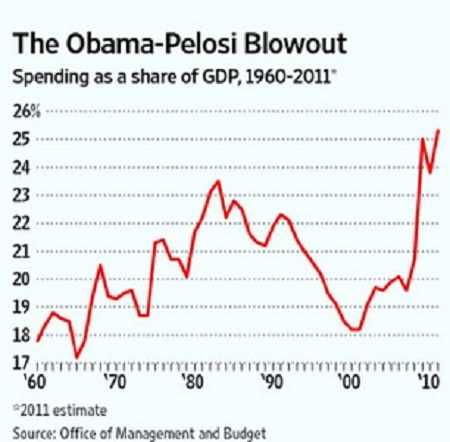

The GOP has won the debt-limit debate and American voters now understand how President Obama has spent the United States into a ditch. Look at this graphic:

The GOP has won the debt-limit debate and American voters now understand how President Obama has spent the United States into a ditch. Look at this graphic: So, the House should pass the Boehner Plan and if the Democrats decide to vote against it in the Senate, then they broke it and they will own it.

So, the House should pass the Boehner Plan and if the Democrats decide to vote against it in the Senate, then they broke it and they will own it.Stay tuned as the vote commences this morning. Looks like a close vote.

Previous: -

The Boehner Debt-Llimit Plan GOP Whip List

The Hill has an updated list for either this morning’s vote or one which could be postponed if the votes are not there.

House Republicans are scrambling to come up with the votes to pass Speaker John Boehner’s (R-Ohio) new plan to raise the nation’s debt ceiling.

While they have some work ahead of them, House GOP leaders are starting to pick up more yes votes. On Wednesday, several Republican members who had been undecided earlier in the week said they are leaning toward yes, including Reps. Marsha Blackburn (Tenn.), Bob Goodlatte (Va.), Rob Woodall (Ga.) and Cynthia Lummis (Wyo.).

Yet, it appears that the vote will be a nail-biter as a slew of Republican members are firmly opposed to the bill.

If all Democrats vote no, Republican leaders will have to minimize defections to about two dozen members.

Here is the list who are opposed:

House Republicans against/leaning no on Boehner plan (22)

- Todd Akin (Mo.) — Senate hopeful is a no

- Justin Amash (Mich.) — Not shy about breaking from GOP leaders

- Michele Bachmann (Minn.) — Against raising debt ceiling; voted against CCB*

- Paul Broun (Ga.) — Against raising debt ceiling; voted against CCB*

- Jason Chaffetz (Utah) — Possible Senate candidate is a no

- Jeff Duncan (S.C.) Told thestate.com, a South Caroline media outlet, that he is a no

- Jeff Flake (Ariz.) — Senate hopeful “can’t support the current bill”

- Phil Gingrey (Ga.) — A definite no

- Louie Gohmert (Texas) — Planning to vote no

- Paul Gosar (Ariz.) — Leaning no

- Trey Gowdy (S.C.) — Leaning no

- Tom Graves (Ga.) — Firm no

- Andy Harris (Md.) — Strong proponent of BBA**; Indicated to Baltimore Sun he is a no

- Tim Huelskamp (Kan.) — Firm no

- Jim Jordan (Ohio) — RSC chairman is strongly opposed

- Steve King (Iowa) — Firm no

- Connie Mack (Fla.) — Voted against CCB*; firm no

- Mick Mulvaney (S.C.) — A no vote

- Ron Paul (Texas) — Against raising debt ceiling; voted against CCB*

- Dennis Ross (Fla.) — Leaning no, according to National Journal Daily

- Steve Southerland (Fla.) — Lawmaker told AP he is a no

- Joe Walsh (Ill.) — Said on MSNBC he is a no

-

Senate Democrats Send Speaker Boehner a Letter Favoring an American Debt Default?

Senate Majority Leader Harry Reid is pictured as he speaks to the press following more U.S. debt reduction talks on Capitol Hill, July 26, 2011

Well, something like that because their letter promises to reject Boehner’s Debt-Limit Plan.Fifty-three Democratic senators have signed a letter to House Speaker John A. Boehner saying they intend to vote against his plan for an increase in the debt ceiling, virtually assuring its defeat in the Senate even as the speaker lines up Republican votes to pass it in the House on Thursday.

Votes are not final until they are cast. But if the Democrats hold to their promise in the letter, Mr. Boehner’s plan for a six-month increase in borrowing authority will not make it to President Obama’s desk.

“We heard that in your caucus you said the Senate will support your bill,” the senators say in the letter. “We are writing to tell you that we will not support it, and give you the reasons why.”

In the letter, the senators argue that a short-term extension of the debt ceiling would “put America at risk” and “could be nearly as disastrous as a default.”

Some compromise there, eh?

I say the House GOP and whatever Democrats who dare, pass the bill anyway and dare Dingy Harry to hold it up for defeat in the Senate.

To the Democrats then, you voted twice against House passed plans, so if it breaks the American economy, you own it baby – House/Senate Democrats and President Obama.

Here is the double dare letter to Boehner:

Dear Speaker Boehner,

With five days until our nation faces an unprecedented financial crisis, we need to work together to ensure that our nation does not default on our obligations for the first time in our history. We heard that in your caucus you said the Senate will support your bill. We are writing to tell you that we will not support it, and give you the reasons why.

A short-term extension like the one in your bill would put America at risk, along with every family and business in it. Your approach would force us once again to face the threat of default in five or six short months. Every day, another expert warns us that your short-term approach could be nearly as disastrous as a default and would lead to a downgrade in our credit rating. If our credit is downgraded, it would cost us billions of dollars more in interest payments on our existing debt and drive up our deficit. Even more worrisome, a downgrade would spike interest rates, making everything from mortgages, car loans and credit cards more expensive for families and businesses nationwide.

In addition to risking a downgrade and catastrophic default, we are concerned that in five or six months, the House will once again hold the economy captive and refuse to avoid another default unless we accept unbalanced, deep cuts to programs like Medicare and Social Security, without asking anything of the wealthiest Americans.

We now have only five days left to act. The entire world is watching Congress. We need to do the right thing to solve this problem. We must work together to avoid a default the responsible way – not in a way that will do America more harm than good.

And, here I thought Dingy Harry “The Iraq War is Lost” Reid was a deal maker?

Default, here we come….

-

John Boehner’s Debt-Limit Plan is a Good Start?

It is a good start towards replacing Obama as President next year.

It is, as many conservatives have said in floor speeches and statements of support for the Boehner bill, an important first step. The immediate cuts are small relative to our $14 trillion debt, but the trajectory of spending will now go down.

Before we get ahead of ourselves, it is important to remember this has to come to a vote in the House. (I suspect it won’t be all that close, unfortunately relieving some die-hards of the necessity of discarding their political purity.) It also has to get through the Senate, where other hardline Republicans, not to mention a whole lot of Democrats, will have to decide: Boehner or default?

And should this get through both houses, the president will have zero choice in the matter. He will sign it, and we will avoid default. And then the spinning begins. As for those GOP pols and pundits who favored the burn-down-the-building approach, there is perhaps time to reconsider whether they want to be on board with a vote that may change the course of our fiscal future and the shape of the Republican party.

Read Rep. Paul Ryan’s treatise on the revised legislation here.

And, looking at the polls today in the key battleground states, in another year, the GOP House Leadership will not have to worry about negotiating with Harry Reid or the White House.

-

The Debt-Limit Debate: Call it a Day and a Win GOP

House Speaker John Boehner of Ohio, right, and Republican Conference Chairman Rep. Jeb Hensarling, R-Texas , center, listen as House Majority Leader Eric Cantor of Va., left, speaks during a news conference at The Republican National Committee on Capitol Hill in Washington, Tuesday, July 26, 2011

Am I suggesting the GOP House Tea Party Caucus should hold their nose and vote for the Boehner debt-limit plan?

Yes, if you want to beat President Obama in 2012.The debt-limit debate is heading toward a culmination, with President Obama reduced to pleading for the public to support a tax increase and Speaker John Boehner and Senate Majority Leader Harry Reid releasing competing plans that are the next-to-last realistic options. The question now is whether House Republicans are going to help Mr. Boehner achieve significant progress, or, in the name of the unachievable, hand Mr. Obama a victory.

Mr. Obama recognizes these stakes, threatening yesterday to veto the Boehner plan in a tactical move to block any Democratic support. The White House is afraid that it will pass the House and then become the only debt-ceiling vehicle if Mr. Reid can’t get 60 votes for his own proposal in the Senate. This would short-circuit Mr. Obama’s plan to blame the GOP for a U.S. credit downgrade, any market turmoil, a possible default, and the lousy economy too.

Read all of the rest of the piece.

The fact is American voters WILL blame the GOP for a further collapse in the economy and the polling is clear on the matter. Plus, there is no need for frightened credit markets or a possible default.

We will never achieve entitlement or tax reform with a doctrinaire liberal in the White House. Any agreements to do so in “out years” would probably be unenforceable even if agreement were achieved. And we can only do so much while controlling one half of one branch of government. Ladies and Gentlemen of the House Republicans, you have laid some great groundwork to rectify both of those situations. Now it is the time to accept a well-won victory and move on.

Thompson is RIGHT – time to move on, vote for the Boehner Plan and if Obama vetoes it, then he broke it.

-

Poll Watch: Americans Favor Obama’s Mixed Solution for Debt-Limit Deal 56% Vs. 19%

According to the latest Reuters/Ipsos Poll.

Showing an intensity of interest among Americans who often ignore the intricacies of policy in Washington, 83 percent of those polled said they were either very or somewhat concerned about the potential for a U.S. debt default on August 2.

The poll found that 56 percent of Americans want to see a combination of government spending cuts and tax increases included in a deal to bring down the U.S. budget deficit and permit a vote to raise the country’s $14.3 trillion debt ceiling.

This is the approach favored by Obama and his fellow Democrats to begin to put America’s fiscal house in order.

Republicans oppose tax increases and instead want to cut back deeply on spending, saying the federal budget has gotten out of control.

“It does seem to be that the popular narrative is falling on the side of the president on this one,” said Ipsos pollster Julia Clark.

In the poll, 19 percent said the best approach is only to cut existing programs, and 12 percent said only raising taxes would be the favored solution.

Obama’s Democrats and their Republican rivals have so far failed to forge agreement and are pursuing competing debt plans to avert a potentially disastrous default.

But, that is not saying that American voters know what is best for the economy or the government, especially with the President telling them he will only tax the rich.

So, for the debt-ceiling impasse, who do the voters blame?

The Reuters/Ipsos poll found that 31 percent of respondents held Republican lawmakers responsible for the debt impasse, 21 percent blamed Obama and 9 percent blamed Democratic lawmakers.

Along those lines, 29 percent said Republican lawmakers should give the most ground in the negotiations, a quarter said Obama should and a fifth said Democrats should.

The debt debate has potential consequences for the 2012 election year when Obama is seeking a second term as president.

People who identified themselves as political independents, who Obama needs to win re-election, tended to side with the Republicans. The poll found that 29 percent of independents said Obama should give the most ground in the negotiations, while 13 percent said Republicans should.

This is the polling the Democrats will argue places the voters on their side of the debt-limit argument. But, I do not think this will move the narrative for the GOP. The GOP will NEVER accept tax increases, but they may swallow some tax reform.

In fact, in a breaking piece of news, the GOP House Leadership has just announced that they will have to re-write the Boehner proposal in order to obtain 218 votes for passage. Senator Harry Reid has already stated that in the Senate the Boehner proposal is DOA.

So, if the GOP already knows that if they are getting the blame for this financial impasse in an economic climate that Obama now owns, they may be MORE inclined to compromise and just call it a day.

-

Poll Watch: 73 Per Cent of Americans Say the Economy is Getting Worse

According to the latest Gallup Poll.Seventy-three percent of Americans in Gallup Daily tracking over the July 22-24 weekend say the U.S. economy is getting worse. This is up 11 percentage points from the three days ending July 6, and the worst level for this measure since the three days ending March 12, 2009.

Gallup tracks consumer perceptions of the U.S. economy daily and reports the results in three-day rolling, weekly, and monthly averages. More Americans have been saying the U.S. economy is getting worse throughout June and early July than said this over most of the previous five months. However, the number of Americans feeling this way has risen further over the last few weeks.

It is going to be a POX on both political parties, if the POLS don’t take active measures to increase jobs and economic growth.

The president, the Treasury secretary, and congressional leaders worried openly over the weekend about what might happen in the international financial markets if a debt-ceiling increase agreement wasn’t reached. They feared trouble in the Asian money markets when they opened on Sunday night and on Wall Street on Monday morning. Although there were some losses in the money markets after a debt ceiling deal failed to materialize, these were far less than might have been expected — particularly in light of what government leaders were saying.

Still, Gallup’s data show that Americans’ perceptions of the future of the U.S. economy should be the real concern for policymakers and the overall economy. All of the talk about default likely has weighed on consumer confidence, as has the dismal jobs market, increasing gas prices, and the economic soft patch.

It may be that once the debt ceiling battle is resolved, economic confidence will return. In the interim, however, it appears consumer psychology is continuing to deteriorate rapidly. The Conference Board is likely to pick up on this when it reports its Consumer Confidence Index later this week. It is also likely to be reflected in an anemic back-to-school sales season in the weeks ahead.

I would not want to be an incumbent member of Congress, if the economy deteriorates any further. And, the President, if trends do not change, he is a one termer.

-

Mark Steyn: Planless Dems

In this post, Mark Steyn talks about the austerity budgets in Europe and what may be coming very soon to the United States, if the Congress and President Obama do not get serious about government spending.

In this post, Mark Steyn talks about the austerity budgets in Europe and what may be coming very soon to the United States, if the Congress and President Obama do not get serious about government spending.It seems reasonable to conclude from the planlessness and budgetlessness of the Obama/Reid Democrats that their only plan is to carry on spending without limit. Otherwise, someone somewhere would surely have written something down on a piece of paper by now. But no, apparently the Department of Writing Down Plans is the only federal expense the president is willing to cut. You begin to see why the Europeans are a little miffed. They’re passing austerity budgets so austere they’ve spawned an instant anti-austerity movement rioting in the street — and yet they’re still getting downgraded by the ratings agencies. In Washington, by contrast, the ruling party of the Brokest Nation in History has no spending plan other than to plan to spend even more — and nobody’s downgrading them.

Well, don’t worry. It’s coming. The domestic media coverage of this story has been almost laughably fraudulent: To the court eunuchs, a failure to raise the debt ceiling by a couple of trillion would signal to the world that American government was embarrassingly dysfunctional. In reality, raising the debt ceiling by a couple of trillion without any spending cuts would confirm to the world that American government is terminally dysfunctional.

In the debt-ridden treasuries of Europe, they’re talking “austerity.” In the debt-ridden treasury of Washington, they’re talking about more spending (Kathleen Sebelius is touting new women’s health programs to be made available “without cost.”) At the risk (in Samuel Johnson’s words) of settling the precedence between a louse and a flea, I think Europe’s political discourse is marginally less deranged than ours. The president is said to be “the adult in the room” because he is reported to be in favor of raising the age of Medicare eligibility from 65 to 67.

By the year 2036.

If something is not done soon, the financial markets will react for the Congress and the President.

It won’t be pretty and all the POLS will be able to do will be to try to blame the other side.

Why can’t they simply pass a short term compromise and have the great debate in 2012?

Or, does President Obama relish a financial crisis for re-election demagoguery?

-

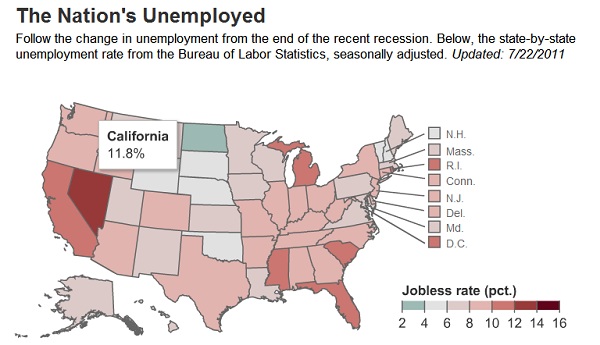

American Unemployment Increases in 28 States in June

The unemployment rate increased in 28 states in June, reflecting the nationwide increase to 9.2% from 9.1% over the month, the Labor Department said. Some 14 states saw their unemployment rate hold steady while eight logged decreases.

The U.S. economy added a paltry 18,000 jobs in June, as measured by a separate national survey, and an average of just 21,500 over the past two months – a disappointing result that has raised big questions about the sustainability of the nation’s economic recovery. The regional unemployment data show that the states that were hardest hit by the recession continue to have the toughest road in recovery.

For instance, California, Florida and Nevada — all three of which were hit hard by the housing bust — all had unemployment rates well over 10%. Nevada, at 12.4%, continues to have the nation’s highest unemployment rate, as the near-halt in homebuilding activity and steep drop in construction jobs continues to weigh heavily on the state’s economy.

Meantime, states that are rich in natural resources continue to outperform the nation. The lowest unemployment rate, 3.2%, was in oil-rich North Dakota, followed by Nebraska (4.1%) and South Dakota (4.8%) – both big farming states.

The Obama Administration must be extremely worried with these results.

Hope is not on the way and President Obama’s re-election prospects will dim, should unemployment NOT dramatically improve.

-

American Taxpayers Lose $1.3 billion in Chrysler Bailout

Bankruptcy for Chrysler would have been better.

Bankruptcy for Chrysler would have been better.U.S. taxpayers likely lost $1.3 billion in the government bailout of Chrysler, the Treasury Department announced Thursday.

The government recently sold its remaining 6% stake in the company to Italian automaker Fiat, wrapping up the 2009 auto bailouts that were part of TARP.

Fiat paid the Treasury a total of $560 million for the remaining shares, as well as rights to shares held by the United Auto Workers retiree trust.

Originally, the government committed a total of $12.5 billion to the struggling automaker, Old Chrysler and Chrysler Group. Of those funds, $11.2 billion has been returned through principal repayments, interest and cancelled commitments, the Treasury said. Chrysler paid back $5.1 billion in loans in May.

Even though that means $1.3 billion will not be recovered, the Treasury called it a “major accomplishment.”

“With today’s closing, the US government has exited its investment in Chrysler at least six years earlier than expected,” Tim Massad, Treasury assistant secretary for financial stability said in a release.

As part of the loan agreement, Chrysler was given until 2017 to return the bailout funds. If it had taken the full term, the interest accrued on the loans would have significantly reduced the government’s losses.

Next time, the government should let these companies go out of business or seek bankruptcy protection.

No more government bailouts.